Pennsylvania Cheapest Car Insurance & Best Coverage Options

Erie Insurance has the best Pennsylvania cheapest car insurance and best coverage options for Pennsylvania drivers. Erie minimum auto insurance coverage in PA is only $28 per month. Drivers who want Pennsylvania full coverage from Erie for better protection will pay an average of $96 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Erie Insurance has the cheapest PA car insurance rates

- PA minimum coverage averages $28 per month at Erie

- PA full coverage averages $96 per month at Erie

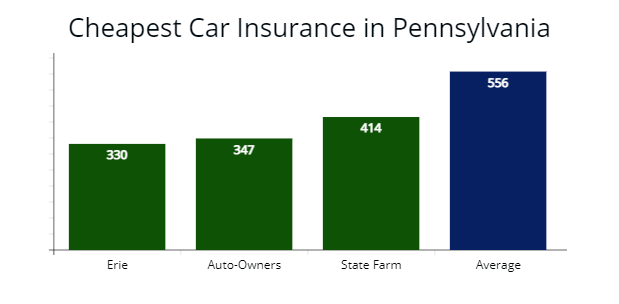

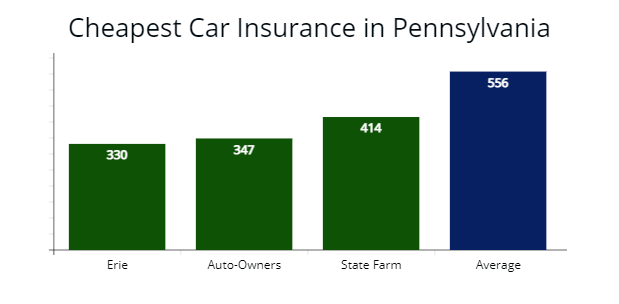

Want the Pennsylvania cheapest car insurance and best coverage options? Erie Insurance has the cheapest rates on average for most PA drivers, followed by Auto-Owners and State Farm. Read on to learn more about the best auto insurance companies for cheap coverage in Pennsylvania.

If you need to quickly compare quotes from the cheapest PA auto insurance companies, we offer a free online comparison tool that can help you.

Affordable Pennsylvania Car Insurance Rates

Drivers in Pennsylvania have several options to choose from when looking for affordable and reliable car insurance companies.

| Cheapest Car Insurance in Pennsylvania - Key Takeaways |

|---|

The cheapest Pennsylvania car insurance options are: The cheapest Pennsylvania car insurance options are:Cheapest for minimum coverage: Erie Insurance Cheapest for full coverage: Erie Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Erie Cheapest after a DUI: State Farm Cheapest for poor credit history: Nationwide Cheapest for young drivers: Erie For younger drivers with a speeding violation: Erie For younger drivers with an at-fault accident: Erie |

This excellent Pennsylvania auto insurance guide will help you find the best car insurance premiums and save money for drivers in various categories and age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Pennsylvania for Minimum Coverage

We found Erie Insurance offers the cheapest rates for minimum coverage car insurance in Pennsylvania for drivers with good driving records with a $330 yearly quote or $27 monthly rate during our comparison shopping analysis.

Learn more: A Review of Erie Auto Insurance & Policy Options

The average Pennsylvania state minimum rate is $556 per year, and Erie’s quote is $226 cheaper or 41% less expensive than average rates.

| Company | Average annual rate |

|---|---|

| USAA | $264 |

| Erie | $330 |

| Auto-Owners | $347 |

| State Farm | $414 |

| Geico | $487 |

| Nationwide | $529 |

| Progressive | $580 |

| Penn National | $614 |

| Allstate | $865 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

While drivers in Pennsylvania can enjoy lower insurance rates by taking out a minimum coverage policy, you may not have all the coverage you need to cover the cost of repairs if your motor vehicle is involved in a severe crash.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Therefore, it is good to compare the rates with multiple car insurance providers with full coverage policies in Pennsylvania that offer first-party coverage above state requirements, which pays to replace or repair your vehicle in an accident.

Cheapest Full Coverage Car Insurance For Drivers in Pennsylvania

We found Erie offers the cheapest auto insurance option with a quote at $1,154 per year or $96 per month for affordable full coverage rates.

Erie’s rate is 32% less expensive than Pennsylvania‘s average rate of $1,680 annually or $526 less per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $1,154 | $96 |

| State Farm | $1,190 | $99 |

| Geico | $1,347 | $112 |

| Auto-Owners | $1,411 | $117 |

| Pennsylvania average | $1,680 | $140 |

The average cost for full coverage auto insurance for drivers in Pennsylvania is $1,680 annually or $140 per month. The difference between the average price of minimum coverage and a policy with comprehensive and collision insurance in Pennsylvania is $1,124.

Although full coverage is more expensive than a basic insurance policy, the amount you can save over time with comprehensive and collision coverage can help make up the difference since you won’t pay for your vehicle’s property damage from inclement weather or vandalism out of pocket.

Read more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance Coverage in Pennsylvania with Speeding Tickets

Pennsylvania drivers with a speeding ticket in their driving history can save 35% with Erie Insurance, which has average annual premium costs of $1,265 per year.

We found Erie’s rate is $669 cheaper than Pennsylvania‘s mean speeding violation rate of $1,934 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $1,265 | $105 |

| State Farm | $1,433 | $119 |

| Auto-Owners | $1,476 | $123 |

| Pennsylvania average | $1,934 | $161 |

Wondering how much will my auto insurance go up with a speeding ticket in PA? In Pennsylvania, drivers pay an average of $1,934 annually for their car insurance or a 14% rate increase if they have traffic tickets on their driving records.

Therefore, it is good to choose an insurance company that offers the lowest rates for drivers with speeding tickets, even if you do not currently have one on your driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance with an Auto Accident in Pennsylvania

Drivers needing coverage in Pennsylvania with one at-fault car accident on their driving records can get cheaper auto insurance with State Farm, which provided us with a $1,769 yearly rate or 30% less expensive than Pennsylvania‘s average accident rate for full coverage.

We suggest comparing insurance quotes with Erie and Geico to find the best rates since their quotes are 14% cheaper for an at-fault accident in Pennsylvania.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,769 | $147 |

| Erie | $1,845 | $153 |

| Geico | $2,170 | $180 |

| Pennsylvania average | $2,511 | $209 |

We found the average cost of coverage can increase by 34% in Pennsylvania with an at-fault accident during AutoInsureSavings.org analysis.

Read more: Will car insurance rates increase after an accident?

The average insurance premium difference for a driver with a clean driving history than a driver with one accident is $831 per year.

Cheapest Car Insurance With a DUI in Pennsylvania

State Farm offers the cheapest DUI coverage rates for drivers in Pennsylvania with a $1,980 annual premium or $165 per month during our rate analysis.

Read more: The Best Car Insurance Companies After a DUI

State Farm’s rate is 30% less expensive than Pennsylvania‘s average car insurance premiums for a driver with a DUI in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,980 | $165 |

| Geico | $2,266 | $188 |

| Nationwide | $2,439 | $203 |

| Pennsylvania average | $2,813 | $234 |

Drivers who receive a DUI conviction in Pennsylvania can expect their insurance to go up by as much as 41% annually, along with a temporary driver’s license suspension or a required ignition interlock device (IID) installed in their motor vehicle.

Learn more: How To Find & How Much is Car Insurance With a Suspended License?

According to the Pennsylvania Department of Transportation (PENNDOT), drivers who take a defensive driving course or Pennsylvania’s Accelerated Rehabilitative Disposition Program could lower insurance costs by 25% after a DUI violation and have the offense wiped clean from their driving record.

Cheapest Car Insurance for Drivers With Poor Credit in Pennsylvania

Drivers in Pennsylvania with bad credit can find the cheapest auto insurance with Nationwide, with an annual $1,894 rate for full coverage. Nationwide’s rate is 21% less expensive than the state average of $2,386.

Additional car insurance companies with better than average rates for drivers with poor credit are Geico and State Farm.

Both auto insurers offer monthly rates at $170 and $189 for a 30-year-old driver or 6% lower than average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,894 | $157 |

| Geico | $2,041 | $170 |

| State Farm | $2,273 | $189 |

| Pennsylvania average | $2,386 | $198 |

The average cost of car insurance for drivers in Pennsylvania with a poor credit score is $2,386 per year, or 30% higher than drivers with a good credit score. Car insurance companies will often look at your credit report’s details to determine what your insurance rate should be. Make sure to pay your credit cards, student loans, and bills on time to keep car insurance rates low. Otherwise you’ll have to look for companies that don’t check your credit score.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance Coverage in Pennsylvania for Young Drivers

During our comparison analysis, young Pennsylvania drivers or college students with good driving records can find the cheapest minimum liability auto insurance with Erie Insurance with a $2,765 full coverage rate.

The next best car insurance for young drivers is State Farm for full coverage, which provided us with a $3,033 per year rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $1,865 | $670 |

| Erie | $2,765 | $893 |

| State Farm | $3,033 | $1,167 |

| Geico | $3,876 | $1,451 |

| Nationwide | $4,359 | $1,654 |

| Progressive | $4,977 | $1,903 |

| Allstate | $6,785 | $2,238 |

| Pennsylvania average | $4,543 | $1,611 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

Young or teen drivers looking for the most affordable minimum coverage auto policy should go with Erie Insurance, which provided us an $893 quote or 44% lower than Pennsylvania‘s average of $1,611 per year.

Additional auto insurers offering cheaper than average minimum coverage rates for young drivers in Pennsylvania are State Farm and Geico, with quotes at $1,167 and $1,451 or at least 11% cheaper.

Young or adolescent drivers have higher car insurance rates in Pennsylvania due to their lack of experience and a higher risk of being involved in a car accident. According to PENNDOT, vehicle crashes are the leading cause of death among 16 – 24-year-old drivers in Pennsylvania.

One of the best ways for younger drivers to get cheaper auto insurance rates is by adding a young or new teen driver to their parent’s policy.Dani Best Licensed Insurance Producer

According to the Pennsylvania Insurance Department, the average household’s car insurance bill rose by 116% when adding an inexperienced driver to an adult policy, compared to a 183% increase when a young person has their own insurance policy in Pennsylvania.

Cheapest Car Insurance for Young Drivers with Speeding Tickets

With a speeding violation in their driver history, younger drivers in Pennsylvania should look to Erie for cheap auto insurance.

Erie’s annual rate of $3,027 per year or $252 per month is 40% cheaper than the average $4,970 rate for full coverage in Pennsylvania. Take a look at the rates below to see how a traffic ticket can impact your car insurance rates as a young driver.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie Insurance | $3,027 | $252 |

| Geico | $4,149 | $345 |

| Progressive | $4,977 | $414 |

| Pennsylvania average | $4,970 | $414 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

The cheapest auto insurance coverage for younger drivers with one at-fault accident in Pennsylvania is Erie, which which showed a $276 monthly rate for full coverage or 40% less expensive than the state average.

The next cheapest insurance option is Geico, with a $390 monthly rate or 16% less expensive than the average at-fault accident rate for younger people.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie Insurance | $3,312 | $276 |

| Geico | $4,680 | $390 |

| State Farm | $4,940 | $411 |

| Pennsylvania average | $5,530 | $460 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Pennsylvania

Our research found USAA and Nationwide are car insurance companies in Pennsylvania offering some of the best full coverage auto insurance rates with quality customer service and sound financial strength ratings for various Pennsylvania drivers.

Learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits

Suppose you want to find the best car insurance company with customer service and claims handling. In that case, Nationwide is the best option where 77% of customers are satisfied with a recent claim, according to ValuePenguin’s recent survey.

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 79% | 60% |

| Nationwide | 77% | 52% |

| State Farm | 75% | 46% |

| Allstate | 70% | 47% |

| Progressive | 74% | 34% |

| Erie | 66% | 65% |

| Geico | 64% | 42% |

We used the National Association of Insurance Commissioners (NAIC) complaint index to find the best auto insurer in an alternative approach.

The car insurance company with the lowest complaint index ratio in Pennsylvania is Progressive with 0.42, with 1.00 being the national average. Allstate’s ratio is 0.63, well below the national average, and Nationwide’s is 0.64.

Progressive has an 856 out of 1,000 ratings with J.D. Power’s claims satisfaction survey. Still, they have an “A+” financial strength ratings with A.M. Best, while Allstate has an “A+” financial strength ratings and an 876 J.D. Power claims satisfaction ratings.

If you are shopping for the cheapest car insurance in Pennsylvania with quality coverage and excellent customer service, we recommend either Nationwide or Progressive.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Progressive | 0.42 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| Nationwide | 0.64 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Geico | 1.02 | 871 | A++ |

| Erie | 1.10 | 880 | A+ |

*NAIC complaint ratio index, the lower the number, the better. Progressive has an index of 0.42 complaints based on market share, while Allstate’s is 0.63. Both car insurers are well below the national average of 1.00.

Average Car Insurance Cost by City in Pennsylvania

We surveyed multiple insurance companies across most Pennsylvania cities and found the average cost of Pennsylvania car insurance is $1,680 per year.

Your zip code in Pennsylvania is a significant factor that can influence your car insurance rates, along with your credit score, driver profile, marital status, type of motor vehicle, and coverage levels.

Cheapest Auto Insurance in Philadelphia, PA

We found Auto-Owners is the cheapest car insurance company for drivers in Philadelphia. They provided us a $1,415 per year rate for full coverage, 26% less expensive than Philadelphia’s yearly average rate of $1,906.

| Philadelphia Company | Average Premium |

|---|---|

| Auto-Owners | $1,415 |

| Geico | $1,470 |

| Penn National | $1,712 |

| Philadelphia average | $1,906 |

Cheapest Auto Insurance in Pittsburgh, PA

Pittsburgh drivers can find the cheapest full coverage insurance policy with Erie, which showed a $1,460 per year rate for our sample 30-year-old. Erie’s insurance quote is 24% cheaper than average car insurance rates for similar driver profiles in Pittsburgh PA.

| Pittsburgh Company | Average Premium |

|---|---|

| Erie | $1,460 |

| Geico | $1,583 |

| Penn National | $1,871 |

| Pittsburgh average | $1,911 |

Cheapest Auto Insurance in Allentown, PA

Drivers in Allentown, PA can find cheap auto insurance policies with Geico, which provided us a $1,319 per year rate for our sample 30-year-old driver with full coverage. Geico’s quote is 30% cheaper than Allentown’s $1,875 average rates.

| Allentown Company | Average Premium |

|---|---|

| Geico | $1,319 |

| Erie | $1,375 |

| Penn National | $1,421 |

| Allentown average | $1,875 |

Cheapest Auto Insurance in Erie, PA

Erie residents looking for the best auto insurance policies should get quotes from State Farm, which showed us a $1,276 per year rate for a 30-year-old driver with $100,000 in liability insurance and a $500 deductible for collision and comprehensive.

State Farm’s car insurance quote is $491 less per year than Erie’s average annual rate of $1,766.

| Erie Company | Average Premium |

|---|---|

| State Farm | $1,276 |

| Erie | $1,298 |

| Penn National | $1,469 |

| Erie average | $1,767 |

Cheapest Auto Insurance in Reading, PA

We found the cheapest auto insurance in Reading, PA is with Erie, with a $1,300 per year rate for a full coverage policy with $500 deductibles for comprehensive and collision insurance. Erie’s quote is 30% less expensive than Reading’s $1,836 average rates.

| Reading Company | Average Premium |

|---|---|

| Erie | $1,300 |

| Geico | $1,369 |

| Penn National | $1,671 |

| Reading average | $1,836 |

Cheapest Auto Insurance in Scranton, PA

Scranton drivers can find the cheapest car insurance with Auto-Owners, showcasing a $1,417 per year rate with $100,000 in liability insurance and $500 deductibles for collision and comprehensive insurance. Auto-Owners’ $118 monthly rate is 31% less expensive than Scranton’s $2,030 average rates.

| Scranton Company | Average Premium |

|---|---|

| Auto-Owners | $1,417 |

| Geico | $1,523 |

| Penn National | $1,661 |

| Scranton average | $2,030 |

Average Car Insurance Cost for All Cities in Pennsylvania

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Philadelphia | $1,906 | Forks | $1,570 |

| Pittsburgh | $1,911 | Hilltown | $1,612 |

| Allentown | $1,875 | Cumru | $1,633 |

| Erie | $1,767 | South Middleton | $1,592 |

| Reading | $1,836 | Lower Salford | $1,700 |

| Upper Darby | $1,916 | Upper Southampton | $1,735 |

| Scranton | $2,030 | Guilford | $1,840 |

| Bensalem | $2,039 | North Fayette | $1,570 |

| Lancaster | $2,054 | Washington | $1,694 |

| Lower Merion | $1,865 | Warwick | $1,570 |

| Bethlehem | $1,906 | Franklin | $1,633 |

| Abington | $1,876 | Skippack | $1,704 |

| Bristol | $1,924 | North Strabane | $1,678 |

| Millcreek | $1,570 | Greensburg | $1,857 |

| Haverford | $1,811 | Caln | $1,768 |

| Harrisburg | $1,900 | Bloomsburg | $1,735 |

| Lower Paxton | $1,704 | Derry | $1,907 |

| Middletown | $1,787 | East Norriton | $1,592 |

| York | $1,963 | Plumstead | $1,694 |

| Altoona | $1,917 | Salisbury | $1,748 |

| State College | $1,633 | Ephrata | $1,796 |

| Penn Hills | $2,043 | Nether Providence | $1,612 |

| Hempfield | $1,768 | Robinson | $1,704 |

| Wilkes-Barre | $1,748 | Pottsville | $1,570 |

| Manheim | $1,917 | Adams | $1,768 |

| Northampton | $1,694 | Washington | $1,810 |

| Cheltenham | $1,570 | Whitehall | $1,735 |

| Norristown | $1,704 | South Park | $1,836 |

| Chester | $1,620 | Newtown | $1,768 |

| Falls | $1,678 | Indiana | $1,633 |

| Lower Makefield | $1,796 | Franconia | $1,678 |

| Warminster | $1,845 | Richland | $1,694 |

| Mount Lebanon | $1,836 | Sharon | $1,850 |

| Lower Macungie | $1,612 | Lower Moreland | $1,796 |

| Bethel Park | $1,817 | Coatesville | $1,748 |

| Radnor | $1,735 | Pine | $1,704 |

| Ridley | $1,678 | Dunmore | $1,592 |

| Cranberry | $1,796 | Butler | $1,768 |

| Ross | $1,633 | Elizabeth | $1,570 |

| North Huntingdon | $1,694 | Spring Garden | $1,620 |

| Upper Merion | $1,570 | West Bradford | $1,678 |

| Hampden | $1,678 | Amity | $1,633 |

| Tredyffrin | $1,768 | Kingston | $1,796 |

| Williamsport | $1,748 | Meadville | $1,822 |

| York | $1,620 | New Hanover | $1,612 |

| McCandless | $1,704 | Hopewell | $1,678 |

| Shaler | $1,850 | Cecil | $1,735 |

| Monroeville | $1,592 | New Kensington | $1,748 |

| Spring | $1,817 | St. Marys | $1,694 |

| Whitehall | $1,858 | Logan | $1,704 |

| Plum | $1,633 | Somerset | $1,768 |

| Easton | $1,678 | North Union | $1,570 |

| Springettsbury | $1,612 | New Garden | $1,620 |

| Lower Providence | $1,810 | Lower Pottsgrove | $1,633 |

| Horsham | $1,694 | Richland | $1,836 |

| Upper Dublin | $1,748 | Rapho | $1,592 |

| Montgomery | $1,850 | North Lebanon | $1,612 |

| Lebanon | $1,836 | West Deer | $1,678 |

| Exeter | $1,592 | East Whiteland | $1,895 |

| Moon | $1,633 | Dingman | $1,748 |

| Derry | $1,704 | North Middleton | $1,694 |

| Susquehanna | $1,735 | Upper Uwchlan | $1,735 |

| Hazleton | $1,570 | Lower Gwynedd | $1,810 |

| Swatara | $1,592 | Center | $1,633 |

| East Hempfield | $1,620 | Hanover | $1,704 |

| Warrington | $1,612 | Yeadon | $1,768 |

| Springfield | $1,694 | Elizabethtown | $1,810 |

| Upper Macungie | $1,748 | Richland | $1,612 |

| Upper Moreland | $1,796 | Salisbury | $1,892 |

| Bethlehem | $1,678 | Emmaus | $1,850 |

| Upper Providence | $1,850 | New Britain | $1,748 |

| Marple | $1,633 | Lower Burrell | $1,620 |

| West Goshen | $1,704 | Jefferson Hills | $1,694 |

| Pottstown | $1,678 | Munhall | $1,633 |

| Unity | $1,735 | Hamilton | $1,810 |

| New Castle | $1,836 | Rostraver | $1,592 |

| Peters | $1,612 | Mount Joy | $1,704 |

| Dover | $1,633 | Loyalsock | $1,570 |

| East Pennsboro | $1,768 | Willistown | $1,735 |

| Palmer | $1,694 | Westtown | $1,612 |

| Chambersburg | $1,810 | Pocono | $1,678 |

| Manor | $1,850 | Hanover | $1,633 |

| Coolbaugh | $1,620 | Waynesboro | $1,768 |

| Buckingham | $1,678 | Lower Saucon | $1,592 |

| Muhlenberg | $1,748 | Darby | $1,678 |

| West Chester | $1,633 | Lansdowne | $1,694 |

| Upper Allen | $1,796 | Easttown | $1,735 |

| West Mifflin | $1,704 | East Cocalico | $1,810 |

| Bethlehem | $1,612 | Mount Pleasant | $1,748 |

| Murrysville | $1,678 | Sandy | $1,836 |

| South Whitehall | $1,768 | Douglass | $1,612 |

| Baldwin | $1,796 | Wyomissing | $1,694 |

| Upper St. Clair | $1,836 | Upper Providence | $1,620 |

| Springfield | $1,570 | Lehigh | $1,810 |

| Newtown | $1,592 | Worcester | $1,768 |

| Johnstown | $1,694 | South Union | $1,633 |

| Penn | $1,735 | Columbia | $1,678 |

| Lower Allen | $1,748 | West Hanover | $1,620 |

| Ferguson | $1,810 | Harrison | $1,704 |

| McKeesport | $1,850 | Ephrata | $1,796 |

| Whitpain | $1,866 | East Stroudsburg | $1,748 |

| Carlisle | $1,612 | Nanticoke | $1,694 |

| Lower Southampton | $1,735 | Coal | $1,810 |

| Warwick | $1,796 | Lehman | $1,592 |

| Limerick | $1,620 | Fairview | $1,570 |

| Stroud | $1,678 | College | $1,850 |

| Uwchlan | $1,748 | Berwick | $1,899 |

| West Manchester | $1,810 | Milford | $1,915 |

| West Whiteland | $1,694 | North Versailles | $1,678 |

| Manchester | $1,768 | East Bradford | $1,735 |

| Towamencin | $1,620 | South Lebanon | $1,612 |

| Hampton | $1,678 | Northampton | $1,836 |

| East Goshen | $1,704 | Oil | $1,910 |

| Windsor | $1,592 | Uniontown | $1,850 |

| Whitemarsh | $1,735 | Butler | $1,748 |

| Concord | $1,570 | Plains | $1,678 |

| Greene | $1,836 | Penn | $1,694 |

| Hatfield | $1,810 | Penn Forest | $1,713 |

| Plymouth | $1,678 | Bristol | $1,620 |

| Doylestown | $1,694 | Hazle | $1,796 |

| Fairview | $1,612 | Sunbury | $1,850 |

| Harborcreek | $1,850 | South Strabane | $1,768 |

| Silver Spring | $1,620 | Maidencreek | $1,704 |

| Lancaster | $1,855 | Brentwood | $1,810 |

| East Lampeter | $1,850 | Lititz | $1,850 |

| Upper Chichester | $1,748 | Moore | $1,592 |

| Phoenixville | $1,704 | Middletown | $1,678 |

| Chestnuthill | $1,713 | Benner | $1,612 |

| Upper Saucon | $1,850 | Darby | $1,620 |

| Aston | $1,857 | Neshannock | $1,570 |

| Lansdale | $1,694 | Lock Haven | $1,796 |

| Scott | $1,592 | Jeannette | $1,704 |

| Butler | $1,612 | Dallas | $1,796 |

| West Hempfield | $1,796 | Warren | $1,836 |

| Penn | $1,768 | Economy | $1,934 |

| North Whitehall | $1,836 | Bethel | $1,612 |

| Middletown | $1,678 | Perkiomen | $1,713 |

| West Lampeter | $1,620 | West Caln | $1,810 |

| Upper Gwynedd | $1,903 | Marshall | $1,678 |

| Patton | $1,570 | North Codorus | $1,748 |

| White | $1,704 | Mechanicsburg | $1,592 |

| Middle Smithfield | $1,810 | Aliquippa | $1,863 |

| Newberry | $1,836 | East Nottingham | $1,620 |

| Hermitage | $1,678 | Upper Leacock | $1,704 |

| West Norriton | $1,748 | South Abington | $1,796 |

| South Fayette | $1,713 | O'Hara | $1,694 |

| Hanover | $1,612 | Hamilton | $1,765 |

| Antrim | $1,694 | Jackson | $1,570 |

| Wilkinsburg | $1,592 | Canonsburg | $1,620 |

Pennsylvania Minimum Auto Insurance Requirements

Drivers in Pennsylvania for vehicle registration must have bodily injury and property damage liability coverage, including medical benefits coverage (MedPay) requirements, to be legal and compliant with state requirements and law. If you buy an auto insurance policy, below are the minimum coverage limits you must have for Pennsylvania state law.

| Liability insurance | Minimum requirements |

|---|---|

| Bodily injury liability | $15,000 per person / $30,000 per accident |

| Property damage liability | $5,000 per accident |

| Medical Benefits Coverage (MedPay) | $5,000 per person |

Buying a minimum coverage policy is the most affordable and cheapest insurance option; however, if you are involved in an auto accident, a state minimum insurance policy will not cover property damage to your car.

We recommend policyholders in the Keystone State increase liability limits and adding uninsured motorist coverage when buying insurance products for additional financial and asset protection.

To learn more about the most affordable car insurance options in Pennsylvania, enter your zip code in our quote comparison tool or get expert advice at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy with a clean driving record for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Pennsylvania rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

– National Highway Traffic Safety Administration. “Motor Vehicle Crashes: Overview.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– PennDOT Driver & Vehicle Services. “Vehicle Self Insurance.”

– Pennsylvania Insurance Department. “Auto Insurance.”

Frequently Asked Questions

Who has the cheapest car insurance in Pennsylvania?

Out of the best insurance companies in PA, Erie offers the most affordable car insurance rates for those wanting minimum coverage in Pennsylvania, with an annual rate of $330 or $27 per month for 30-year-olds with a good driving record. Erie’s rate is 41% less expensive than the state average of $556. USAA offers state minimum coverage at $264 per year or $22 per month for those who qualify.

How much is car insurance in Pennsylvania per month?

The average cost of car insurance in Pennsylvania is $46 per month for those who want minimum coverage and $140 per month for people with a clean driving record needing full coverage policies. Insurance companies that offer rates less than that per month include Erie, Auto-Owners, and State Farm.

How much is full coverage car insurance in Pennsylvania?

The average cost of full coverage Pennsylvania car insurance is $1,680 per year or $140 per month, including Medical Benefits Coverage. The following insurance companies offer cheaper rates than the state’s average: Erie at $1,154, State Farm at $1,190, and Geico at $1,347 per year for a 30-year-old driver.

How do I save on car insurance in Pennsylvania?

It is best to compare auto insurance quotes with the same coverage level in Pennsylvania from several top insurance companies to find the most affordable rates. Asking your agent or insurance company about money-saving discounts or usage-based insurance can help you lower your overall insurance costs, such as a safe driver or multi-policy discounts from life, rental, or home insurance policies. Keeping an eye on your credit report and maintaining safe driving habits can help you save money on your Pennsylvania auto insurance.

What is the best car insurance in Pennsylvania?

The best car insurance in PA is full coverage policies, as this provides the most protection to drivers.

Why is car insurance in PA so expensive?

PA auto insurance rates depend on local factors, such as crashes, claims, uninsured drivers, and more. PA drivers are more likely to file claims, which raises the cost of the best auto insurance in PA.

Is Pennsylvania a no-fault state?

Pennsylvania is a choice no-fault state, which means drivers can choose to file with the at-fault driver’s insurance company or their own insurance company.

Can you sue an uninsured driver in PA?

It depends on the amount of tort coverage you have on your PA auto insurance policy, but in most cases, you can sue an uninsured driver.

Is driving without insurance in Pennsylvania illegal?

Yes, all drivers in PA must carry insurance that meets PA auto insurance laws.

What is the best car insurance in PA for new drivers?

Erie has the cheapest rates for drivers, and a full coverage policy is recommended for new drivers for better protection in case of an accident due to inexperience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.