Filing A Flooded Car Claim With MetLife: A Step-by-Step Guide & a Quick Comparison “How do They Stack up Against their Competitors?”

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Floods can do a lot of damage to your personal property, especially if you find yourself driving in or near one and happen to be engulfed by floodwaters.

If you have MetLife and your coverage needs propelled you to add comprehensive coverage, you won’t have to worry about paying to repair any flood damage done to your car.

Make sure you have “Comprehensive Coverage” to be protected from a flood and to file a claim.

Filing flooded car claims to get back on your feet is easy as long as you follow the necessary steps.

And this goes for about any other carrier.

Procedures & Documentation are important for any provider when filing a flood claim.

How does MetLife Compare to other Carriers?

If you want to skip to the flood procedures use the table of contents (TOC) to the right and jump to it.

Before I go into it I want to give you a perspective of how MetLife compare to their competitors.

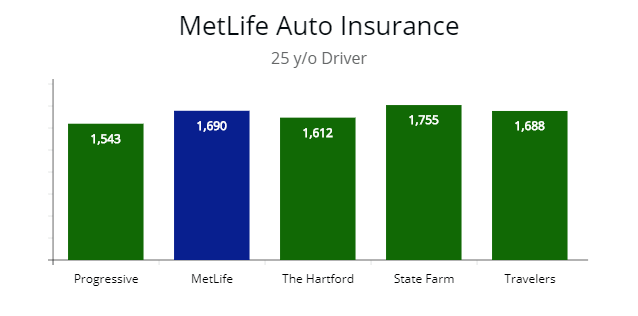

| Company | 25 y/o Quote | 35 y/o | 45 y/o | 55 y/o | Customer Service Rating |

|---|---|---|---|---|---|

| Metlife | $1,690 | $1,333 | $803 | $622 | 4.1 out of 5 |

| Progressive | $1,543 | $1,132 | $690 | $532 | 4.1 out of 5 |

| The Hartford | $1,612 | $1,255 | $745 | $601 | 3.9 out of 5 |

| Travelers | $1,688 | $1,290 | $790 | $625 | 3.7 out of 5 |

| State Farm | $1,755 | $1,365 | $810 | $559 | 4.0 out of 5 |

| Allstate | $1,711 | $1,387 | $742 | $538 | 3.9 out of 5 |

| Farmers | $1,811 | $1,198 | $804 | $567 | 3.9 out of 5 |

| USAA | $1,551 | $1,108 | $678 | $501 | 4.5 out of 5 |

| Ameriprise | $1,699 | $1,376 | $729 | $627 | 4.0 out of 5 |

| Good2go | $1,965 | $1,611 | $926 | $711 | 3.2 out of 5 |

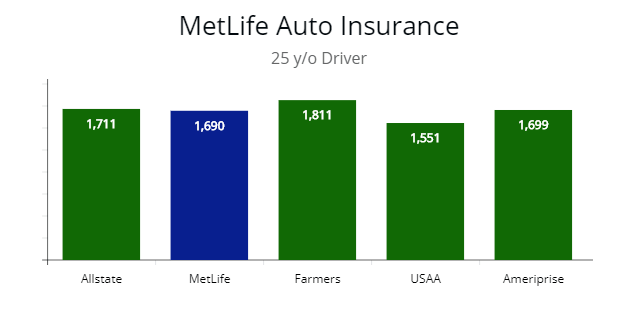

Note: Out of the 4 other carriers compared MetLife was 4th. For a 25 year old driver the quotes are more than $150 more as compared to Progressive.

Note: Out of the 4 other carriers compared MetLife was 4th. For a 25 year old driver the quotes are more than $150 more as compared to Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Step 1: Put the right coverage in place to start with

You will only be covered for flood damage to your car if you have comprehensive coverage as part of your MetLife car insurance.

Determining whether to add comprehensive coverage can depend on a number of considerations. Your choice may be a little more complicated if you already have an active auto insurance policy.

MetLife is one of a number of providers that require drivers to have both collision and comprehensive in place as a package (you can’t have one without the other.)

One quick rule of thumb for determining if options like collision or comprehensive are value-added choices is to total the added premium you will pay for the options (plus deductibles) over the life of how long you hope to insure the car.

If the total exceeds the actual value of your car, you’ll need to weigh your options.

However, if you live in an area where floods or severe weather are common, or if you live somewhere that has regular hurricanes, you may want to give yourself the added protection of comprehensive auto coverage.

(Remember that with MetLife, you will have to add collision in order to add comprehensive insurance. Each will carry a separate deductible and an added cost to insurance premiums.)

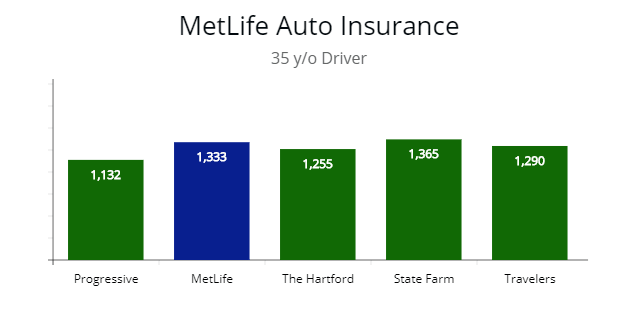

Note: In this illustration, only State Farm is more expensive for a 35 year old driver. Still in line with a pretty decent quote. No discounts were taken into consideration when I queried for quotes.

Note: In this illustration, only State Farm is more expensive for a 35 year old driver. Still in line with a pretty decent quote. No discounts were taken into consideration when I queried for quotes.

Step 2: Document any damage as quickly as possible

If you get caught in a flood, you might not be able to reach your agent quickly if his/her phone or email system is overloaded.

You might also be so preoccupied with dealing with the aftermath of a flood that calling your agent may not be one of the first things you consider.

Documentation of the incident will be critical. The sooner you do this, and the more detailed your initial efforts, the better. Use your cellphone to take a few pictures of the specific damage that occurred.

If you can, take some real time photos of the car as it’s being flooded. Make notes to yourself or even leave yourself a voice mail message to help you remember details later.

The more accurate the details you can include in your claim, the better, even if you can’t submit you claim for several days or even weeks later.

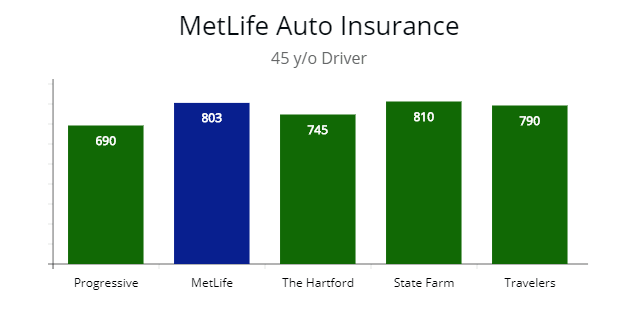

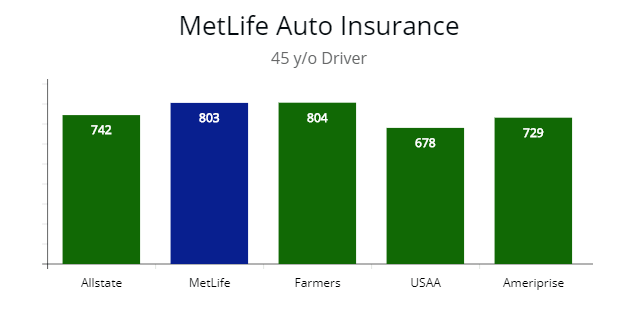

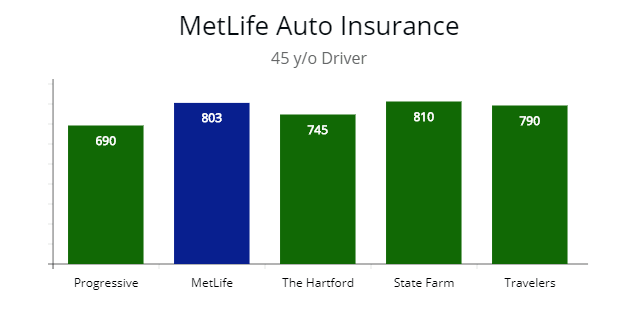

Note: I found the quotes clustering between $690 and $810 for a 45 year old driver. MetLife is on the higher end of the spectrum with a quote at $803.

Note: I found the quotes clustering between $690 and $810 for a 45 year old driver. MetLife is on the higher end of the spectrum with a quote at $803.

Step 3: Contact MetLife to start your claim

If the flood is the result of a major regional or area disaster, your MetLife agent(s) and representative(s) will probably have a special system set up to facilitate filing claims and handle increased server load.

In any event, calling your agent as soon as safely possible will be the next necessary step in getting the claims process started.

Even if you take advantage of the mobile app or online services currently available through MetLife, you will want to speak to an agent to alert him/her of any online processes you may have started.

Direct contact with an agent will also confirm if you have the proper coverage in place to handle a flooded car claim and can serve to remind you of any exclusions or deductibles that may apply.

If your agent has instructions for you, follow them carefully, especially as they pertain to making arrangements for having your car towed to a MetLife preferred repair garage.

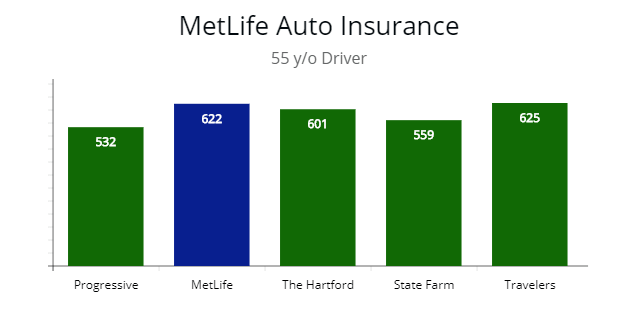

Note: For a 55 year old the quotes clustered between $532 to $625. Progressive was the cheapest at $532 and Travelers the highest at $625. While MetLife I queried at $622. Between the highest and lowest price is more than 15%.

Note: For a 55 year old the quotes clustered between $532 to $625. Progressive was the cheapest at $532 and Travelers the highest at $625. While MetLife I queried at $622. Between the highest and lowest price is more than 15%.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Step 4: Minimize damage

Your claims adjuster may partially or completely deny your claim if they think that some of the flood-related damage was actually the result of your negligence.

With a car that has been flooded, if possible, you should take steps to minimize any extended damage as quickly as possible.

If you can, move the car to higher or drier ground. Of course, be careful about starting a car if it was totally submerged as a result of a flood or if the floodwater rose enough to impact components under the hood.

Flood debris in the engine or water damage to electronics can cause far worse damage if you try to start the car.

If you think there’s a chance that water has gotten into the engine, get a tow truck to move it.

Drying it out requires opening the car, taking out everything wet (like floor mats and rugs) and maybe even employing fans or heaters to promote drying.

Note: I compared 4 different insurers with Metlife and the results are different. In this instance, they are the 2nd cheapest carrier behind USAA.

Note: I compared 4 different insurers with Metlife and the results are different. In this instance, they are the 2nd cheapest carrier behind USAA.

Procedures for a Vehicle Exposed to Water and/or a Flood

Below are the procedures for a flooded vehicle.

The most important part is:

Do not start your vehicle if your engine has been exposed to water from a flood.

Below are “ten-step” guidelines from NADA

| Step | Procedure |

|---|---|

| 1 | Do not start a flooded vehicle until a thorough inspection and cleaning is performed. |

| 2 | Take immediate steps to dry the vehicle as much as possible so as to reduce the length of time vehicle components are exposed to water. |

| 3 | Remove all moisture from the car if the interior got wet. |

| 4 | Contact your insurance company or agent and promptly report the exposure of your vehicle to water or flood. |

| 5 | Record the highest level of water exposure on a flooded vehicle. |

| 6 | Contact a certified technician to arrange for an inspection and evaluation of all mechanical components, including the engine, transmission, axles, brake and fuel system for water contamination. |

| 7 | Flush and replace all fluids, oils and lubricants, and replace all filters and gaskets for components exposed to water. |

| 8 | Repair facilities recommend a thorough cleaning of brake parts and repacking of bearings, particularly for rear-drive vehicles. |

| 9 | Replace the materials to prevent the forming of mold or mildew that may contaminate the entire vehicle. |

| 10 | Have a qualified technician inspect all wiring and electrical components exposed to water |

Step 5: Arrange to have your car transported to a pre-approved shop

It’s possible your claims adjuster will declare your car a total loss.

If the car was completely inundated or was exposed to salt water, for example, repairing the car may be more expensive than what the car’s worth and they may prefer to compensate you for the current market value car instead (minus, of course, any deductible that applies.)

This is one reason why you will want your flooded car transported to a garage or shop that has been approved.

Using an approved shop for determining just what the estimate for repairing flood damage is going to speed up the process.

Note: As illustrated, the quotes clustered between $678 and $804. Metlife is the 4th cheapest at $803 or only $1 less than Farmers. When I completed the comparison of insurers for a spectrum of ages I found that, at times, Metlife could be cheaper, but overall was slightly higher than their competitors.

Note: As illustrated, the quotes clustered between $678 and $804. Metlife is the 4th cheapest at $803 or only $1 less than Farmers. When I completed the comparison of insurers for a spectrum of ages I found that, at times, Metlife could be cheaper, but overall was slightly higher than their competitors.

Step 6: Confirm and track your claim status

After your initial contact with your agent and possibly a claims adjuster, schedule routine calls or emails to your agent, especially just before and after your car has been sent to a shop for an estimate.

MetLife Claims & Contact Information

You can also use a number of MetLife’s online tools to track the status of any claim.

Contact info below:

| Resources | Contact Information |

|---|---|

| Website | MetLife.com |

| Claims | 1-800-854-6011 |

| @MetLife | |

| MetLife | |

| Mobile app | Mobile App |

If your provider determines that your car it a total loss after a shop inspects it, ask about options for restoring it or for starting the totaled car claims process.

Totaled Car Claims Process

This is important if you want to file a Total Loss Claim. Some states determine how much the damage needs to be to be a “total loss”.

This is referred to as the Total Loss Threshold (TLT).

If the TLT is not dictated by the state, your insurance company will generally use another formula.

Known as the Total Loss Formula (TLF) which is: Cost of Repair + Salvage Value > Actual Cash Value.

If the sum of the repair cost and the salvage value is greater than the ACV, the car can be declared a total loss.

To find out your states Total Loss Threshold (TLT) or TLF please see table below.

All you have to do is search your state to find it.

| State | TLT / TLF | Risk of Flood? |

|---|---|---|

| Alabama | 75% | Medium |

| Alaska | TLF | Low |

| Arizona | TLF | Low |

| Arkansas | 70% | Medium |

| California | TLF | High |

| Colorado | 100% | Medium |

| Connecticut | TLF | Medium |

| Delaware | TLF | Medium |

| Florida | 80% | High |

| Georgia | TLF | High |

| Hawaii | TLF | High |

| Idaho | TLF | Low |

| Illinois | TLF | Low |

| Indiana | 70% | Low |

| Iowa | 75% | Low |

| Kansas | 75% | Low |

| Kentucky | 75% | Low |

| Louisiana | TLF | High |

| Maine | 75% | Low |

| Maryland | TLF | Medium |

| Massachusetts | 75% | High |

| Michigan | 70% | Low |

| Minnesota | TLF | Low |

| Mississippi | 80% | High |

| Missouri | TLF | Medium |

| Montana | 75% | Low |

| Nebraska | 65% | Low |

| Nevada | 50% | Low |

| New Hampshire | 75% | Medium |

| New Jersey | TLF | High |

| New Mexico | TLF | Low |

| New York | 75% | High |

| North Carolina | 75% | High |

| North Dakota | 75% | Low |

| Ohio | TLF | Low |

| Oklahoma | 60% | Low |

| Oregon | 80% | Low |

| Pennsylvania | TLF | Low |

| Rhode Island | TLF | Medium |

| South Carolina | 75% | High |

| South Dakota | TLF | Low |

| Tennessee | 75% | Low |

| Texas | 100% | Medium |

| Utah | TLF | Low |

| Vermont | TLF | Low |

| Virginia | 75% | High |

| Washington | TLF | Low |

| West Virginia | 75% | Low |

| Wisconsin | 70% | Low |

| Wyoming | 75% | Low |

Final Thoughts

If you experience a flood that damages your car, your first priority will always be to get yourself and your family to safety.

Then, if you happen to be a MetLife customer, keep a cool head and follow these steps to file a claim for your flooded car.

Sources

https://www.iii.org/article/how-are-value-my-car-and-cost-repair-determined

https://www.fema.gov/

(Note: this article is intended for informational purposes only and should not be considered a promotion, endorsement or a solicitation. The author has no affiliation with MetLife, any of its affiliates or with any other provider.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.