Car Insurance Guide for 2026 & More; Ultimate Guide to Saving

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Finally, you have selected the new car you want to purchase.

Now it is time for the less exciting part.

That is, to get car insurance coverage.

Car insurance products can be inconvenient and expensive, and no one wants to pay more than necessary.

But to protect you and your vehicle and follow the state-mandated rules, it’s necessary. Plus, accidents happen, and the right coverage will help.

Ultimate Car Insurance Guide

Without the right coverage, you may not be able to repair or replace your motor vehicle. And in the event of an accident, you may have to pay out of pocket.

Finding an affordable level of car insurance coverage may be fairly easy if you make sure to get a little bit of knowledge, a few tips, and a resourceful buying guide with straightforward answers.

What we’ve done is present the best car insurance quote data to you in a few different ways.

And we will present factors or how car insurance works that either raise your premium or, better – lower it!

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Car Insurance 101

Auto insurance carriers are going to use “factors” to determine your premium.

Note: Illustrated above are the primary factors auto insurers use to decide how much and type of coverage you will pay for a policy term. Some count more than others and depends on the car insurance company. This is why you get a different rate from one insurance company to the next. However, your driving profile hasn’t changed.

Note: Illustrated above are the primary factors auto insurers use to decide how much and type of coverage you will pay for a policy term. Some count more than others and depends on the car insurance company. This is why you get a different rate from one insurance company to the next. However, your driving profile hasn’t changed.

Some factors count more than others.

The following factors are:

- Age

- Location

- Driving history

- Vehicle type

- Credit history

- How far you drive

- Gender

- Marital status

- Deductibles

How Your Age Affects Car Insurance

Insurance coverage is going to depend greatly on your age.

Your driver profile is going to change throughout your lifespan too.

This is another important reason to shop around and compare auto insurance quotes throughout your life to save money.

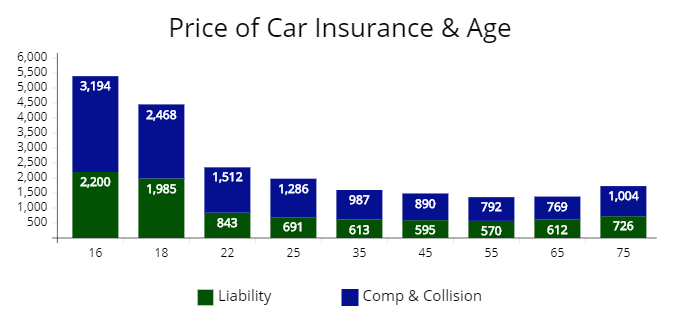

Below are illustrations showing personal car insurance costs throughout a lifetime of driving and types of coverage.

Age 16 18 22 25 35 45 55 65 75

Comp & Collision Coverage $3,194 $2,468 $1,512 $1,286 $987 $890 $792 $769 $1,004

Liability $2,200 $1,985 $843 $691 $613 $595 $570 $612 $726

Total Cost $5,394 $4,453 $2,355 $1,977 $1,600 $1,485 $1,362 $1,381 $1,730

As you can see, the cost of an auto insurance rate is expensive for teen drivers.

Then it begins to lower until the age of 65 or so.

Note: The cost of auto insurance for a teen driver is always high, no matter the driver’s profile. Once a driver is at the age of 25, do premiums begin to lower significantly. From 35 to about 60 years of age are when premiums are the lowest for most drivers. Around the age of 65, premiums will begin to rise in price.

Note: The cost of auto insurance for a teen driver is always high, no matter the driver’s profile. Once a driver is at the age of 25, do premiums begin to lower significantly. From 35 to about 60 years of age are when premiums are the lowest for most drivers. Around the age of 65, premiums will begin to rise in price.

According to the Insurance Information Institute (III.org), over the course of your lifetime, from 18 to 75 years of age, you can spend upwards of $100,000+ on an insurance policy.

Teenage Drivers

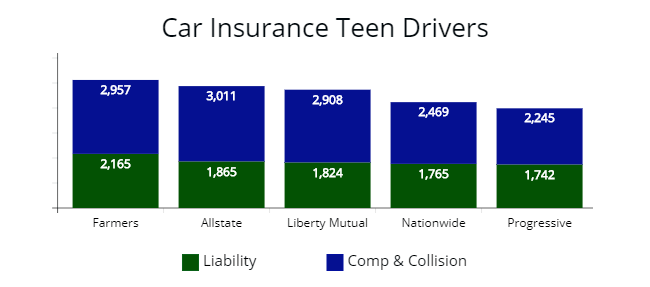

If you are a teen driver, you know auto insurance costs are expensive.

Many teen drivers pay more than double compared to a 30-year old.

Illustrated above is the cost with the type of coverage for teen drivers. Insurance companies offer different prices for young drivers. Things like the amount of coverage you need will impact your premium. All insurers illustrated have the same level of coverage for a teenage driver. Though not illustrated, State Farm offers an excellent Good Student Discount for students with a B average or better.

Parents have added teens to their auto policy only to see it double too.

Illustrated below is a comparison of competitive rates for teen drivers from various auto insurance companies.

| Company | Premium |

|---|---|

| Farmers | $5,122 |

| Allstate | $4,876 |

| Liberty Mutual | $4,732 |

| Nationwide | $4,234 |

| Progressive | $3,987 |

Insurance companies consider a teen driver the riskiest because of the lack of driving experience.

There are a few things you can do. Young drivers’ best options are to keep a clean driving record, maintain safe driving habits, make sure to avoid speeding tickets, take defensive driving courses, and shop around for the best rates.

Some auto insurers offer a good student discount to teens for maintaining at least a 3.0 GPA in school. Allstate and Progressive offer an excellent discount for those with a student going to school or college.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

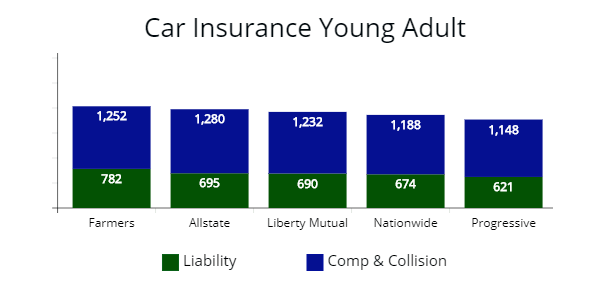

Young Adult Drivers

The age of 25 is when young adults are likely to decrease an automobile insurance provider’s rates.

It’s probably not as low as you would like, however.

Many drivers this age are likely to be married, own a home, and have better credit.

All these help lower your quote to get the best car insurance in your situation.

Illustrated are five vehicle insurance companies and the average cost to insure a 25-year-old driver with full coverage options.

| Company | Premium |

|---|---|

| Farmers | $2,034 |

| Allstate | $1,975 |

| Liberty Mutual | $1,922 |

| Nationwide | $1,862 |

| Progressive | $1,769 |

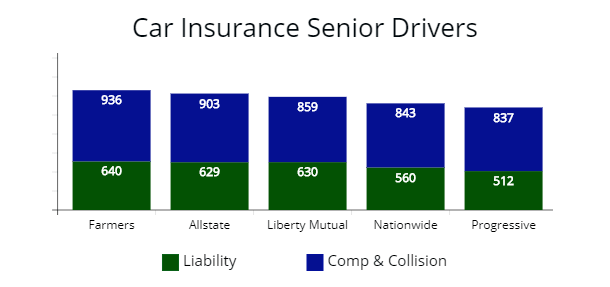

Senior Drivers

From the age of 30 to approximately 55, the cost of a policy doesn’t fluctuate much.

You may see a slight decrease in your premium from 45 to 55 years of age, assuming you keep a good driving history.

On the other hand, as you reach the age of 60 to 70 (insurer dependent), your insurance costs begin to increase even when you have a clean driving history.

An auto insurance company may weigh senior drivers as having more risk while driving on the road.

Depending on the insurer, they may or may not consider a driver a senior until the age of 70.

Either way, you’ll want to comparison shop at that age.

Illustrated are five companies with an average rate for senior drivers.

| Company | Premium |

|---|---|

| Farmers | $1,576 |

| Allstate | $1,532 |

| Liberty Mutual | $1,489 |

| Nationwide | $1,403 |

| Progressive | $1,349 |

Location & Car Insurance

Your location is going to have one of the biggest impacts on your auto insurance premium.

The auto insurance industry is regulated at the state level.

The state will mandate regulations and, in turn, can increase or decrease premiums.

If you live in a high crime or a region prone to floods, hurricanes, etc., your premium price with an insurance company will be reflected by this.

If you live in a city where the public roads are in poor condition and poor claims history, you will pay a higher premium.

Illustrated is the price of an average car insurance premium from state to state with full coverage:

| State* | Annual Premium | State | Annual Premium |

|---|---|---|---|

| Alabama | $1,877 | Montana | $2,206 |

| Alaska | $1,598 | Nebraska | $1,732 |

| Arizona | $2,643 | Nevada | $2,648 |

| Arkansas | $2,052 | New Hampshire | $1,922 |

| California | $1,953 | New Jersey | $2,318 |

| Colorado | $2,498 | New Mexico | $2,100 |

| Connecticut | $2,512 | New York | $2,532 |

| Delaware | $2,059 | North Carolina | $2,498 |

| Florida | $2,712 | North Dakota | $1,655 |

| Georgia | $2,500 | Ohio | $1,640 |

| Hawaii | $1,455 | Oklahoma | $2,262 |

| Idaho | $1,501 | Oregon | $2,200 |

| Illinois | $2,185 | Pennsylvania | $2,100 |

| Indiana | $1,488 | Rhode Island | $2,821 |

| Iowa | $1,472 | South Carolina | $2,015 |

| Kansas | $2,022 | South Dakota | $2,282 |

| Kentucky | $2,665 | Tennessee | $1,861 |

| Louisiana | $2,721 | Texas | $2,423 |

| Maine | $1,268 | Utah | $2,411 |

| Maryland | $1,983 | Vermont | $1,700 |

| Massachusetts | $1,860 | Virginia | $1,409 |

| Michigan | $3,982 | Washington | $1,622 |

| Minnesota | $2,134 | West Virginia | $2,095 |

| Mississippi | $1,994 | Wisconsin | $1,550 |

| Missouri | $2,417 | Wyoming | $1,832 |

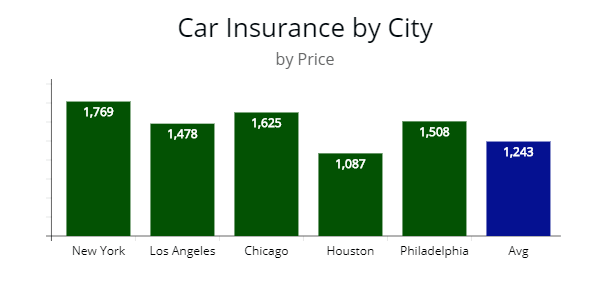

Not only will your premium vary by price from state to state, but the city you live in is also going to be reflected in the final price you pay.

Below is illustrated the average cost of premiums with an insurance company in major cities in the United States.

Note: Location is a major factor for auto insurers to decide the cost of your premium. A premium can fluctuate by 40% or more, depending on the city you reside in. For example, the cost of an average premium in Houston is $1,087, while the cost in New York is $1,769 per year for full coverage.

Note: Location is a major factor for auto insurers to decide the cost of your premium. A premium can fluctuate by 40% or more, depending on the city you reside in. For example, the cost of an average premium in Houston is $1,087, while the cost in New York is $1,769 per year for full coverage.

If you live in an area prone to hurricanes, such as Florida or Louisiana, it could be difficult to find a competitive auto insurance rate.

Driving History & Car Insurance

Probably the biggest factor used by insurance companies to decide your premium is your driving history.

Poor driving history can skyrocket your premium.

Depending on the violation, you can pay from 30% to 100% more than the normal cost.

It can be challenging to find an affordable premium with a poor driving history. You want to make sure to maintain safe driving habits to keep rates low.

The probability of finding an insurance company that won’t raise your rates after a violation is slim.

However, the amount your premium is raised varies from one auto insurance company to the next.

Reckless Driving

Reckless driving is a serious traffic violation.

You can have a rate increase of 30% or more.

Illustrated is the cost of a premium for a reckless driving violation before and after:

| Company | Premium | Reckless Driving |

|---|---|---|

| Farmers | $1,576 | $2,045 |

| Allstate | $1,532 | $1,987 |

| Liberty Mutual | $1,489 | $1,865 |

| Nationwide | $1,403 | $1,932 |

| Progressive | $1,349 | $1,814 |

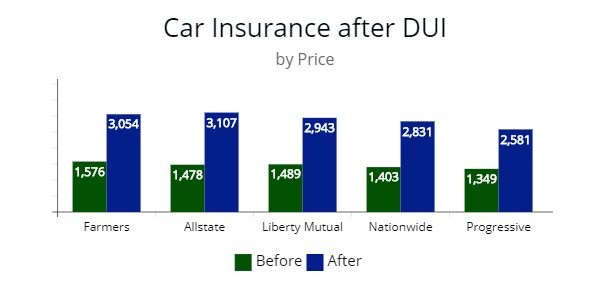

Car Insurance after DUI

Besides reckless driving, a DUI is the most serious traffic offense you can receive.

A DUI can set you back nearly $1,500 per year, depending on your age.

In most states, a DUI will stay on your record for three years. In some states, it can stay on your insurance record for ten years.

Note: A driving under the influence (DUI) violation is one of the worst violations you can get as a driver. As illustrated, the cost of premiums can nearly double in price—the price of a premium for each insurer clustered near $1,500 per year. After a DUI violation, the price clustered near $3,000 per year.

Note: A driving under the influence (DUI) violation is one of the worst violations you can get as a driver. As illustrated, the cost of premiums can nearly double in price—the price of a premium for each insurer clustered near $1,500 per year. After a DUI violation, the price clustered near $3,000 per year.

There are some instances where an insurance carrier may drop you.

If this happens, you will have to find an insurer specializing in a “high-risk” car insurance policy.

Illustrated is the before and after the cost of a DUI violation.

Average Annual Auto Insurance Premium Before and After DUI

| Insurance Company | Average Annual Premium | Average Annual Premium After DUI |

|---|---|---|

| Farmers | $1,576 | $3,054 |

| Allstate | $1,532 | $3,107 |

| Liberty Mutual | $1,489 | $2,943 |

| Nationwide | $1,403 | $2,831 |

| Progressive | $1,349 | $2,581 |

Car Insurance & At-fault Accident

An at-fault accident can set you back nearly $1,000 per year for the next three years or so.

Depending on the insurance company, this could cost you nearly $3,000 in extra premiums over three years.

If you have a premium or looking for one, expect to pay 40% to 60% more than if you didn’t have the violation on your record.

Illustrated is the before and after the cost of an at-fault accident:

| Company | Premium | At-Fault Accident |

|---|---|---|

| Farmers | $1,576 | $2,439 |

| Allstate | $1,532 | $2,379 |

| Liberty Mutual | $1,489 | $2,026 |

| Nationwide | $1,403 | $1,879 |

| Progressive | $1,349 | $1,803 |

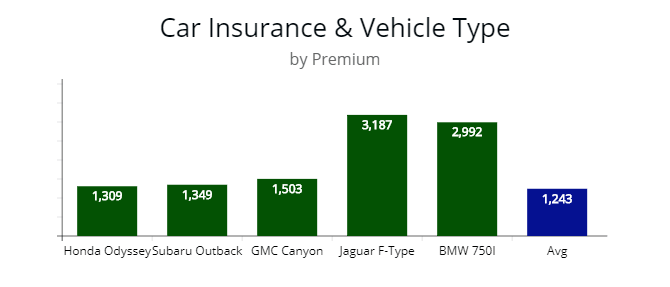

Your Vehicle & Car Insurance

The type of vehicle you drive is another major factor car insurers use to decide your premium.

Insuring a luxury vehicle or a large truck will cost more to insure than a small compact car.

The reason is auto insurers know it costs more to replace parts on expensive vehicles.

Note: The more sporty and expensive the personal vehicle, the more it will cost to insure it. The Honda Odyssey, Subaru Outback, and GMC Canyon all priced from $1,300 to $1,500 per year for full coverage. In contrast, the expensive Jaguar F-Type and BMW 750I are priced at $3,187 and $2,992, respectfully.

Note: The more sporty and expensive the personal vehicle, the more it will cost to insure it. The Honda Odyssey, Subaru Outback, and GMC Canyon all priced from $1,300 to $1,500 per year for full coverage. In contrast, the expensive Jaguar F-Type and BMW 750I are priced at $3,187 and $2,992, respectfully.

In essence, the more it costs to replace your vehicle, the more it costs to insure.

When you are looking to purchase a new vehicle, it is smart to get online quotes before purchasing, so you know what it will cost to insure it and buy the right coverage.

For some safe drivers, the cost to insure expensive cars is not worth the investment, and they prefer to buy a less expensive automobile.

Illustrated is the premium cost of typical “every day” and luxury automobiles:

| Vehicle | Premium |

|---|---|

| Honda Odyssey LX | $1,309 |

| Subaru Outback 2.5i | $1,349 |

| GMC Canyon SL | $1,503 |

| Jaguar F-Type SVR | $3,187 |

| BMW 750I | $2,992 |

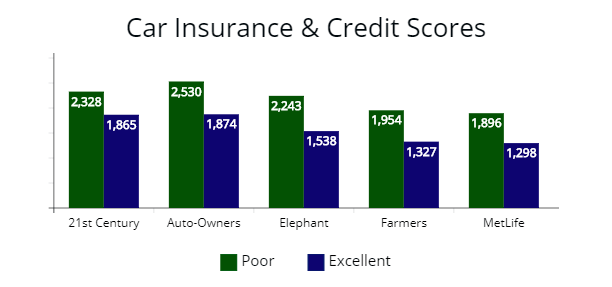

Insurance Credit Score

Your insurance credit score will be another factor auto insurers decide how much you pay for any coverage.

While it is not related to your driving, insurers use your credit to determine your financial responsibility.

Poor credit could indicate a lack of responsibility, while excellent credit could indicate the opposite. To get the best rates, make sure to maintain good credit.

Note: Your credit history is going to reflect in the price of your premium in most states. The difference between poor and excellent credit is over 30% for each insurer illustrated. Three states prohibit the use of it when auto insurers determine a premium. They are California, Hawaii, and Massachusetts.

Note: Your credit history is going to reflect in the price of your premium in most states. The difference between poor and excellent credit is over 30% for each insurer illustrated. Three states prohibit the use of it when auto insurers determine a premium. They are California, Hawaii, and Massachusetts.

If you are shopping for insurance quotes to save money, it is good to check your financial situation.

It is important to realize if your score decreases, insurers can hike your rates.

Another reason to make sure to pay your creditors on time.

On the flip side, if your score increases, you may want to ask your insurer if you can get a break from high premiums to get the best car insurance possible.

Illustrated is the cost of an auto insurance policy with poor to excellent credit from various auto insurers:

| Company | Poor (300-579) | Difference | Excellent (800-850) |

|---|---|---|---|

| 21st Century | $2,328 | 24% | $1,865 |

| Geico | $2,189 | 26% | $1,632 |

| Esurance | $2,276 | 25% | $1,712 |

| Ameriprise | $2,512 | 54% | $1,621 |

| Auto-Owners | $2,530 | 35% | $1,874 |

| Elephant | $2,243 | 45% | $1,538 |

| Erie | $2,165 | 53% | $1,400 |

| Farmers | $1,954 | 47% | $1,327 |

| Good2go | $3,231 | 66% | $1,943 |

| Grange | $2,087 | 27% | $1,638 |

| Liberty Mutual | $1,769 | 37% | $1,285 |

| Mercury | $2,095 | 74% | $1,200 |

| MetLife | $1,896 | 46% | $1,298 |

Depending on the insurer, the difference between poor and excellent credit can vary from 24 to 74%.

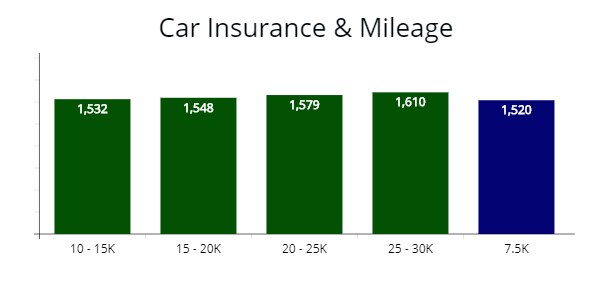

Mileage

How many miles you drive per year is a minor factor car insurance companies use to decide your rate.

The typical mileage used for an accurate auto insurance quote is 12,000 per year.

If you drive more than 20,000 miles a year, you would be considered high mileage.

If you drive less than 7,500, you are low mileage.

Note: How much you drive is another factor auto insurers use to decide your premium price. On the other hand, the maximum premium reduction is 5% if you were driving 30,000 per year and reduced it to 7,500 miles per year. In all other cases, car mileage was no more than a 2% reduction when evaluating auto insurance rates.

Note: How much you drive is another factor auto insurers use to decide your premium price. On the other hand, the maximum premium reduction is 5% if you were driving 30,000 per year and reduced it to 7,500 miles per year. In all other cases, car mileage was no more than a 2% reduction when evaluating auto insurance rates.

The good news about mileage is it doesn’t affect your final premium by much.

With all metrics being equal, there’s a 5% difference in price between a low and high mileage driver. If you drive less than 3,000 or 4,000 miles per year, make sure to tell your insurer the motor vehicle is for pleasure use.

Below is a table of a premium with 10,000 to 30,000 annual miles:

| Annual mileage* | Premium Rates |

|---|---|

| 10,000 - 15,000 miles | $1,532 |

| 15,000 - 20,000 miles | $1,548 |

| 20,000 - 25,000 miles | $1,579 |

| 25,000 - 30,000 miles | $1,610 |

Even though the mileage is part of the factors used to decide your premium, reducing your mileage will not make a big reduction in your final cost after a study of quotes.

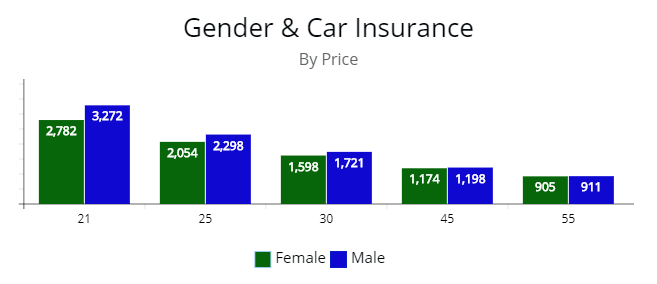

Gender

Gender is going to make a difference when you’re buying car insurance coverage.

For men, particularly at a young age, their premiums are significantly higher than their female counterparts.

Auto insurers see young men as high-risk drivers since they are less experienced and likely to take more risks than older drivers.

However, no matter the gender, young drivers, male or female, pay exorbitantly high premiums with car insurers.

Note: At a young age, males will pay nearly 14% more for an auto policy than their female counterparts. After 40, the price difference among genders is negligible, or less than 1%. In many instances, males will pay slightly less for a premium after the age of 45.

Note: At a young age, males will pay nearly 14% more for an auto policy than their female counterparts. After 40, the price difference among genders is negligible, or less than 1%. In many instances, males will pay slightly less for a premium after the age of 45.

Though a young male driver’s insurance cost is high, females are beginning to catch males in recent times.

Statistics show more females are driving, and they are more likely to file claims.

In turn, their rates are increasing.

For drivers from 35 years of age and up, gender makes a negligible difference in auto insurance prices.

In fact, after the age of 40, men begin to see a decline in their insurance premiums compared to women assuming all other metrics are equal.

Below is the cost of a premium compared from 21 to 45 years of age and by male and female:

| Age | Female | Male | Difference |

|---|---|---|---|

| 21 | $2,782 | $3,272 | 14% |

| 25 | $2,054 | $2,298 | 11% |

| 30 | $1,598 | $1,721 | 7% |

| 45 | $1,174 | $1,198 | 1% |

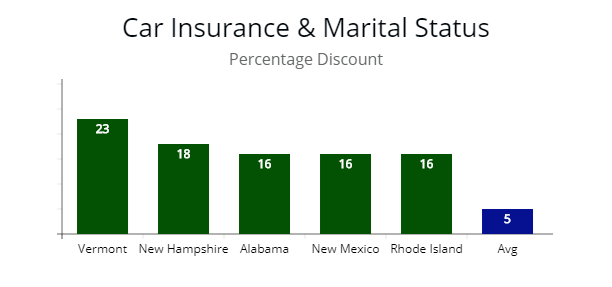

Marital Status

Your relationship status will make a difference in how much car insurance products are in many states.

Married drivers are seen as more responsible and less likely to take risks than their unmarried counterparts.

With some auto insurers, the cost of the premium isn’t different between married or unmarried couples.

Note: In many states, the “marriage” discount is significant. Vermont and New Hampshire offer 23% and 18% driver discounts respectfully for married couples. Alabama, New Mexico, and Rhode Island offer 16% insurance discounts. The average is 5% for many states.

Note: In many states, the “marriage” discount is significant. Vermont and New Hampshire offer 23% and 18% driver discounts respectfully for married couples. Alabama, New Mexico, and Rhode Island offer 16% insurance discounts. The average is 5% for many states.

Most of the time, being married is a policy discount on your premium.

How much of a car insurance discount?

It’s from 0% in Hawaii and Massachusetts to 23% in Vermont.

Below is illustrated the percentage discount for married couples state by state.

| State | Marriage Discount |

|---|---|

| Alabama | 16% |

| Alaska | 14% |

| Arizona | 15% |

| Arkansas | 12% |

| California | 10% |

| Colorado | 9% |

| Connecticut | 12% |

| Delaware | 8% |

| Florida | 6% |

| Georgia | 15% |

| Hawaii | 0% |

| Idaho | 13% |

| Illinois | 15% |

| Indiana | 10% |

| Iowa | 12% |

| Kansas | 11% |

| Kentucky | 14% |

| Louisiana | 10% |

| Maine | 14% |

| Maryland | 15% |

| Massachusetts | 0% |

| Michigan | 2% |

| Minnesota | 14% |

| Mississippi | 15% |

| Missouri | 13% |

| Montana | 0% |

| Nebraska | 10% |

| Nevada | 12% |

| New Hampshire | 18% |

| New Jersey | 12% |

| New Mexico | 16% |

| New York | 12% |

| North Carolina | 0% |

| North Dakota | 15% |

| Ohio | 15% |

| Oklahoma | 9% |

| Oregon | 12% |

| Pennsylvania | 12% |

| Rhode Island | 16% |

| South Carolina | 11% |

| South Dakota | 12% |

| Tennessee | 12% |

| Texas | 7% |

| Utah | 14% |

| Vermont | 23% |

| Virginia | 15% |

| Washington | 13% |

| Washington D.C. (District of Columbia) | 12% |

| West Virginia | 15% |

| Wisconsin | 13% |

| Wyoming | 10% |

Source: Quadrant Information Systems via CarInsurance.com

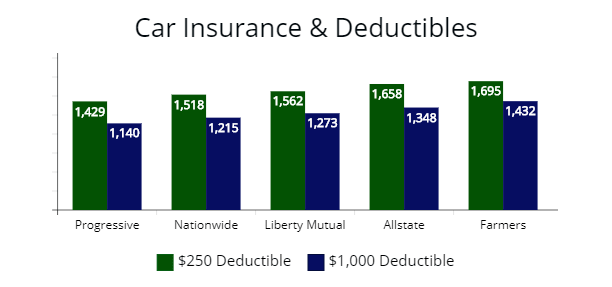

Deductibles

A deductible is what you will pay after an accident and while filing a claim with an insurance company.

If you have a $500 deductible, you will pay that amount while your insurance company covers the remainder.

For example, you had a fender bender and damaged the rear end of your insured vehicle.

The cost of damage is estimated at $2,500.

If you have a $500 deductible, you pay that amount, while your insurer would cover the other $2,000.

Note: Raising your deductible is an easy way to lower your premium cost while maintaining car insurance coverage. This strategy is good for many drivers since you could be swayed from making insurance claims with $500 or more deductible.

Note: Raising your deductible is an easy way to lower your premium cost while maintaining car insurance coverage. This strategy is good for many drivers since you could be swayed from making insurance claims with $500 or more deductible.

The deductible only applies to certain types of coverage options, which are:

- Comprehensive insurance

- Collision insurance

- Uninsured Motorist Property Damage (UMPD)

There are no deductibles for bodily injury and property damage liability coverage.

The liability insurance (sometimes called minimum coverage) of your auto insurance policy is not held to deductible limitations.

The most common deductible amounts for a comprehensive or collision claim are $100, $250, $500, and $1,000.

The higher your deductible, the lower your comprehensive and collision premium is.

What many drivers do is raise their deductibles to lower their premiums.

This is a good strategy since the higher your deductible, the less likely you will file a claim with an insurance company.

Below is comprehensive and collision optional enhancements from various companies with different deductibles.

| Company | $100 Deductible | $250 Deductible | $500 | $1,000 |

|---|---|---|---|---|

| Farmers | $1,859 | $1,695 | $1,576 | $1,432 |

| Allstate | $1,839 | $1,658 | $1,532 | $1,348 |

| Liberty Mutual | $1,752 | $1,562 | $1,489 | $1,273 |

| Nationwide | $1,707 | $1,518 | $1,403 | $1,215 |

| Progressive | $1,641 | $1,429 | $1,349 | $1,140 |

As you can see from the illustrations, raising your deductible can save you nearly $400 per year with some companies.

Comprehensive Deductible

Comprehensive coverage, also referred to as “other than collision,” protects and pays for car repairs from damage resulting from theft, weather-related accidents, vandalism, animals, or any other related auto accident.

The auto repair costs will be covered, minus your deductible, no matter who is at fault.

Collision Deductible

When most people think of an auto insurance policy, they probably think of collision.

A common optional coverage enhancement.

Collision insurance protects and pays for car repairs or a fender bender from another object, such as a car, stop sign, garage door, or similar auto accident.

The auto repair costs will be covered, minus your deductible, regardless of fault with a car insurance company.

Uninsured Motorist Coverage

According to the Insurance Research Council (IRC), 1 in 8 people drives uninsured.

Uninsured motorist coverage will pay for the car repairs if you are in a no-fault accident with an uninsured or hit-and-run driver.

Or there are policy limits on liability coverage, which are not enough to cover all damages in an auto accident to your insured vehicle.

Many times your insurer can recoup the deductible via the other driver.

PIP and MedPay Coverage

For an added layer of protection, you can add underinsured motorist coverage, personal injury protection (PIP), and medical payments coverage (MedPay) to help with bills and medical expenses.

MedPay and PIP coverage are excellent choices if you don’t have health insurance. Also, PIP coverage reimburses for lost wages or income after a car accident.

Not every state requires PIP or MedPay. Both coverages are a powerful add-on to your insurance premium.

Again, if you don’t have health insurance, you may want to consider either coverage to help with medical expenses in the event of an accident.

If you have health insurance, personal injury protection is a coverage that has to be used first (before your health insurance) if you are injured in an auto accident, according to the Insurance Research Council.

For coverage levels, be sure to contact your local agent or current insurer and make sure to ask about coverages to help with medical expenses.

Roadside Assistance

Roadside assistance is an optional coverage if your car runs out of gas or is broken down on the side of the road.

Companies offer roadside assistance for $60 or more per month, but insurers offer it a few dollars a month.

GAP Coverage

GAP, also known as Guaranteed Auto Protection, helps pay off the car loan if your motor vehicle is totaled or stolen and you owe more than the car’s depreciated value. GAP coverage will pay the gap between the depreciated value and what you owe.

According to III.org, you can buy GAP insurance at some car dealerships, but insurers offer the coverage at a lower price.

Frequently Asked Questions

What is auto insurance?

Car insurance is a contract between you and the insurer, which will protect you from financial loss.

States require all registered vehicles to have minimum liability coverage known as bodily injury and property damage liability insurance.

Some states may require additional coverage such as:

– Personal injury protection (PIP)

– Uninsured/underinsured motorist coverage (UM, UIM)

– Medical payments coverage (MedPay)

Optional coverage for owners of registered cars is collision and comprehensive coverage unless you lease or have a car loan for your vehicle.

If so, the lender requires car owners to maintain what is called “full coverage” or bodily injury, property damage liability coverages, and comprehensive and collision.

According to the Insurance Information Institute, the main coverages are:

- Liability coverage

- Collision

- Comprehensive coverage

- Uninsured motorist

- Underinsured motorist

- Personal Injury Protection

What is not covered by auto insurance?

Well-crafted car insurance policies are robust and protect you from liability and theft, but even the best coverage will not protect you and your car from everything.

Under a basic policy with minimum insurance requirements, you probably will not have protection from:

– Damages that exceed your coverage limit.

– Damages caused by another person driving your car.*

– Routine maintenance and unable to repair or replace your car.

*In most states, it is covered if the automobile owner gave permission to operate the car.

What are the factors that influence my rate?

Auto insurance policies are individualized to each person.

There are quite a few factors considered for your rates, but the basic ones are:

- Your age

- Type of car

- Age of the car

- Location

- Claims history

- Credit score

- Gender

- How much you drive

- Marital status

- Safety features

Who’s required to have auto insurance, and how much is required?

Forty-eight states require drivers to maintain minimum coverage requirements.

The coverage amount varies by state.

If you are caught driving without insurance in any of those states, fines and penalties will be imposed.

Only two states do not require coverage: New Hampshire and Virginia.

Both states urge drivers to maintain minimum liability coverage and over 95% of drivers in New Hampshire and Virginia buy coverage for their vehicles.

How much insurance is enough insurance?

The minimum coverage for bodily injury in some states is as low as $10,000 per person and $20,000 per accident.

However, if you are in an accident, you can be sued for greater damages.

Most licensed agents recommend coverage levels at $100,000 per person and $300,000 per accident.

It would be best if you bought liability insurance appropriate to cover the value of your assets.

What are the benefits of car insurance?

Proper car insurance coverage can protect you from legal action and financial loss.

It protects your property and makes it easier to repair or replace damages caused by an accident and/or theft.

Most importantly, it will give you peace of mind.

Sources

Insurance Information Institute (III.org)