Most Common Car Insurance Repair Scams and What You Can Do To Avoid Being a Victim

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

After being involved in an accident, the very last thing you want to worry about is car insurance repair fraud.

And that is exactly the reason why you may be targeted.

Scam artists almost always tend to target those that are most vulnerable.

The moments, hours, and days following a car accident can be particularly stressful.

As you deal with getting your car towed, talking with the insurance company, and securing a rental car.

Common Repair Scams

| Common Car Insurance Repair Scam |

|---|

| Overcharging Your Insurance Provider for Repair Costs |

| Improper Airbag Replacement |

| Fraudulent Windshield Replacement |

| Staged Crashes |

| Towing Scams |

Only two states do not have an insurance fraud law on the books, Virginia & Oregon.

Below are the “hotspot” States with the most insurance fraud:

Stats from InsuranceFraud.org

For some auto body shops, the scam is an easy one.

While most people have little, if any trust, for car mechanics, they typically don’t think twice about being scammed after an accident.

After all, the insurance company is the one footing the bill after the deductible’s been paid.

However, the following three car insurance repair scams could prove to be quite costly down the road.

Overcharging Your Insurance Provider for Repair Costs

This type of car insurance repair scam is the most common.

You take your car into the shop following an accident.

They tell you they’re going to replace just about everything with brand new parts.

If using quality-used parts would’ve maxed out your deductible, what harm could there possibly be in outfitting your car with brand new parts instead?

The trouble is: less-than-honest auto body repair shops aren’t going to use brand new parts at all.

Sure, they’ll bill the insurance company for the new parts.

Unfortunately for you, for those brand new parts you were promised could actually be cheap, shoddy parts that are, at best, unsafe.

While you may not necessarily pay more at the time of the accident repair (due to the deductible limit), there’s no doubt that you’ll be paying a lot more in the near future when those shoddy parts fail and your car breaks down.

When you see that repair bill, you won’t even know what hit you!

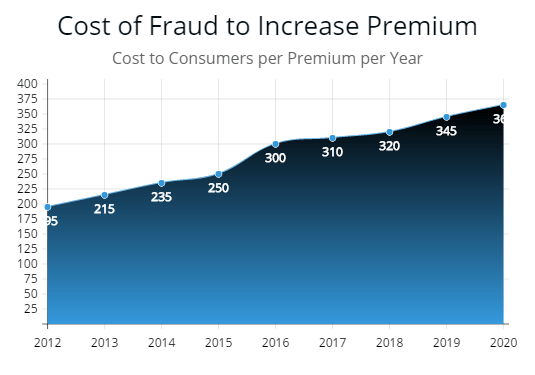

Note: As illustrated by the graph the cost added to consumers premium per year in 2012 is approximately $195. By 2021, it was estimated to cost consumers between $400 and $700 extra per year.

Improper Airbag Replacement

A fully functioning air bag could be the difference between life and death after an accident.

That’s why improper air bag replacement is perhaps one of the most dangerous car insurance repair frauds that you could possibly encounter.

While lawmakers have tried to crackdown on the installation of faulty air bags.

It has not stopped auto body repair shops from taking advantage of car owners and insurance companies.

Rather than installing a fully-functioning air bag following the deployment of the original.

Shady auto body repair shops may instead use the following items:

-

Packing peanuts

-

Paper towels

-

Aluminum cans (soda, beer, etc.) Airbags from non-compatible makes & models of cars

-

Untested air bags from junked or salvaged cars

Because the average driver doesn’t know how to recognize whether or not they have a fully-functional air bag.

This type of car insurance repair fraud is an easy-money maker for shady auto body repair shops.

Fraudulent Windshield Replacement

Have you ever been approached by a so-called mechanic while getting out of, or into your car at the mall or supermarket?

It’s not as uncommon as one might think.

These so-called mechanics may try to convince you that there is something wrong with your car, and they just happen to have the parts on-the-spot to make the needed repairs.

This kind of situation often involves windshields, as a less-than-upfront mechanic will attempt to tell you that your windshield is in desperate need of repair as soon as possible due to some kind of non-existent damage.

These individuals are typically quite convincing, as they’ve perfected their routine in every way.

Amazingly, they’ll have the exact type of windshield you need (because they are targeting certain car makes and models), and the replacement won’t even cost you a dime. Insurance will cover the whole replacement in full.

It almost seems too good to be true, right?

Well, as with anything else in life – it is.

These overly helpful mechanics that saved you from some kind of windshield crisis will most likely replace your windshield with one of lesser quality.

Additionally, they might use your insurance information to file multiple windshield replacement claims – thereby causing your insurance rates to soar, or causing your insurance to cancel your policy completely.

So what can you do to avoid being a victim of car insurance repair scams?

For the average individual, detecting car insurance repair scams may seem near impossible.

However, there are a few things that you can do to prevent getting stuck with an improper air bag replacement or faulty parts.

Get recommendations for a good body shop

Want to avoid any chance at ever falling victim to car insurance repair fraud?

The best thing that you can do is find an auto body repair shop that you can trust.

By doing the following, you’re sure to find a trusted mechanic who takes pride in doing good work for his or her clientele:

1. Get recommendations from friends before you get into an accident

2. When shopping for insurance providers, ask each company what local mechanics are in their network

3. Take your car into the recommended auto body shop for regular maintenance or minor repairs to “test the waters.”

Ask for explanations and get more than one estimate

From the appraiser to the mechanic, make sure you ask enough questions to understand what kind of repair work needs to be done on your car following an accident. Always check all business ratings.

The more you know about the work that needs to be done, the less chance you’ll have of being taken advantage of. Do you research to avoid dent repair scams and other common car repair scams.

An honest mechanic will provide you with a detailed report of the damage to your car, and the estimated cost to your insurance company.

Make sure that you keep a copy for yourself so that you can compare it with the estimate from your mechanic.

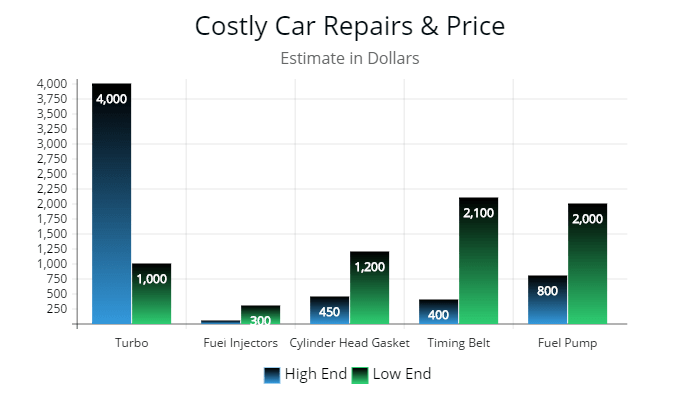

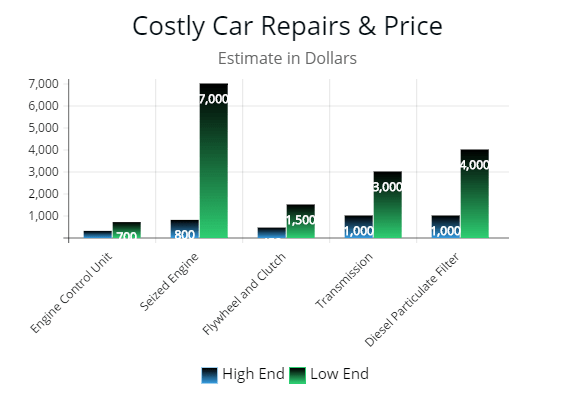

Ten most costly vehicle repairs

| Repair |

|---|

| Turbo |

| Fuel Injectors |

| Cylinder Head Gasket |

| Timing Belt |

| Fuel pump |

| Engine control unit |

| Seized engine |

| Flywheel and clutch |

| Transmission |

| Diesel particulate filter |

In addition to getting explanations, it is best to also have various mechanics provide you estimates on the cost of the parts and overall repairs.

By getting a few estimates, you’ll be able to get an idea as to who is honest, and who is trying to scheme for a few extra dollars.

A few questions and a few additional opinions could go a long way in saving you money on your insurance rates over the long haul.

Note: The blue is the low end range of repair while the green is the higher approximate cost.

Review the repairs after they’ve been made

One of the most important things that you should do after your car has been to the auto body repair shop is to look over the repairs that were made.

Chances are that you’re not a car parts expert.

However, there are some simple things that you can check to make sure that legitimate repairs were performed on your car.

In the case of improper air bag replacement, you’ll be able to see if you were a victim of fraudulent practices simply by familiarizing yourself with your dashboard.

With a fully functional air bag in place, an air bag indicator light should light up upon starting your car.

Almost immediately after lighting up, the indicator light should go out.

If, after being repaired, your air bag indicator light fails to light up at all, or flashes continuously, there’s a good chance that you have an improper air bag.

Should that be the case for you, it is best to contact your car insurance provider and ask how they recommend you handle the situation.

By contacting them, you’ll also let them know that the particular mechanic you used may be committing auto insurance repair fraud.

Don’t fall for unsolicited repair advice

If you’re approached by a “mechanic” that promises to provide you with an immediate unsolicited repair – run and don’t look back.

These “mechanics” want nothing more than to rip you off.

Even if they promise a free repair fully covered by insurance, they have ulterior motives.

Ask yourself this question: why would this mechanic solicit and perform repairs away from their shop?

More than likely, it is because they don’t have a shop, they aren’t licensed, or they are a scam artist looking to prey on the naïve.

If they are insistent that they help you with an easy repair and won’t take no for an answer, ask for their card, and tell them you don’t have a spare moment.

Chances are, they won’t have a business card, or the address on it is a fake one.

Conclusion

If you’re a victim of car insurance repair fraud, contact your car insurance provider immediately

Car insurance fraud could lead to increased insurance rates for you and everybody else.

It is best to have such fraudulent activity addressed as soon as possible.

Whether the fraud involves the filing of multiple repeat claims, or the use of shoddy or improper parts, such car insurance repair scams will drive your premium up.

Which can lead to your insurance policy being voided.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.