Cheapest Car Insurance in Long Island, NY and Affordable Rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

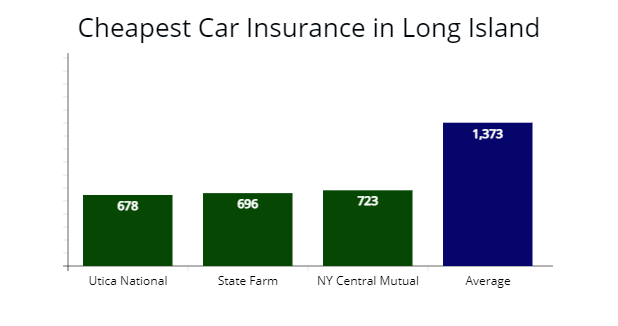

AutoInsureSavings.org team of licensed insurance agents found Utica National ($678 per year) offers the cheapest auto insurance in Long Island for minimum coverage.

Progressive ($1,489 per year) is the most affordable insurance company for Long Island drivers’ full coverage policy.

Affordable Long Island, New York Car Insurance Rates

Finding the right car insurance policy in Long Island, New York, can help you save more money each month and make sure you enjoy the benefits of excellent coverage.

Long Island Cheapest Car Insurance Quick Hits

| Cheapest Car Insurance in Long Island - Quick Hits |

|---|

The cheapest Long Island car insurance options are: The cheapest Long Island car insurance options are:For minimum coverage: Utica National at $678 per year. For full coverage: Progressive at $1,489 per year. After an at-fault accident: State Farm at $2,765 per year. After a speeding ticket: Progressive at $2,214 per year. After a DUI: Progressive at $2,412 per year. For poor credit history: Geico at $2,319 per year. For young drivers: New York Central Mutual (NYCM) at $6,745 per year for full coverage. |

But comparing quotes from multiple providers is time-consuming, and many drivers looking for car insurance do not know where to start.

That is why the AutoInsureSavings.org team of agents put together this essential guide to help you through the process of finding the best car insurance and protection options in Long Island.

Cheapest Car Insurance in Long Island for Minimum Coverage

Utica National offers the lowest rates at $678 annually or $56 per month for drivers who want a minimum coverage auto insurance policy in Long Island.

Utica National price is 50% lower than the $114 monthly Long Island rate.

Active military members or veterans can get the cheapest insurance rates, with USAA offering coverage at $57 per month.

Long Island Minimum Coverage

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Utica National | $678 | $56 |

| USAA | $684 | $57 |

| State Farm | $696 | $58 |

| New York Central Mutual | $723 | $61 |

| Geico | $763 | $63 |

| Preferred Mutual | $780 | $65 |

| Travelers | $834 | $70 |

| Allstate | $862 | $72 |

| Long Island average | $1,373 | $114 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

According to the New York State Department of Motor Vehicles, Long Island drivers must have insurance at or above the state minimum coverage. That includes coverage for bodily injury and property damage liability, uninsured motorist coverage, and personal injury protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Many drivers choose to carry higher liability limits than the required amount and additional PIP coverage beyond state requirements.

Cheapest Full Coverage Insurance in Long Island, New York

For cheap full coverage insurance in Long Island, Progressive is the cheapest option, which provided our agents a $1,489 quote or 35% lower than the average $190 monthly rate.

Long Island Full Coverage

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,489 | $124 |

| USAA | $1,511 | $125 |

| State Farm | $1,580 | $131 |

| Utica National | $1,644 | $137 |

| Geico | $1,750 | $145 |

| New York Central Mutual | $1,843 | $153 |

| Allstate | $1,965 | $163 |

| Long Island average | $2,274 | $190 |

The next best option is State Farm, with a $131 monthly rate for full coverage, 32% lower than the Long Island average.

Most full coverage car insurance policies include liability insurance as well as collision and comprehensive coverage. Drivers with a clean driving history who choose to go with Progressive for their full coverage auto policy will save 20% or more on their premium.

To guarantee that you find the best rates that fulfill all your auto insurance needs, you should compare the rates from at least three insurance providers. That will help you narrow down your coverage choices and find the company that works best for you to save money.

Cheapest Car Insurance in Long Island With a Car Accident

According to our licensed agent’s research, Long Island residents who have a recent at-fault accident on their driving record should go with State Farm, which provided a quote at $2,765 annually or $230 per month.

Long Island Coverage With An Accident on Record

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,765 | $230 |

| New York Central Mutual | $3,043 | $253 |

| Geico | $3,254 | $271 |

| Long Island average | $3,627 | $302 |

The average cost of full coverage insurance from State Farm for drivers who have one accident on their record is 24% less than the average price of Long Island coverage.

They are the only insurance company that we found that offers policies over 20% cheaper than average for drivers in the car accident category.

It is possible to find another reasonably priced auto insurance policy from other Long Island providers such as Geico and New York Central Mutual (NYCM).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

These auto insurance companies may be higher than State Farm, but their rates are typical $200 less than the state’s average of $3,627 per year.

Cheapest Car Insurance with a Speeding Ticket in Long Island

Drivers in Long Island who have been caught speeding can get the cheapest full coverage rates with Progressive, who provided our agents a $2,214 annual or $184 monthly rate.

Compared to the average speeding ticket rate at $2,876, Progressive is $662 cheaper per year.

Long Island Coverage with A Speeding Ticket

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,214 | $184 |

| Erie | $2,437 | $203 |

| State Farm | $2,477 | $206 |

| Geico | $2,583 | $215 |

| Long Island average | $2,876 | $221 |

After receiving a speeding ticket, drivers in Long Island could save as much as $621 compared to the average annual cost drivers pay throughout the city.

A speeding ticket will usually stay on your record for at least three years.

After that time has passed, you should be able to enjoy lower auto insurance premiums if your driving history remains clean, according to Insurance Information Institute (III.org).

Adding on more speeding tickets and other violations can cause your rates to go even higher.

Cheapest DUI Car Insurance Rates in Long Island, New York

During our comparison shopping study, Long Island drivers with a DUI on their driving record can get the cheapest coverage with Progressive or State Farm.

With a recent DUI, Progressive provided a $2,412 rate, and State Farm offered a quote at $2,670 per year for our sample 30-year-old driver.

Both auto insurers are at least $1,200 less expensive than the average $3,893 DUI rate.

Long Island Coverage with a DUI

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,412 | $201 |

| State Farm | $2,670 | $222 |

| Geico | $2,932 | $244 |

| Liberty Mutual | $3,237 | $270 |

| Long Island average | $3,893 | $324 |

Drivers who have a DUI can expect to see their premiums go up by as much as 47% of what they would typically pay.

For Long Island drivers trying to lower insurance rates with a DUI, taking a defensive driver course and maintaining a clean driving record is the best way to keep future rates low.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance for Drivers with Poor Credit

Geico offers the best rates for drivers with poor credit in Long Island. During our study, Geico provided our licensed agents a $193 monthly rate for full coverage, which is 35% cheaper than the average rate.

Other auto insurers with cheaper than average rates are State Farm ($2,477 per year) and Progressive ($2,843 per year).

Long Island Coverage with Poor Credit

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $2,319 | $193 |

| State Farm | $2,477 | $206 |

| Progressive | $2,843 | $236 |

| Allstate | $3,361 | $280 |

| Long Island average | $3,539 | $294 |

Drivers who have poor credit may notice their insurance rates are more expensive than average in Long Island. For most drivers, the rates for those with bad credit are 60% more.

Who Has the Cheapest Car Insurance for Young Drivers in Long Island?

Young drivers shopping for coverage in Long Island can find the cheapest auto insurance with New York Central Mutual (NYCM), who provided us a $6,475 annual rate for full coverage and $2,788 per year for minimum coverage.

Other insurance carriers to comparison shop for are State Farm and Progressive. State Farm offers minimum coverage at $2,867 per year, and young drivers can get the cheap full coverage insurance with Progressive at $7,143 per year.

Long Island Coverage for Young Drivers

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| New York Central Mutual (NYCM) | $6,475 | $2,788 |

| USAA | $6,623 | $2,833 |

| Progressive | $7,143 | $3,033 |

| State Farm | $7,785 | $2,867 |

| Geico | $8,129 | $3,864 |

| Liberty Mutual | $8,366 | $3,903 |

| Travelers | $8,940 | $4,123 |

| Allstate | $9,123 | $3,439 |

| Long Island average | $7,539 | $3,477 |

Young drivers tend to have higher rates regardless of what city or state they reside in. Insurance quotes for young drivers are close to three times more than those for older drivers in their late 20s and 30s.

Young or teen drivers should make sure to compare quotes with three or more insurance providers to find the best deal.

Average Car Insurance Costs by City in Long Island

Insurers will use your zip code to determine your Long Island, New York insurance rates, as well as your credit score, marital status, and driving history.

The Empire State average rate is $2,412 per year; through our comparison study of rates, our agents found Long Island (the most populated island in the United States) residents have slightly lower premiums with an average quote of $2,274 annually or $189 per month for full coverage.

Cheapest Car Insurance in Babylon, NY

During our study, Babylon drivers can find the most affordable insurance coverage with Progressive who has the lowest average rates at $1,543 annually or 21% cheaper than Babylon’s average of $1,911.

Car Insurance in Babylon, NY

| Babylon Company | Average Premium |

|---|---|

| Progressive | $1,543 |

| Utica National | $1,672 |

| State Farm | $1,833 |

| Babylon average | $1,911 |

Cheapest Car Insurance in Bethpage, NY

Drivers in Bethpage who opt for full coverage can get the cheapest insurance coverage with Utica National, who provided our licensed agents a quote at $1,477 per year or 23% lower than average citywide rates as illustrated.

Car Insurance in Bethpage, NY

| Bethpage Company | Average Premium |

|---|---|

| Utica National | $1,477 |

| Progressive | $1,499 |

| State Farm | $1,674 |

| Bethpage average | $1,916 |

Cheapest Auto Insurance in Hempstead, NY

If Hempstead drivers are shopping for Long Island car insurance, the best rates are State Farm, who provided our agents a $1,615 quote for our sample driver.

State Farm’s rate is 17% lower than average for people in Hempstead with similar driver profiles.

Auto Insurance in Hempstead, NY

| Hempstead Company | Average Premium |

|---|---|

| State Farm | $1,615 |

| Geico | $1,745 |

| Progressive | $1,876 |

| Hempstead average | $1,948 |

Cheapest Auto Insurance in Huntington, NY

Huntington drivers can get the best coverage rates with Geico, who provided us a quote at $1,413 annually or a $117 monthly rate for full coverage insurance. Geico’s rate is $486 lower than the average $1,899 Hempstead rate.

Auto Insurance in Huntington, NY

| Huntington Company | Average Premium |

|---|---|

| Geico | $1,413 |

| State Farm | $1,598 |

| New York Central Mutual | $1,732 |

| Huntington average | $1,899 |

Cheapest Auto Insurance in Islip, NY

During the AutoInsureSavings.org comparison shopping study, State Farm provides the most affordable quotes 23% cheaper for Islip drivers with rates at $1,501 annually. The second-best insurance option is Geico ($1,623 per year), which 16% less expensive than Islip’s average $1,934 rate.

Auto Insurance in Islip, NY

| Islip Company | Average Premium |

|---|---|

| State Farm | $1,501 |

| Geico | $1,623 |

| Allstate | $1,840 |

| Islip average | $1,934 |

Cheapest Auto Insurance in Oyster Bay, NY

Oyster Bay residents can get affordable insurance coverage with New York Central Mutual, which provided our agents a quote at $1,716 annually or a $143 monthly rate for full coverage, including personal injury protection and uninsured motorist coverage.

Auto Insurance in Oyster Bay, NY

| Oyster Bay Company | Average Premium |

|---|---|

| New York Central Mutual | $1,716 |

| State Farm | $1,864 |

| Liberty Mutual | $1,983 |

| Oyster Bay average | $2,022 |

Cheapest Auto Insurance in Southampton, NY

The Southampton average rate is $2,033 per year; through our research, Progressive provided us a quote at $1,490 per year or 27% less expensive than average. The next cheapest option is State Farm, with a $1,652 annual rate.

Auto Insurance in Southampton, NY

| Southampton Company | Average Premium |

|---|---|

| Progressive | $1,490 |

| State Farm | $1,652 |

| Geico | $1,759 |

| Southampton average | $2,033 |

Average Insurance Cost for All Cities in Long Island, New York

Average Insurance Cost for All Cities in Long Island, New York

| City | Average Annual Rate | City | Average Annual Rate |

|---|---|---|---|

| Albertson | $1,934 | Manhasset | $1,911 |

| Amagansett | $1,876 | Manorville | $1,939 |

| Amityville | $1,981 | Massapequa | $1,934 |

| Aquebogue | $1,948 | Massapequa Park | $1,899 |

| Atlantic Beach | $1,876 | Mastic | $1,967 |

| Babylon | $1,911 | Mastic Beach | $1,916 |

| Baldwin | $1,899 | Mattituck | $1,948 |

| Bayport | $1,981 | Medford | $1,967 |

| Bayshore | $1,916 | Melville | $1,876 |

| Bayville | $1,939 | Merrick | $1,911 |

| Bellerose Terrace | $1,899 | Middle Island | $2,032 |

| Bellmore | $1,934 | Mill Neck | $1,899 |

| Bellport | $1,948 | Miller Place | $2,027 |

| Bethpage | $1,916 | Mineola | $1,981 |

| Blue Point | $1,967 | Montauk | $1,939 |

| Bohemia | $1,876 | Moriches | $1,899 |

| Brentwood | $2,024 | Mount Sinai | $1,916 |

| Bridgehampton | $1,967 | Nesconset | $1,876 |

| Brightwaters | $1,981 | New Hyde Park | $2,022 |

| Brookhaven | $2,016 | New Suffolk | $1,934 |

| Brookville | $1,934 | North Amityville | $1,967 |

| Calverton | $1,939 | North Babylon | $1,948 |

| Carle Place | $1,899 | North Lynbrook | |

| Cedarhurst | $1,911 | North New Hyde Park | $1,948 |

| Center Moriches | $1,916 | North Patchogue | $2,009 |

| Centereach | $1,948 | North Valley Stream | $1,939 |

| Centerport | $1,876 | North Woodmere | $1,899 |

| Central Islip | $2,041 | Northport | $1,967 |

| Cold Spring Harbor | $1,981 | Oakdale | $1,876 |

| Commack | $2,013 | Ocean Beach | $1,934 |

| Copiague | $1,934 | Oceanside | $1,948 |

| Coram | $2,013 | Old Bethpage | $1,981 |

| Cutchogue | $1,911 | Old Westbury | $1,911 |

| Deer Park | $1,967 | Oyster Bay | $2,022 |

| Dix Hills | $2,023 | Patchogue | $1,981 |

| East Hampton | $1,899 | Peconic | $1,967 |

| East Islip | $1,939 | Plainview | $1,911 |

| East Marion | $1,916 | Point Lookout | $1,948 |

| East Meadow | $2,026 | Port Jefferson | $1,939 |

| East Moriches | $1,876 | Port Jefferson Station | $1,934 |

| East Northport | $1,967 | Port Washington | $2,013 |

| East Norwich | $1,876 | Quogue | $2,005 |

| East Patchogue | $1,948 | Remsenburg | $2,007 |

| East Quogue | $1,981 | Riverhead | $1,876 |

| East Rockaway | $1,911 | Rockville Centre | $2,041 |

| East Setauket | $1,939 | Rocky Point | $1,899 |

| Eastport | $1,899 | Ronkonkoma | $1,911 |

| Elmont | $1,934 | Roosevelt | $1,948 |

| Elwood | $1,911 | Roslyn | $1,916 |

| Farmingdale | $1,911 | Roslyn Heights | $1,981 |

| Farmingville | $2,013 | Sag Harbor | $1,967 |

| Fishers Island | $1,916 | Sagaponack | $2,021 |

| Floral Park | $1,948 | Saint James | $2,018 |

| Franklin Square | $2,023 | Sands Point | $1,911 |

| Freeport | $1,876 | Sayville | $1,967 |

| Garden City | $1,899 | Sea Cliff | $1,948 |

| Glen Head | $1,981 | Seaford | $1,876 |

| Glenwood Landing | $1,939 | Selden | $1,916 |

| Great Neck | $1,876 | Shelter Island | $1,934 |

| Great River | $2,017 | Shelter Island Heights | $1,939 |

| Greenlawn | $1,967 | Shirley | $2,013 |

| Greenport | $2,015 | Shoreham | $1,876 |

| Greenvale | $1,934 | Smithtown | $1,999 |

| Hampton Bays | $1,939 | Sound Beach | $1,895 |

| Hauppauge | $1,876 | South Hempstead | $2,031 |

| Hempstead | $1,948 | South Jamesport | $1,934 |

| Hewlett | $1,939 | Southampton | $2,033 |

| Hicksville | $1,916 | Southold | $2,041 |

| Holbrook | $2,032 | Speonk | $1,981 |

| Holtsville | $1,939 | Stony Brook | $2,013 |

| Huntington | $1,899 | Syosset | $1,948 |

| Huntington Station | $1,981 | Uniondale | $1,876 |

| Inwood | $2,031 | Upton | $1,948 |

| Island Park | $1,876 | Valley Stream | $2,030 |

| Islandia | $1,967 | Wading River | $1,967 |

| Islip | $1,934 | Wainscott | $1,899 |

| Islip Terrance | $1,948 | Wantagh | $1,916 |

| Jamesport | $1,948 | Water Mill | $1,939 |

| Jericho | $1,911 | West Babylon | $2,043 |

| Kings Park | $2,022 | West Hempstead | $1,996 |

| Kings Point | $1,876 | West Islip | $1,948 |

| Lake Grove | $2,013 | West Sayville | $1,911 |

| Laurel | $1,899 | Westbury | $1,948 |

| Lawrence | $1,999 | Westhampton | $1,876 |

| Levittown | $1,916 | Westhampton Beach | $1,934 |

| Lindenhurst | $1,996 | Williston Park | $1,899 |

| Lloyd Harbor | $1,948 | Woodbury | $1,967 |

| Locust Valley | $1,876 | Woodmere | $1,996 |

| Lynbrook | $1,939 | Wyandanch | $1,916 |

| Malverne | $1,899 | Yaphank | $1,948 |

Minimum Requirements for Auto Insurance Coverage in Long Island, NY

Long Island drivers are required to have a minimum amount of liability coverage in their auto insurance policies.

Minimum Requirements for Auto Insurance Coverage in Long Island, NY

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $10,000 per accident |

| Personal injury protection (PIP) | $50,000 per accident |

| Uninsured motorist bodily injury (UMBI) | $25,000 per person and $50,000 per accident |

AutoInsureSavings.org licensed agents recommend getting higher liability limits if you have multiple assets or a high-net-worth individual. Minimum coverage policies are the lowest coverage limits you can buy as per state insurance laws and the cheapest. Still, people with multiple assets or high-net-worth could be left financially vulnerable if in a car accident.

Our agents recommend most motorists carry collision and comprehensive coverage in their policies to make sure they have the best financial protection.

Frequently Asked Questions

Who has the Cheapest Car Insurance in Long Island?

Utica National offers the cheapest overall insurance rate in Long Island, with a quote at $56 per month. Then USAA at $57 per month, State Farm with a $58 monthly rate, and New York Central Mutual at $61.

It is important to note that USAA only offers its insurance policies to current and former members of the U.S. Military and their families. For drivers who are not eligible for this coverage, their best option for the lowest priced insurance would be Utica National for minimum coverage policies.

How Much Is Full Coverage Car Insurance in Long Island?

The average amount for full coverage car insurance in Long Island is $2,274 per year or $189 per month. Full coverage insurance policies include liability, comprehensive, and collision. The amount you pay for your full coverage insurance can go up depending on other factors such as traffic violations or poor credit.

The following list has the average annual amount of full coverage insurance for different types of drivers: drivers with an accident: $3,627, drivers with a speeding ticket: $2,876, drivers with a DUI: $3,893, and drivers with poor credit: $3,539.

How do I Save on Car Insurance in Long Island?

You can save on your Long Island insurance rates by comparing quotes from various auto insurance companies until you find the one that works best for you and has excellent customer service. You can also find out about money-saving discounts you may be eligible for, such as Good Student or Multiple Policy discounts. Be sure to ask your insurance agent if you are unsure of your eligibility for auto policy discounts.

How Much is Car Insurance in Long Island per Month?

The average monthly rate for insurance in Long Island is $189. That comes to $2,274 per year for a driver who is 30-years-old and has full coverage insurance.

Here are some of the average monthly rates from some of the top insurance companies in Long Island: Progressive at $124, Utica National at $127, Geico at $145, and NYCM at $153.

How Much Will My Car Insurance Rise with a Speeding Ticket in Long Island?

As of 2020, the increasing amount for speeding at 31+ miles per hour over the limit was 30.7%. However, if you received a ticket for failure to yield, you could expect your premium to go up 22.1%. Overall, your rates could rise as little as 5% for a minor violation. Like not wearing your seat belt, for instance. Or they could go up as much as 96% for something more severe such as a DUI.

Long Island, New York drivers can expect their rates to go up by as much as 22% after receiving one speeding ticket. But that amount can vary from one driver to the next and may be based on several factors.

The amount you will pay for your insurance rates after you get a ticket could be based on how many violations you have on your record. It could also be determined by your history or how long you have been with the same insurance company, the type of traffic violation in question, and the New York State laws.

To learn more about the most affordable insurance options in Long Island, New York, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

| AutoInsureSavings.org collects quotes from the state’s largest insurance companies for a 30-year-old male motorist for our driver profile. Our driver had a clean driving record unless otherwise stated. AutoInsureSavings.org collects three to five quotes from each insurer via Quadrant Information Services. Unless stated, our methodology’s operating vehicle is a 2018 Honda Accord (12,000 annual miles) with a paperless, safe driver, and anti-theft discounts. For full coverage policies, we used the following coverage limits: $100,000 bodily injury liability per person. $300,000 bodily injury liability per accident. $50,000 property damage liability per accident. $100,000 uninsured motorist coverage per person. $300,000 uninsured motorist coverage per accident. Collision coverage with a $1,000 deductible. Comprehensive coverage with a $1,000 deductible. AutoInsureSavings.org uses rate data from Quadrant Information Services. We sourced quotes from insurer filings that are publicly available for rate comparison. |

Sources

National Highway Traffic Safety Administration. “Traffic Safety Facts.”

New York Department of Motor Vehicles. “Get a Learner Permit.”

New York Department of Motor Vehicles. “New York State Insurance Requirements.”

New York Department of Motor Vehicles. “Penalties for Alcohol or Drug-related Violations.”

NOLO. “DUI Laws By State.”

National Association of Insurance Commissioners (NAIC). “2019 Market Share Reports.”

Experian. “2019 Consumer Credit Review.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Laura Kuhl

Managing Content Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ...

Managing Content Editor

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.