GAP Coverage Basics & Farmers Insurance Customers May Want to Add its Version of GAP to a Policy

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

When you shop for auto insurance premiums, there are literally dozens of coverage options and types of add-ons available with any policy and through any insurer.

Knowing which auto coverage you should have in place can be a challenge. If you are financing the purchase of a newer car or if you have a car you are leasing, you may want to seriously consider adding a GAP insurance option to your coverage.

If you happen to be a Farmers Insurance Company customer, they offer their own version of this option.

If you bought a vehicle which you pay slower than it depreciates – you probably need GAP coverage.

Some GAP Basics & Understanding

GAP stands for Guaranteed Asset Protection (or in the case of car insurance, Guaranteed Auto Protection), though some insurance companies refer to this as a loan/lease payoff option.

If an insurer finds your vehicle is worth 23,000 at the time of the accident, but you owe 25,000 on the loan, GAP coverage will cover the difference in an ideal world.

Simply put, GAP insurance covers the difference between the amount you still owe to a car loan or a lease and the amount of money the car is determined to be worth should you suffer a total loss.

In essence, GAP coverage protects you in the event your car is totaled in an accident or if your car is stolen or lost in some other fashion.

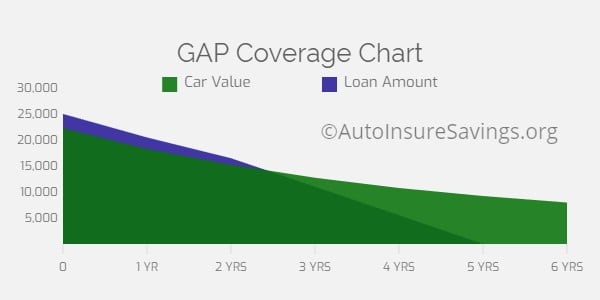

Note: The blue color is the loan amount and, as illustrated by the chart, the loan amount is higher than the car value for over 2 years. In this instance, the loan amount is $16,500 while the car value is $15,250 at the 2-year mark. If perhaps you have totaled or stolen vehicle in the first couple of years then GAP coverage would be worth it.

How can you owe money after a settlement from the Insurer?

You may wonder how it could be possible that you could still owe something on your auto loan if your car is totaled, and you receive a total settlement from your insurer.

This happens because of a single word: Depreciation.

And there is another term that is not used often: Negative Equity, in the housing industry you may have the term “Upside Down?”

This is the same thing except on a smaller scale with a vehicle.

In other words you have a vehicle where you owe more than it is worth. This is an example where GAP coverage helps. Also, it is called “Totaled Insurance” or a Debt Cancellation Agreement.

We’ve probably all heard the adage The second you drive a new car off the lot, it loses half its value.

While not quite that extreme, depreciation can occur rapidly for many cars. In fact, the National Automobile Dealers Association (NADA) warns car owners that the value of a new car can decrease between 17 and 30 percent within the first 18 months of ownership.

Most car loans have an amortization schedule where fees and interest are front-loaded for the first few months or years and most leases have fees and charges attached that also require higher front-loaded payments.

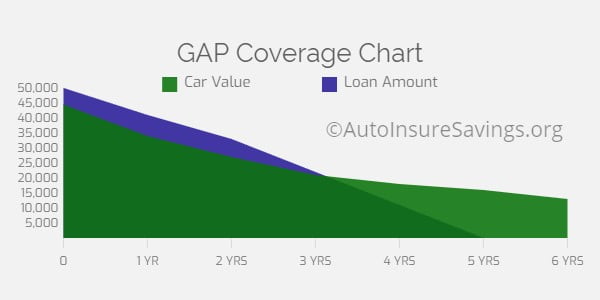

Note: This is an example of an expensive vehicle with a faster depreciating value. In this instance, the value of the vehicle was less than the loan amount for 3 years. The blue color in the chart is the difference between the car value and the loan amount. Or the “GAP” in coverage.

Cars with the fastest depreciation value

Below I have prepared a table with some fairly popular vehicles and their recent depreciation value.

As mentioned, NADA states cars depreciate from 17% to 30% over 18 months.

The list below has vehicles depreciating from 30% to 38% over 12 months.

Even the Toyota Camry made the list with a 12-month depreciation value of 30.6% over 12 months.

In this instance a Camry sold at $23,500 would be worth $15,200 in one year!

As you can see if you were making small monthly payments, i.e. a long-term loan, then GAP coverage for one a vehicle might be a necessity.

And if you are financing one of the fastest depreciating vehicles and you are on a budget you certainly want to be looking at GAP coverage.

| Rank | Vehicle | % Difference after One Year | Cost Difference after One Year |

|---|---|---|---|

| 1 | Cadillac XTS | -38.7% | -$21,000 |

| 2 | Jeep Compass | -34.8% | -$9,650 |

| 3 | Mercedes Benz E-Class | -34.5% | -$22,900 |

| 4 | Lincoln MKZ | -33.7% | -$14,300 |

| 5 | Cadillac CTS | -33.4% | -$18,100 |

| 6 | Infiniti Q50 | -32.3% | -$14,600 |

| 7 | Toyota Camry | -30.6% | -$8,200 |

| 8 | Kia Sedona | -30.0% | -$9,600 |

Examples of GAP Coverage at work

Using the Toyota Camry from above I am going to run the numbers for you.

For this example, you didn’t make a down payment.

The amount you paid for the Camry is $23,500 which is the current market value for a new one at that time.

One year later, the insurer is going to use the Market Value. This is important, and I will go into more on that below.

In this instance, the market value is $15,200 at the time the vehicle was totaled or stolen one year later.

I have included a $500 deductible which comes out of your pocket.

At the end of the day, and in the example below, you would owe a whopping $5,800!

The average price for GAP coverage is $20 a month.

So in this example, it would certainly be worth it since you paid out $240 to cover the difference of $5,800.

And Farmers insurance can do it for as little as $10 per month.

| Toyota Camry | ||

|---|---|---|

| Car Value After 1 Year | $15,200 | |

| Deductible | $500 | |

| Amount Recoverable from Standard Policy | $14,700 | |

| Car Loan Balance | ||

| Remaining Balance | $20,500 | |

| Amount Recoverable from Standard Policy | $14,700 | |

| What you would owe (or the GAP) | $5,800 |

Below is another example of GAP coverage at work when you have a down payment.

In the example below you make a $5,000 down payment on the Toyota Camry.

The remaining balance would be $15,500 and the amount you recovered from the insurers is $14,700.

Leaving you a $800 deficit or GAP.

Even in this instance GAP coverage at $20 a month would have been beneficial.

| Toyota Camry | ||

|---|---|---|

| Car Value After 1 Year | $15,200 | |

| Deductible | $500 | |

| Amount Recoverable from Standard Policy | $14,700 | |

| Car Loan Balance | ||

| Remaining Balance | $15,500 | |

| Amount Recoverable from Standard Policy | $14,700 | |

| What you would owe (or the GAP) | $800 |

Insurers use market value price & not replacement value

The rub here is that car insurance coverage is geared to the market value of your car should it be severely damaged or totaled, not the loan or replacement value.

Farmers Insurance suggests to its customers that some form of GAP be put in place should any of the following circumstances apply:

-

You’ve made a down payment on a new car loan of 20 percent or less

-

You’ve taken negative equity from a previous car loan and rolled it into a new car purchase

-

You have a car loan where the term is 72 months or longer

-

You’ve bought a car that depreciates quickly (like a sports car) See list above.

If you’re leasing a car, most leases have a clause requiring you to have GAP in place and leasing companies (and many financial institutions) will offer GAP protection with your loan or lease.

The terms of these policies are not always to your advantage, especially compared to adding it to your existing policy.

The Farmers Insurance approach

Farmers Insurance offers a New Car Pledge program that can be added along with full GAP coverage.

With the pledge, Farmers auto insurance company will replace a new car (without depreciation) if it is deemed a total loss within the first two years of ownership or the first 24,000 miles of driving (whichever comes first).

Under this program, not only would you have any outstanding loan or lease balance retired in the event of a total loss of your new car, you won’t’ have to go through the hassles of re-acquiring a new or replacement car.

Depending on the make and model of your car, where you live, and the full spectrum of coverage options and auto policy levels you have in place on your existing policy.

This additional GAP coverage from Farmers can be added for as little as $10-12 in additional premium over the course of your coverage term.

Suffering a total loss of a car is a horrible experience and the last thing you will need in such an event is a bill from a lender for a car that, literally, doesn’t exist anymore.

Final thoughts & word of caution

Depending on the vehicle and your financial habits there are many instances where GAP coverage will help in the event you need it. Or at the least, you give yourself a little peace of mind.

For as little as $20 a month it certainly could be worth it. However, in the end, it depends on how risk-averse you are.

There are many car dealerships that offer GAP coverage. And the cost is about $500 upfront. I have seen some charge $800 for coverage.

When I see some premiums the dealerships charge I cringe big time. I feel bad for the customer that just got ripped off!

All they do is charge quadruple for the premium and pocket what’s left to the dealership.

Of course, there are some websites, such as AutoNews, which proclaim the benefits of getting GAP coverage through a dealership.

Personally, I don’t think it is worth it. Not even close.

Not only do the dealerships overcharge there is another caveat for some. Which is this, many dealerships will put it on the “front end” of a loan.

Therefore, your $500 front-end fee is accruing interest. Not good.

Any of your top companies, excluding Geico, will offer GAP coverage. Try to avoid using a dealership for that.

Sources

https://www.iii.org/article/what-gap-insurance

https://www.nolo.com/legal-encyclopedia/gap-insurance-car-do-you-30132.html

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.