Auto Insurance Companies That Don’t Check Credit – What to Know

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If your credit report is less than perfect, your credit score might cost you money in several ways; this can include your car insurance premiums.

In most states, car insurers can use your personal credit score to determine personalized rates when you start your policy or adjust rates at renewal.

People with a good score may pay less for a premium than people with a poor credit score.

But not all car insurers use credit scores to set rates or establish eligibility — and not all states allow the practice.

Credit-based scores are one of many factors used by auto insurers to determine monthly premiums.

Auto insurers that use it as a rating factor might refer to the measurement as your insurance credit score or your credit-based insurance score.

A 2007 report from the Federal Trade Commission (FTC) detailed the correlation between credit scores and risk of insurance losses.

The FTC pointed to credit-based scores as predictors of risk.

On average, credit performance can be predictive of both the number of claims, which insurers refer to as frequency, and the cost of claims, which insurers call severity.

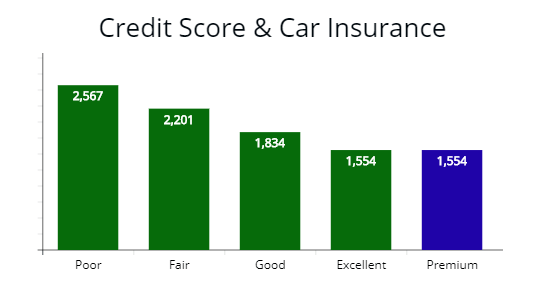

Illustrated above is how your score affects the price of your annual premium from a car insurance company. With a low score, the price is 60% higher than a person with an excellent score.

Illustrated above is how your score affects the price of your annual premium from a car insurance company. With a low score, the price is 60% higher than a person with an excellent score.

Which states allow credit scores for auto insurance?

Before exploring auto insurers that don’t check credit, let’s look at states restricting or banning the practice.

The department of insurance for each state regulates insurance coverage within its borders so that rules can differ from one state to another.

This means that no insurance companies can use credit in some states when setting premiums, while other states allow the practice.

Some states allow credit for an auto insurance company, either to determine eligibility or to determine rates.

Other states prohibit the use of it.

A third group restricts the use of credit reports but does not prohibit their use.

States that prohibit the use of credit for car insurance rates

- California

- Hawaii

- Massachusetts

- Michigan

States that restrict the use of credit for car insurance rates

States that restrict the use of credit ratings may impose more stringent rules on how insurers can use credit history while not disallowing the practice.

| State | Banned | Restricted | Limits |

|---|---|---|---|

| California | Yes | None | |

| Hawaii | Yes | Can affect homeowners insurance | |

| Massachusetts | Yes | None | |

| Michigan | Yes | None | |

| Georgia | Yes | Cannot use it to cancel a policy. | |

| Maryland | Yes | Uses it to determine the rate, but insurers cannot use it to cancel a policy. | |

| Oregon | Yes | Insurers can't use it to determine your premium, only to underwrite the policy. | |

| Utah | Yes | Used only to underwriting a policy. |

According to the National Association of Insurance Commissioners, states typically disallow the use of credit-based scores as the sole reason for changing rates.

This means something else must change for your credit to play a role in states that take this stance.

Triggers might include a broad rate change or underwriting changes specific to you, like changes to your driving record or a claim.

In other states, your insurer can run a credit check during your policy term.

Still, any insurance premium changes due to your credit won’t take effect until your policy renews.

Which auto insurance companies don’t check credit?

First, most insurers use credit to determine rates in states that allow the practice to address the bad news.

However, a handful of companies don’t use it, and others are less reliant on credit, possibly providing some more attractive choices.

Auto insurance companies that don’t check credit may be limited to regional insurers.

For example, Dillo Insurance offers coverage in Texas.

In Oklahoma, Equity Insurance offers coverage without a check.

Drivers in New Jersey or Pennsylvania can turn to CURE auto insurance company, an auto insurer that doesn’t rate premiums based on credit, homeownership, education, or occupation.

| Company | State | Phone number |

|---|---|---|

| Dillo | Texas | (855)-693-4556 |

| Equity Insurance | Oklahoma | (800)-777-0404 |

| Cure | Pennsylvania & New Jersey | (800) 535-2873 |

Because relatively few companies don’t use credit, you can consider using an auto insurer that puts less weight on insurance as a rating factor.

A telling report on WalletHub shows that an excellent score can save you 20% with Geico, for example, while it can save you 54% with Farmers.

This also suggests Geico may be more forgiving of less-than-perfect credit, while Farmers may be a better fit once you’ve established it or repaired a spotty history.

The effect of credit on auto insurance rates can vary by state as well.

For example, drivers with no credit history can pay twice as much for a premium in New Jersey.

In contrast, studies show this difference as closer to a two-thirds increase nationally.

Montana and Alaska both see less than a 30% average increase due to poor ratings.

How is my credit-based insurance score calculated?

The scores used for car insurance rates (and sometimes home insurance) differ slightly from a regular FICO score, placing more weight on payment history and placing lesser importance on the types of credit used.

A regular FICO score uses payment history as 35% of the score.

By contrast, a FICO credit-based insurance score makes payment history its leading criteria, making up 40% of the score.

The types of credit you have played a smaller role in both types of scores, but the importance of rating factors is halved with a FICO insurance score, making up only 5% of your score.

Ways to improve credit scores if you have bad credit

Most car insurers check your score when giving quotes and setting auto insurance premiums.

Average rates can be higher if you have a bad score, but you can often earn more competitive rates by improving your credit report.

Consider making these changes to improve your credit score.

– Make payments on time: Paying your bills on time may have the largest effect on your score. Payment history makes up 40% of your FICO credit-based insurance score.

– Credit utilization ratio: Credit utilization refers to how much of your available credit you’ve used. Many finance experts recommend keeping card balances at less than 30% of your available limits. Lower is better.

– Number of accounts: Having too many accounts can hurt your score.

Also, check your report for errors or to learn in which you can improve your scores.

Federal law makes a free report available to you each year.

Request a copy of your report from the 3 major reporting bureaus at annualcreditreport.com.

Alternatives to auto insurers that check credit

Because most traditional car insurers check credit, it may make sense to consider insurers that use telematics or usage-based insurance companies.

Telematics uses a smart device to measure your driving habits, including mileage, use of your vehicle, and driving speeds.

These devices may also monitor hard braking or sudden starts.

Safer driving habits can help reduce the cost of your premium.

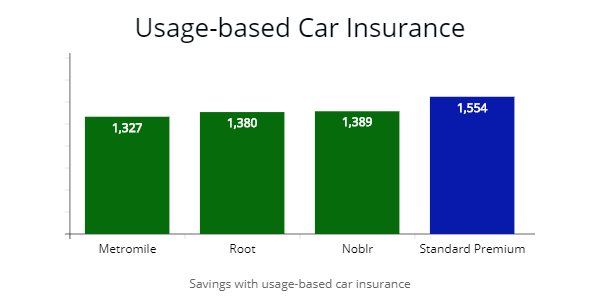

With usage-based companies, you can find savings from 10 to 15% over a standard premium. This can be a good alternative to reduce your premium when it is affected by credit.

With usage-based companies, you can find savings from 10 to 15% over a standard premium. This can be a good alternative to reduce your premium when it is affected by credit.

Usage-based insurance bases your insurance cost on how much you use your vehicle.

Low mileage drivers can expect to pay less with true usage-based coverage.

Newer insurance providers like Metromile, Root, and Noblr offer usage-based auto coverage.

However, usage-based providers might incorporate credit checks as part of their underwriting.

For example, Metromile and Root use credit as a rating tool, although Root plans to eliminate the practice by 2025.

With traditional providers, discounts based on driving habits can help offset higher rates due to less-than-perfect credit.

Consider getting coverage through well-known national brands, such as Progressive or Geico, both known for lower-than-average rates for drivers with bad credit.

Big names like Allstate, State Farm, Farmers, and Liberty Mutual also offer telematics-based discounts or low usage discounts.

Does checking car insurance quotes affect my credit score?

Credit-based insurance scoring isn’t a request for new credit, so there is no adverse effect on your score when you get insurance quotes.

Requests for your history take the form of a hard inquiry, also called a hard pull, for new requests.

By contrast, an insurance-based request is not associated with a new account or a credit line increase, so this type of request is a soft inquiry or a soft pull.

Your FICO score won’t change due to applying for insurance coverage or when your insurer runs an update to your insurance score.

Is it legal for car insurance companies to check my credit score?

It is legal to check credit as part of quoting or the insurance application process in most states.

A car insurance company is regulated at the state level, so each state determines how insurers can set rates within the state.

If your state allows the use of it, insurers can check your score per state regulations.

However, like other financial service providers, insurers can’t check your credit without your consent. In some cases, this permission may be verbal.

Does car insurance use credit scores alone to determine rates?

Where credit scores are used, rates can increase by an average of over 70% due to poor credit.

Please see the table below:

| Company* | Poor (300-579) | Difference | Excellent (800-850) |

|---|---|---|---|

| Allstate | $2,230 | 55% | $1,274 |

| Geico | $2,311 | 51% | $1,177 |

| USAA | $2,032 | 65% | $1,231 |

| American Family | $2,218 | 57% | $1,278 |

| 21st Century | $2,328 | 24% | $1,865 |

| Auto-Owners | $2,530 | 35% | $1,874 |

| Elephant | $2,243 | 45% | $1,538 |

| Erie | $2,165 | 53% | $1,400 |

| Farmers | $1,954 | 47% | $1,327 |

| Good2go | $3,231 | 66% | $1,943 |

| Liberty Mutual | $1,769 | 37% | $1,285 |

| Mercury | $2,095 | 74% | $1,200 |

*Quote is for a 30-year-old male with good driving history (good and bad score) and property damage liability, bodily injury liability, comprehensive and collision coverage, uninsured and underinsured motorists coverage, medical payments coverage, and/or personal injury protection to keep financial responsibility in the state you reside in.

However, not all states allow the practice and several other key factors that can affect insurance costs.

Insurers also consider the following factors:

- Driving record

- Driving experience

- Accidents

- Coverage amounts

- Repair costs

- Theft rates

- Safety features

- Gaps in coverage

- Other types of policies you own

In some cases, insurers analyze thousands of data points when setting a premium.

Final Thoughts

In most states, a driver’s credit rating can play a big role in insurance costs.

However, each car insurer can weigh rating criteria differently. Your auto insurance quote will be specific to your situation and based on your insurance history.

This means some insurers may not place as big a penalty if you have less-than-perfect credit, while a handful of insurers don’t consider it at all when setting rates.

When shopping for insurance, compare insurance quotes from multiple carriers. But also consider coverage details in addition to the price.

Your auto insurance policy can protect you against difficult-to-predict losses that can change your finances for years to come, so it’s important to have the right policy and consider additional options or comprehensive coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.