Is It Possible To Get An Anonymous Car Insurance Quote?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The one thing most people complain about when comparing insurance quotes is inputting all the personal information.

While it is simply a tedious task for some, others dislike sharing their personal information with unknown sources, and rightfully so.

Many would like to shop for accurate insurance quotes for their vehicle while searching anonymously, without handing over any sensitive data.

But is it possible to compare rates from insurance companies without providing any of your secure information?

Yes, but the auto policy quotes will not be accurate.

Do insurance companies need things such as your current credit score to give you an online auto insurance quote?

Yes, unless you reside in California, Hawaii, Massachusetts, or Michigan.

Here are the key takeaways:

| Anonymous Insurance Quote Quick Hits |

|---|

| It's not possible to get an accurate anonymous quote from auto insurers. |

| You can get a reasonably accurate estimate of your premium without giving your personal information using a car insurance estimator such as Nerdwallets. |

| Anonymous quotes, not requiring personal information, won't include your car's specifics, driving record, or the type of coverage you need, also called nonguaranteed quotes. |

| If you prefer an accurate quote, you will have to provide personal information to auto insurers. Also called a guaranteed quote. |

| Using burner or secondary emails during the quote process is futile if you plan to purchase an insurance policy. |

What Information is Required to Get a Car Insurance Quote?

It depends on the company, really.

To quote you a premium and sell you a policy, the auto insurer is going to require the below personal information:

– Your name

– Your age

– Your gender

– Your marital status

– Address

– Make, model, and year of your vehicle

– Driver’s license number

– Vehicle Identification Number

– Your credit score (in states permitted to use your credit score to underwrite a policy)

– Social security number

Remember, each carrier has its own requirements.

Take a look at some male and female car insurance comparisons to realize how gender influences insurance quotes.

| Company | Single 35-Year-Old Female | Single 35-Year-Old Male |

|---|---|---|

| Progressive | $1,635 | $1,676 |

| Geico | $1,621 | $1,732 |

| American Family | $1,769 | $1,829 |

| State Farm | $1,793 | $1,836 |

| Allstate | $1,754 | $1,827 |

Some may request more personal details from you than just those listed above, while others may allow you to request a quote semi-anonymously.

You have a choice.

If you believe the auto insurance company is asking for too much information, there are less demanding options.

Why Do Insurance Carriers Need My Personal Information?

– Email List

There are several reasons your personal information is needed when comparing auto insurance rates.

One of the main reasons is that the provider can put you into their system as a “prospective customer” and can send reminders in the mail or by email in hopes that you will take out a policy with them down the road.

Insurance companies are VERY patient, and this method really works for them.

It is like being added to someone’s email distribution list.

If you don’t want numerous calls from insurance agents, using your email address is best.

Some prospective customers use a “burner email” or “throw-away” email address to get a quote without personal information.

It’s perfectly fine to use this method, but follow up quotes from insurers probably won’t reach you.

– Guaranteed Quotes

Insurance companies need your personal information because they want to offer you a more accurate quote or guaranteed quote.

Guaranteed quotes are insurance rates the carrier is willing to follow through on and sell you a policy because they are more accurate.

If you are shopping for a more accurate insurance premium, guaranteed quotes are what you want.

This gives you a realistic way to compare auto insurers since the quotes are custom-tailored to you.

Car insurance providers consider many specific factors when it comes to determining your rates.

For instance, if you have any traffic violations, a speeding ticket, accidents on your driving record, or your credit score is low, that could impact your insurance quote.

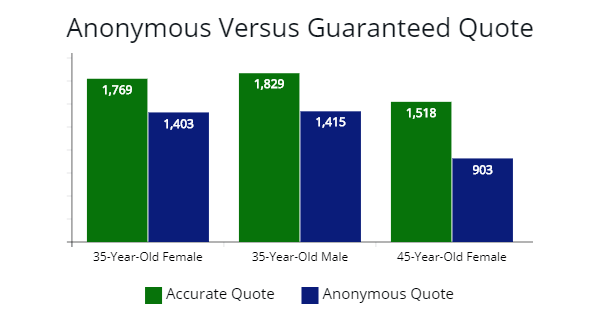

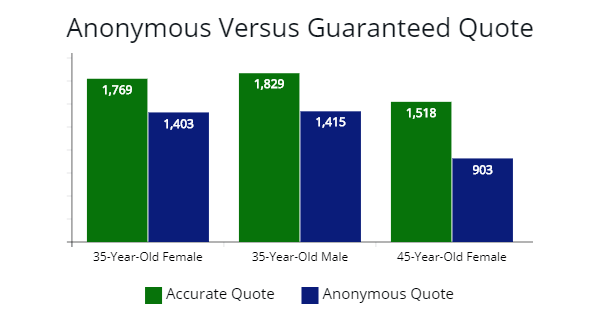

Illustrated above is the price difference from the quoting process using personal information and anonymous auto insurance quotes for 35-year-old and 45-year-old motorists. When doing our analysis, the older the driver, the less accurate anonymous car insurance quotes are.

Illustrated above is the price difference from the quoting process using personal information and anonymous auto insurance quotes for 35-year-old and 45-year-old motorists. When doing our analysis, the older the driver, the less accurate anonymous car insurance quotes are.

– Nonguaranteed Quotes

The type of quote not requiring personal information is called a nonguaranteed quote.

They are based on drivers’ average premiums and similar driving history.

Typically, nonguaranteed quotes aren’t accurate, and an insurance provider doesn’t have to follow through and offer you a policy at the time of your quoting process.

Your nonguaranteed quote will be very different than your actual premium.

How Your Driving History Can Affect Your Insurance Premium

Here are a few examples of how your driving history can affect your insurance rates.

We took average rates from four major providers and compared them using different scenarios, a clean driving history, at-fault accident, and driving while drunk violation.

| Company | Clean Record | One Accident | DUI |

|---|---|---|---|

| USAA | $1,933.68 | $2,516.24 | $3,506.03 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 |

| Farmers | $2,268.35 | $3,376.16 | $4,932.12 |

Reasons Car Insurance Companies Need Your Credit Score or Credit History

Several car insurance providers use credit-based insurance scores to determine the risk of insuring a driver.

The practice is allowed in all U.S. states except California, Hawaii, Massachusetts, and Michigan.

A credit-based insurance score uses your payment history and the total amount of debt on your credit report to determine your risk level.

Many insurance companies use credit-based insurance scores and the driving history, the number of claims filed in the past, and other factors determining if the driver is worth the risk.

The details can also help with defining insurance rates and credit-based pricing.

| Company | Poor Credit | Difference | Excellent Credit |

|---|---|---|---|

| Allstate | $2,230 | 55% | $1,274 |

| Geico | $2,311 | 51% | $1,177 |

| State Farm | $2,032 | 65% | $1,231 |

| Liberty Mutual | $2,218 | 57% | $1,278 |

| Progressive | $2,095 | 74% | $1,200 |

| Farmers | $2,411 | 58% | $1,395 |

*Insurance quotes included minimum coverage requirements, such as bodily injury liability (BI), property damage liability (PD), uninsured motorist coverage (UM), personal injury protection (PIP), and comprehensive and collision insurance.

Drivers who have a high credit-based insurance score, good driving history, and no claims on their record will often qualify for much lower rates.

Keep in mind that the score is just one factor used to determine your premium.

Even if you have a perfect credit-based insurance score but have violations on your driving record, the company may still consider you a high risk for the lowest rates.

How to Get an Anonymous Car Insurance Quote?

It can be exceedingly difficult these days to get an anonymous auto insurance quote.

Most companies will require you to input your driver’s license number or social security number on the very first page to start the process.

Some only ask for your date of birth, zip code, and motor vehicle information, along with some details about your driving history.

One way to get a “semi-anonymous” quote for car insurance is to use comparison websites or, if you want to be completely anonymous, use Nerdwallet’s insurance estimator.

The tools will provide quotes from several insurance providers at once but requiring only one alias or identity from you.

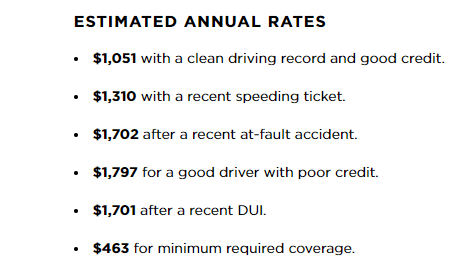

Nerdwallet’s tool will only provide estimated and average annual rates.

Image Credit: NerdWallet Compare, Inc.

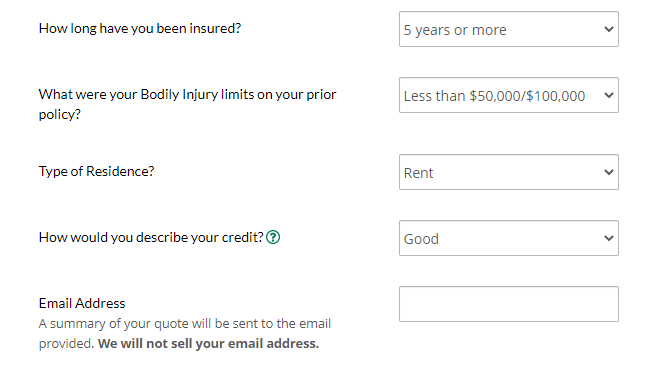

The General offers anonymous insurance quotes sent to your email.

You will not be asked for your name or street address.

The information you need to get a quote from The General includes:

– Your zip code

– Bodily injury limits on prior policy

– Homeownership status

– How long you’ve been insured

– Good, average, or fair credit

Take a look at the information gathered in the screenshot below.

Image Credit: Permanent General Assurance Corporation

What Factors Influence Car Insurance Rates?

While your personal information and credit score can impact your rates, three main factors aren’t as invasive to keep in mind.

Your car insurance premium will also be based on your state coverage liability requirements, your car’s make and model, your age, and more.

The more coverage you are required to purchase in your state, the higher your premium will be, of course.

The vehicle type will influence your cost because insurance companies will consider safety features, repair costs, crime rate, and how high the possibility of theft is for your car.

And for your age, others’ driving tendencies in your age group will help determine how likely you are to file a claim.

How Do I Compare Car Insurance Rates?

The best way to compare accurate car insurance rates without giving up too many personal details is by using a reputable car insurance quote comparison website.

An insurance comparison tool allows you to compare several quotes from the country’s insurance providers, cutting your research time in half.

You can also look at all the great features offered by each auto insurance company, which helps narrow down your choices.

With AutoInsureSavings.org, all you need to do to get car insurance quotes is enter your five-digit zip code at the top of the page.

Then you will receive a list of quotes from the top insurance companies in your area.

Frequently Asked Questions

Can I Calculate my Car Insurance Rate without Revealing Personal Information?

Although it is possible to get an insurance quote with little personal information, it is best to provide as much information as possible when comparing rates due to the auto insurance quote’s personalized nature.

That will ensure you get a rate that is as accurate as possible.

You could research comparison websites to determine if other users experienced any issues after giving their personal information.

Will My Low Credit Score Cause My Insurance Rates to Go Up?

It is possible. Insurance companies look at your credit history to determine if you would be a high-risk driver.

Drivers with past-due accounts are “statistically” more likely to file an insurance claim.

So taking the time to check out your FICO score and make sure there are no inaccuracies on your credit report may help you save money.

If you see anything on your credit report you do not recognize, call, and inquire about it to have it resolved.

How Can I Estimate My Car Insurance Rates?

Using a car insurance comparison website, or an insurance estimator tool, you can get a general idea of how much you will pay each month for your car insurance premium.

You can receive a customized insurance estimate based on factors such as your age, location, and how much coverage you need from several top insurance providers in the country, all at the same time.

Can I Still Get a Car Insurance Quote if I Refuse to Provide Personal Information?

Yes. However, it may not be an accurate rate.

Car insurance companies may use your personal information, such as your credit score, to increase an estimated rate.

Keep in mind that to purchase an auto insurance policy, you will need to provide your personal information to the company.

To learn more about getting car insurance without using personal information, contact our licensed professionals who will be happy to answer any questions you have.

Sources

https://insurify.com/blog/car-insurance/anonymous-car-insurance-quote/

https://www.thezebra.com/auto-insurance/how-to-shop/anonymous-car-insurance-quote/

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.