Are you able to get Auto Insurance with a Suspended License? Sure, just Realize it could be Costly!

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Was your license recently suspended due to a DUI offense, unpaid tickets, or a major traffic violation?

If you’re stuck with a suspended license, you may be wondering what it means for your car insurance policy.

You are able to get a policy while your license is suspended, but realize it is going to be very expensive.

Here at AutoInsureSavings, we frequently get emails inquiring about the impact that a suspended license has on car insurance.

Some of the most commonly asked questions that we get include the following:

-

Can I get insurance with a suspended license?

-

How will a suspended license affect my car insurance?

-

Will I need car insurance with a suspended license?

-

Will my car insurance rates go up?

-

Will I still be eligible for car insurance discounts?

-

How long will a suspended license affect my car insurance rates?

Most insurers are going to forget about your accidents and poor driving record after 3 years. If you recently had a license suspension you will have to clear that up, maintain a clean driving record for at least 3 years, then premium prices should be somewhat normal.

While the consequences of a suspended license often vary depending on the individual and the insurance provider, I’ve provided some general information below that will help you get a better idea as to how your suspended license is going to impact you and your relationship with your carrier.

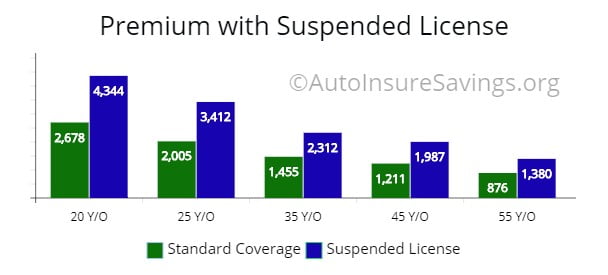

Note: The cost of an auto premium can nearly double when you get a license suspension. If you have to maintain coverage you want to realize the dramatic increase in price. Depending on the state you reside in you may have to get an SR-22. Generally, SR-22’s last for three years.

Can I get Insurance with a Suspended License?

It is possible to get car insurance with a suspended license in most states.

If your provider revoked your policy after your DUI conviction or suspended license, then the first step that you should take to re-obtain a policy is to contact your local DMV.

They will let you know whether your state allows drivers to obtain and maintain car insurance with a suspended license.

If your state allows it, the next option is to get in touch with various car insurance companies to see if they will provide you with coverage.

The easiest and most efficient way to do this is to use our advanced quote comparison tool at the top of the page.

By entering in your zip code, and answering the provided questions honestly, I’ll help you find a company that is willing to offer you a policy.

While there are many providers that will still sell you a premium, keep in mind that many of these providers will also have a list of stipulations that must be met for the policy to be finalized.

Such stipulations may include providing proof that you are working to have the suspension removed, or a guarantee that your license will be reinstated after a specified time period.

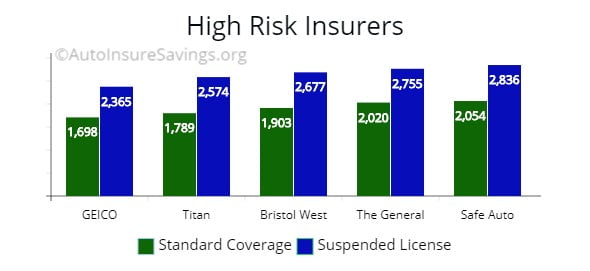

Note: In the illustration above I have queried 5 of the most popular insurers offering coverage for drivers categorized as high risk or nonstandard coverage. Each premium was hiked at least 27%. The best option in this case is Geico Casualty when it comes to price. The other carrier’s rate hike for “high risk” coverage is from 26% to 32%. Titan has the highest percentage hike at 32% while Safe Auto is the lowest with a 27% rate hike. Titan is a subsidiary of Nationwide and The General is a subsidiary of American Family.

Note: In the illustration above I have queried 5 of the most popular insurers offering coverage for drivers categorized as high risk or nonstandard coverage. Each premium was hiked at least 27%. The best option in this case is Geico Casualty when it comes to price. The other carrier’s rate hike for “high risk” coverage is from 26% to 32%. Titan has the highest percentage hike at 32% while Safe Auto is the lowest with a 27% rate hike. Titan is a subsidiary of Nationwide and The General is a subsidiary of American Family.

How will a Suspended License Affect My Car Insurance?

If your insurance provider doesn’t cut you off as a customer after your driving privileges have been suspended, you should consider yourself lucky.

However, there’s a good chance that you will not get away unscathed.

In most cases, a suspended license, be it from a DUI conviction or major traffic violation will prompt your insurance company to switch you to special high-risk policy coverage policy.

With the high-risk label, there is no doubt that your insurance rates will increase substantially.

Auto Insurance rates for high-risk drivers are significantly more expensive than standard automobile insurance.

However, your auto policy may still allow you to qualify for discounts depending on your overall driving history.

High-risk insurance will also earn you a shorter leash with your provider.

That means that they could very easily revoke your insurance for what would typically be considered a minor traffic infraction.

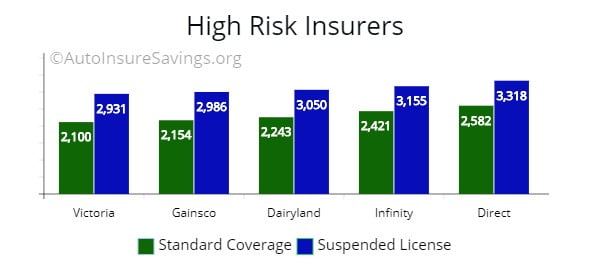

Note: Illustrated above are 5 additional insurers offering coverage for drivers categorized as “high risk”. Each average 26% to 33% more for a driver under a license suspension. If you are able to get coverage. The only carrier with less than excellent rating according to AM Best is Gainsco. Their rating is B++ which is good. If you are in the market for nonstandard coverage any of the carriers should be able to help.

Note: Illustrated above are 5 additional insurers offering coverage for drivers categorized as “high risk”. Each average 26% to 33% more for a driver under a license suspension. If you are able to get coverage. The only carrier with less than excellent rating according to AM Best is Gainsco. Their rating is B++ which is good. If you are in the market for nonstandard coverage any of the carriers should be able to help.

Will I Need Auto Insurance with a Suspended License?

Whether you need car insurance with a suspended license typically depends on you as an individual.

There are circumstances in which a person’s license will be suspended for everything but driving to and from work.

If your suspension includes that or a similar exception, then it is absolutely essential that you have car insurance despite the fact that your license has been suspended.

If you are not the only person on your policy, you’ll also need to maintain your car insurance to make sure that everybody else on the policy is covered.

However, if there is another person of driving age in your household, it may be best to transfer your policy from your name to theirs.

There are quite a few drivers which have to “jump through hoops” to put someone else on the policy.

There is an awesome article here explaining that.

If you opt to transfer your policy, or have the other driver in the household open a new policy under their own name, I strongly encourage you to use our advanced quote comparison tool at the top of this page to find the best rate available.

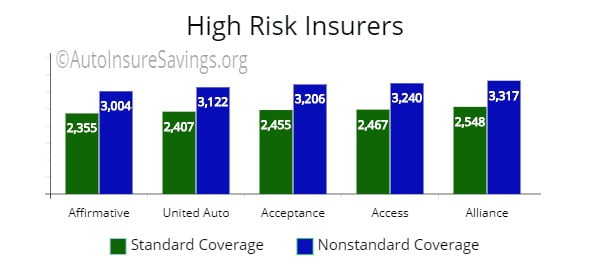

Note: Each of the carriers specialize in nonstandard coverage. They will provide coverage for delivery drivers or some with lapsed coverage. However, in the instance of a license suspension your premium is going to skyrocket by 30% or more. Some of these drivers usually end up putting somebody else on the policy or put the vehicle in storage. Many drivers have to use a vehicle to get to work. I wanted to show you that it is possible to get coverage with a suspended license and let someone else drive. It is going to be expensive though.

Note: Each of the carriers specialize in nonstandard coverage. They will provide coverage for delivery drivers or some with lapsed coverage. However, in the instance of a license suspension your premium is going to skyrocket by 30% or more. Some of these drivers usually end up putting somebody else on the policy or put the vehicle in storage. Many drivers have to use a vehicle to get to work. I wanted to show you that it is possible to get coverage with a suspended license and let someone else drive. It is going to be expensive though.

Will My Car Insurance Rates Go Up?

It is almost guaranteed that your car insurance rates will go up after your license has been suspended.

If your car insurance policy isn’t completely revoked, then it will likely be changed to a policy designated for high-risk drivers. Car insurance for high-risk drivers costs more for less coverage.

The best way to get the most affordable car insurance rate after your license has been suspended is to actively shop around.

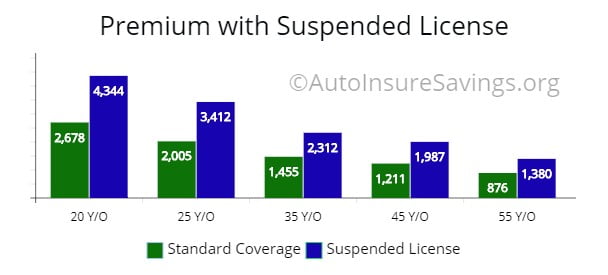

Below I have created a table to show you the average cost of coverage for a driver with a license suspension.

Please realize they are only averages since drivers can get a suspension for a variety of reasons, such as not paying child support, too many points on their license, or court-imposed criminal penalties.

Included in the table is the average quote for each state, speeding violation, DUI, and a young driver.

As you can see your premium is going to skyrocket.

Depending on the type of suspension you can count on your insurance costs to be equal or more than a driver charged with a DUI.

I have included a search bar if you would like to search for your state.

| State | Average Quote | Suspended License | Speeding Violation | DUI / DWI | Young Driver |

|---|---|---|---|---|---|

| Alabama | $966 | $2,987 | $1,290 | $2,564 | $4,692 |

| Alaska | $1,288 | $2,877 | $1,368 | $2,598 | $3,144 |

| Arizona | $1,238 | $3,600 | $1,608 | $3,513 | $4,468 |

| Arkansas | $1,155 | $3,955 | $1,164 | $2,968 | $6,792 |

| California | $1,943 | $7,833 | $3,060 | $7,794 | $6,177 |

| Colorado | $1,587 | $3,422 | $1,908 | $3,060 | $4,792 |

| Connecticut | $1,905 | $6,829 | $2,140 | $6,704 | $7,964 |

| Delaware | $1,944 | $6,532 | $3,450 | $6,156 | $8,716 |

| Florida | $1,632 | $3,438 | $2,424 | $3,384 | $4,278 |

| Georgia | $1,690 | $3,376 | $2,136 | $3,246 | $4,732 |

| Hawaii | $973 | $3,200 | $1,092 | $3,186 | $900 |

| Idaho | $895 | $1,633 | $1,038 | $1,568 | $3,309 |

| Illinois | $1,376 | $2,152 | $2,784 | $2,004 | $6,279 |

| Indiana | $1,120 | $1,843 | $1,134 | $1,584 | $3,330 |

| Iowa | $843 | $1,725 | $1,446 | $1,608 | $4,248 |

| Kansas | $1,060 | $3,893 | $1,188 | $3,780 | $4,680 |

| Kentucky | $1,588 | $4,238 | $2,860 | $4,084 | $9,807 |

| Louisiana | $2,132 | $5,987 | $3,588 | $5,934 | $11,176 |

| Maine | $721 | $1,765 | $828 | $1,692 | $3,188 |

| Maryland | $1,440 | $3,743 | $2,193 | $3,561 | $9,252 |

| Massachusetts | $1,252 | $3,824 | $1,736 | $3,606 | $4,076 |

| Michigan | $2,766 | $8,231 | $4,092 | $6,032 | $11,271 |

| Minnesota | $975 | $2,033 | $1,568 | $1,851 | $3,366 |

| Mississippi | $1,284 | $2,231 | $1,326 | $2,100 | $3,978 |

| Missouri | $1,124 | $1,842 | $1,260 | $1,708 | $3,784 |

| Montana | $1,256 | $1,744 | $1,428 | $1,952 | $4,656 |

| Nebraska | $1,113 | $2,176 | $1,020 | $2,382 | $3,927 |

| Nevada | $1,848 | $3,222 | $2,252 | $3,380 | $7,208 |

| New Hampshire | $1,320 | $2,108 | $1,760 | $2,020 | $4,335 |

| New Jersey | $2,416 | $5,878 | $4,452 | $6,576 | $9,048 |

| New Mexico | $1,508 | $3,802 | $1,532 | $3,744 | $5,504 |

| New York | $1,812 | $6,032 | $2,544 | $5,532 | $6,216 |

| North Carolina | $822 | $2,643 | $1,260 | $2,703 | $1,953 |

| North Dakota | $1,396 | $3,229 | $1,856 | $3,360 | $5,244 |

| Ohio | $824 | $1,905 | $856 | $1,848 | $3,352 |

| Oklahoma | $1,908 | $3,700 | $2,120 | $3,876 | $7,464 |

| Oregon | $1,396 | $1,276 | $2,133 | $1,380 | $5,024 |

| Pennsylvania | $1,819 | $3,563 | $2,028 | $3,436 | $10,208 |

| Rhode Island | $2,051 | $3,447 | $2,190 | $3,492 | $8,000 |

| South Carolina | $768 | $1,837 | $816 | $1,704 | $2,752 |

| South Dakota | $1,002 | $1,900 | $1,122 | $1,842 | $4,320 |

| Tennessee | $1,244 | $4,050 | $1,304 | $3,988 | $4,092 |

| Texas | $1,230 | $2,109 | $1,242 | $2,298 | $4,068 |

| Utah | $1,041 | $2,658 | $1,056 | $2,607 | $4,827 |

| Vermont | $993 | $1,549 | $1,060 | $1,764 | $3,432 |

| Virginia | $1,074 | $2,558 | $1,161 | $2,460 | $3,471 |

| Washington | $1,328 | $1,983 | $916 | $2,120 | $6,000 |

| West Virginia | $1,420 | $2,879 | $1,568 | $2,952 | $6,088 |

| Wisconsin | $1,545 | $3,590 | $2,064 | $3,600 | $7,227 |

| Wyoming | $940 | $1,907 | $966 | $2,016 | $3,738 |

Will I Still be Eligible for Auto Insurance Discounts?

When covered by standard insurance, there is a myriad of discounts available to drivers.

From AAA discounts to auto and home combo coverage discounts, drivers can often take a significant percentage off the amount they pay each month in car insurance.

Once your license has been suspended, your provider may opt to remove many of those discounts.

They may determine that they do not apply to high-risk policies.

The best way to find out if you can get discounts with a suspended license is to contact your insurance provider directly.

Even if your provider does say that you can still get discounts on high-risk plans, you may want to check with them to make sure that any previous discounts you may have been receiving are either still active, or can be re-added to your current plan.

How Long will a Suspended License Affect my Auto Premium?

The length of time that your suspended license will impact your car insurance varies on a few factors.

These factors include:

-

The length of suspension

-

The reason for the suspension

-

Your state’s and insurance provider’s policies regarding suspended licenses

In order to find out how long your rates will be affected following the suspension of your license, it is best to contact your current insurance provider for more details.

They’ll be able to provide you with a more definitive time frame.

They may even be able to offer suggestions as to how you can shorten that time period, or at least how you can lower your current rates.

Final Thoughts

The last note.

You want to stay on top of your situation when you get a suspended license.

However, you don’t want to be punished forever for a driving infraction, such as some which are “Too Broke to Drive” according to The Slate.

I realize that is an extreme case.

On the other hand, not being proactive about your situation can add up in some states. Drivers license reinstatement requirements vary from state to state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.