The Best & Cheapest Car Insurance for Your Honda Civic

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Mar 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The Honda Civic continues to hold the crown as Honda’s most popular and commonly owned car.

Its status as one of the most popular cars in the United States can be attributed to its reputation as a safe yet fun, reliable vehicle; as well as affordable.

Despite its reputation, the vehicle is more expensive to insure than the average vehicle similar to its class.

In fact, it is the most expensive Honda model to insure.

Comparing price quotes from different car insurance companies, the average insurance rate for a new Honda Civic costs about $2,500 per year.

That works out to be about $208 per month for full coverage.

Of course, it will depend on the model.

When I did my analysis, I found Liberty Mutual and Allstate offering the cheapest coverage for an experienced driver.

A driver with a good driving history can get an annual rate at $2,043 per year for a 30-year-old driver and $1,485 per year for a 40-year-old driver from Liberty Mutual.

Allstate offers an annual rate of $2,089 for a 30-year-old driver and $1,510 for a 40-year old.

Below is the national average cost of an insurance premium by model:

| Civic Model | Avg. Premium | Sticker Price |

|---|---|---|

| Coupe | $2,154 | $21,050 |

| Si Coupe | $2,276 | $25,200 |

| Sedan | $2,149 | $21,050 |

| Si Sedan | $2,219 | $25,200 |

| Hatchback | $2,197 | $22,000 |

| Type R | $2,642 | $37,495 |

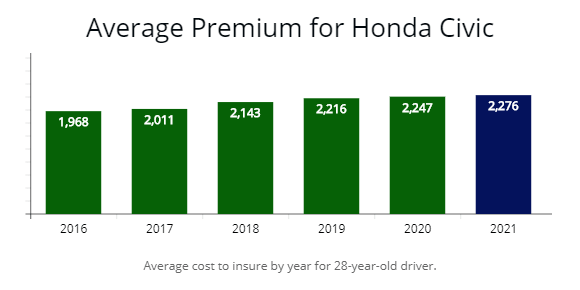

See Honda Civic insurance rates by year.

Why does it cost more to insure a Honda Civic than other cars in its class?

Although the Civic has good safety and crash test ratings, according to the Insurance Institute of Highway Safety, it is costlier to insure than other vehicles with similar features.

The increased cost is due to the Honda Civic being more likely to be stolen than other cars in its class.

Therefore, comprehensive coverage and collision coverage is a little more when getting coverage.

For that reason, its popularity is a gift and a curse.

| Model | Comprehensive | Collision | Liability | Total |

|---|---|---|---|---|

| Coupe | $490 | $893 | $686 | $2,069 |

| Si Coupe | $540 | $948 | $714 | $2,202 |

| Type R | $590 | $1,254 | $815 | $2,659 |

| Accord | $396 | $714 | $587 | $1,697 |

How does the cost of insuring a Honda Civic compare with other Honda models?

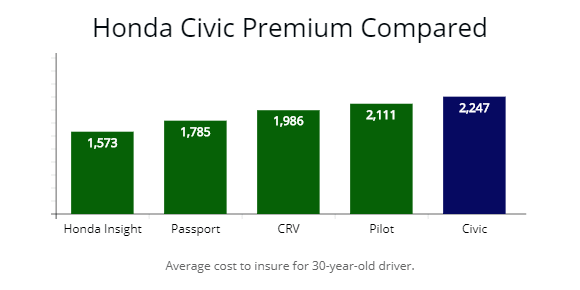

A new base model Civic costs about $150 more to insure than a new base model Honda Accord and $600 more than a new Honda Insight.

While the car is more affordable to purchase, its sale price has little to do with the cost to insure it.

There are two primary reasons Honda Civic insurance rates are more than the Accord, Insight, and any other Honda vehicle.

| Vehicle | Premium |

|---|---|

| Civic | $2,231 |

| Insight | $1,765 |

| Toyota Camry | $2,112 |

| Hyundai Elantra | $2,333 |

| Subaru Impreza | $1,976 |

| Ford Focus | $1,987 |

| Kia Forte | $1,304 |

| Toyota Corolla | $1,467 |

| Chevrolet Cruze | $1,456 |

See Honda Civic insurance rates by year.

1. They depreciate more slowly

Although the average price of a Civic costs less to purchase than the Accord, it tends to retain its value over a five-year period better.

In the case of an accident or damage claim, your insurer will have to pay the car’s actual cash value at the time of the claim.

That means a car that retains its value better will carry a higher insurance rate.

2. It is a popular car choice for young drivers

In general, the claim rate for teenage drivers is higher than middle-aged and older drivers.

The higher claim rate translates to higher costs across the board.

While they might be more costly to insure, that doesn’t mean every Civic owner will pay the same price to insure their vehicle.

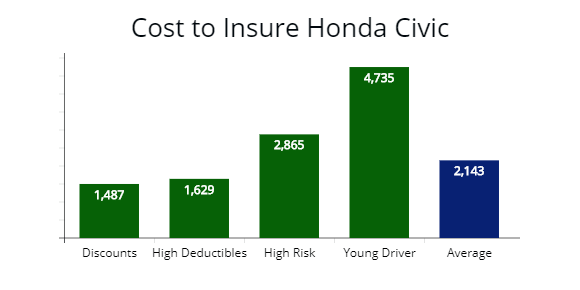

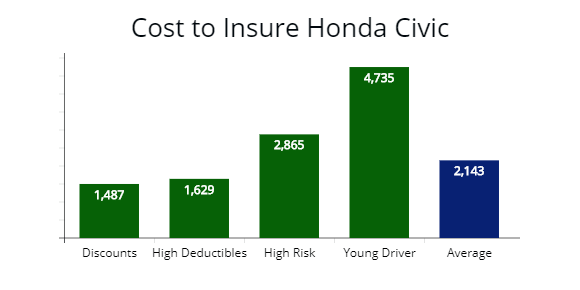

Illustrated above is the amount to insure Civics by driver type, driver age, and profile. Drivers discounts ($1,487) and high deductibles ($1,629) pay the least to insure the vehicle. High risk ($2,865) and young drivers ($4,735) pay the most. The national average cost of an auto insurance premium is $2,134, illustrated in blue.

Illustrated above is the amount to insure Civics by driver type, driver age, and profile. Drivers discounts ($1,487) and high deductibles ($1,629) pay the least to insure the vehicle. High risk ($2,865) and young drivers ($4,735) pay the most. The national average cost of an auto insurance premium is $2,134, illustrated in blue.

What factors influence the cost of insurance?

As with any car, your Honda Civic’s insurance rates depend on a few different factors.

These factors include:

– The age of the driver

An 18 to 20-year old driver can expect to pay significantly more to insure it than a 30-year old driver would have to pay.

The difference in cost could be anywhere from $1,800 to $6,000 more per year.

– The driving record of the driver

If you have violations on your driving record, you will pay more for car insurance, no matter what make and model vehicle you drive.

This is especially true if you have a high-risk violation, such as a DUI conviction or multiple speeding tickets.

– The age of the car

You will pay more for Honda Civic insurance for a brand-new one than you will for one that is five or ten years old.

The actual car value for older vehicles is less than one that is brand new.

The age of the vehicle is going to determine your premium. Civics are notorious for holding value well, thus having higher than average premiums for older models. Particularly for comprehensive and collision coverage. Don’t expect to save much, even if you buy an older model.

The age of the vehicle is going to determine your premium. Civics are notorious for holding value well, thus having higher than average premiums for older models. Particularly for comprehensive and collision coverage. Don’t expect to save much, even if you buy an older model.

Depending on the age of your automobile, you may not need full coverage.

That will further reduce how much you pay for your auto insurance rate.

– The location of the driver

It is no secret that drivers that live in large cities pay more for a premium than those in less populated areas.

In general, cities have far more traffic and limited parking options, making them more susceptible to damage and requiring a submitted claim.

How can I reduce the cost to insure my Honda Civic?

The most effective way to reduce auto insurance costs on your Honda Civic is to shop around.

It is easier than ever to get multiple insurance quotes so you can be confident you’re getting the lowest price on insurance for your Civic.

| Company | Premium 30-year old | 45-year old |

|---|---|---|

| Liberty Mutual | $2,043 | $1,485 |

| Allstate | $2,089 | $1,510 |

| State Farm | $2,115 | $1,512 |

| Geico | $2,184 | $1,543 |

| Progressive | $2,256 | $1,642 |

| Farmers | $2,287 | $1,655 |

| USAA | $2,318 | $1,611 |

| Travelers | $2,451 | $1,689 |

| Elephant | $2,548 | $1,712 |

| Auto-Owners | $2,684 | $1,743 |

| Hartford | $2,690 | $1,655 |

| Ameriprise | $2,712 | $1,743 |

Another effective way to reduce the cost of car insurance on your Civic to see if you qualify for any auto insurance discounts.

Drivers with a clean driving record can save more than $600 per year by taking advantage of good driver discounts.

Below are common discounts and safety features:

- Early signing

- Anti-lock brakes

- Passive restraint

- Homeowner

- Accident-free

- Multi-car

- Loyalty

- Military

- Telematics via an APP

Safety features in the automobiles use state of the art technologies.

Below are advanced safety features to reduce coverage:

| Vehicle Stability Assist with Traction Control | Tire Pressure Monitoring System (TPMS) |

| Electronic Brake Distribution (EBD | LED Daytime Running Lights |

| Brake Assist | Multi-Angle Rearview Camera |

And passive Honda Civic safety features included with all vehicles to get auto insurance discounts:

| Advanced Front Airbags | Front 3-Point Seat Belts with Automatic Tensioning System |

| SmartVent Front Side Airbags | Lower Anchors and Tethers for Children |

| Side Curtain Airbags with Rollover Sensor | Driver’s and Front Passenger’s Seat-Belt Reminder |

| 3-Point Seat Belts at all Seating Positions | Child-Proof Rear Door Locks |

And driver assistance features and technologies, one of the reasons for a high safety rating according to the Insurance Institute for Highway Safety:

| Forward Collision Warning | Road Departure Mitigation System |

| Collision Mitigation Braking System | Lane Keeping Assist System |

| Lane Departure Warning | Adaptive Cruise Control (ACC) with Low-Speed Follow |

Another way to save money when insuring your vehicle is to reduce your auto insurance coverage to a liability-only policy.

That switch can save you as much as $900 per year on your premium.

However, if you are leasing or financing your Civic, you probably won’t be able to reduce your coverage to a liability-only policy until you have fully paid off the vehicle.

The best and easiest way to reduce your Honda Civic insurance is to shop around for an insurance provider that best fits your needs and situation.

Civics are more popular with younger drivers since it is sporty and handles well. If you are looking to save on your premium, other models, such as Passport, CRV, or Insight, have much lower premiums.

Civics are more popular with younger drivers since it is sporty and handles well. If you are looking to save on your premium, other models, such as Passport, CRV, or Insight, have much lower premiums.

What is the best car insurance company for Honda Civics?

If you are looking to get full coverage insurance, I have found Liberty Mutual to offer the best price on average.

That does not mean you might not find cheaper coverage for your new Civic elsewhere.

That is why it is wise to shop around and compare rates before purchasing an insurance policy for your car.

If you are looking to buy car insurance for a used Honda Civic, Liberty Mutual is still a worthy option, but you might find a cheaper alternative.

For used Honda Civics from 2013 to 2018, Allstate offers the best rates.

It will depend on your driver profile, location, or own or rent a home.

On average, Allstate’s annual premium cost is $150 to $200 cheaper than Liberty Mutual.

Coverage for used Honda Civics is, on average, significantly more expensive with other large insurance companies such as Progressive and Nationwide.

Before you purchase car insurance, you should compare quotes with various auto insurers and financial institutions.

By getting more than one quote, you can make sure you get lower Honda Civic insurance rates for additional savings.

Sources

National Highway Traffic Safety Administration

Quadrant Information Services

Insurance Information Institute (III.org)

National Insurance Crime Bureau

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.