Surety Bonds as an Alternative to Auto Insurance

Getting a surety bond instead of car insurance is an option in some states. In this guide will discuss which states allow bonded auto insurance and help you weigh the pros and cons of making that choice.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

There is a common misconception that anyone who drives legally on US roadways must hold an insurance policy that meets a state’s minimum coverage requirements.

Some states mandate proof of insurance when registering a new vehicle, while others make car-owners check a box on a brief form. Often, drivers have the option to get a surety bond instead of car insurance.

Surety bonds are cheaper upfront, but the long term costs can far exceed auto insurance premiums.

The presence of coverage among legal drivers protects them, their passengers, and other road users who may come in literal contact with them while driving.

An auto insurance policy transfers the risk of financial loss, up to certain dollar amounts, to an auto insurance company instead of leaving it on the driver’s shoulders.

This makes perfect sense that a policy would be a requirement as a responsible car-owner.

However, car insurance is not the only solution to mitigating financial loss due to accidents or other liabilities that take place on the road. Getting a surety bond instead of car insurance might be an appealing alternative in certain situations. But there are also drawbacks to auto bond insurance.

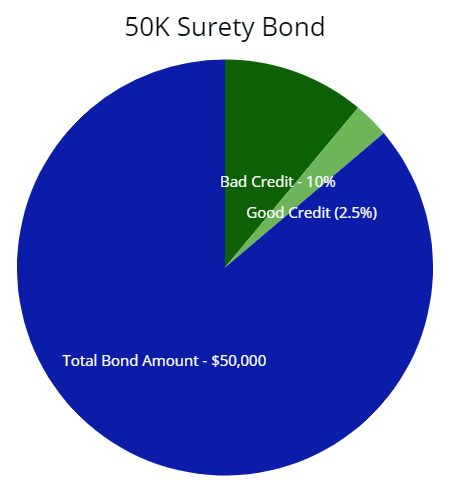

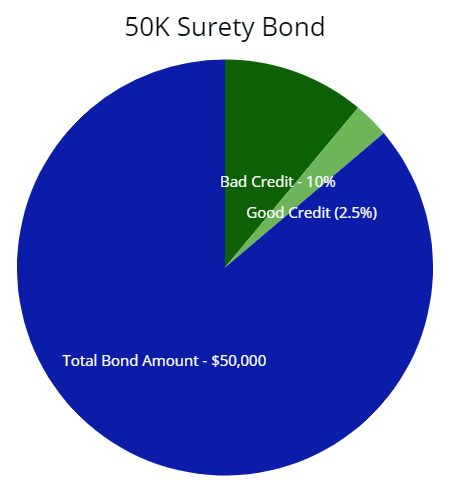

Note: For a 50,000 surety bond, a person with good credit can pay a 1% to 2.5% premium for the bond’s costs or about $1,250. And those with bad credit can pay 10% or more in this example, about $5,000. This is for illustrative purposes only, and your bond premium may be higher or lower.

Note: For a 50,000 surety bond, a person with good credit can pay a 1% to 2.5% premium for the bond’s costs or about $1,250. And those with bad credit can pay 10% or more in this example, about $5,000. This is for illustrative purposes only, and your bond premium may be higher or lower.

Despite what most drivers think, there are alternatives to traditional coverage, typically in the form of a deposit with the state’s Treasury Department or as a surety bond.

The latter is far more common than most are led to believe.

To help understand if auto bond insurance is a viable alternative to auto insurance, it is necessary to break down what a surety bond is, how it differs from an auto policy, and individual drivers and businesses with several vehicles.

What is a Surety Bond?

A surety bond is a legally binding contract between three parties that ensures certain obligations will be met.

The involved parties include the principal or the person requesting the bond, the obligee, the person or entity requiring the bond, and the surety, which is simply the company guaranteeing certain things.

In essence, if the person who initially purchases a bond cannot fulfill their financial obligations to a person, organization, or company, the surety agency promises to pay up to the bond’s amount on their behalf.

The principal then repays the bond overtime should a claim be made against it.

Many consumers and businesses confuse surety bonds with insurance. While a surety bond does offer protection against some financial loss, it is not a transfer of risk in totality.

Instead, the bond covers the full amount of any claim, up to the bond’s limits, and gives the bondholder time to repay if needed.

Surety bonds are priced as a percentage of the bond total, making them more attractive to some who are unable or unwilling to set aside the full amount of capital for a specific need.

However, when a claim is made, the bondholder is responsible for coming up with payment at some point.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Posting a Surety Bond Instead of Car Insurance by State

Below is a table showing which states you can post an auto insurance bond or deposit by state.

There are 32 states where you have this option.

Surprisingly most policyholders do not know this.

If you notice, posting a bond is approximately the same amount or a little more than the minimum liability coverage.

| State | Bond / Deposit Amount | State | Bond / Deposit Amount |

|---|---|---|---|

| Alabama | $50,000 | New Mexico | $60,000 |

| Arizona | $40,000 | New York | $25,000 |

| California | $35,000 | North Carolina | $85,000 |

| Colorado | $35,000 | Ohio | $30,000 |

| Delaware | $40,000 | Oklahoma | $75,000 |

| Idaho | $50,000 | Rhode Island | $75,000 |

| Indiana | $40,000 | South Carolina | $35,000 |

| Iowa | $55,000 | South Dakota | $25,000 |

| Louisiana | $55,000 | Tennessee | $60,000 |

| Maine | $127,000 | Texas | $55,000 |

| Maryland | $75,000 | Utah | $160,000 |

| Massachusetts | $10,000 | Vermont | $115,000 |

| Mississippi | $15,000 | Virginia | $50,000 |

| Missouri | $60,000 | Washington | $60,000 |

| Montana | $55,000 | Wisconsin | $60,000 |

| Nebraska | $75,000 | Wyoming | $25,000 |

The Difference Between Surety Bonds and Auto Insurance

In the realm of individual car owners and businesses that own and operate several vehicles at a time, auto insurance is often the go-to choice for transferring financial risk from accidents and liabilities related to a specific vehicle or vehicle owner.

Part of that has to do with the myth that all states require it, but it can also be linked to the fact that many fail to recognize the difference between insurance and surety bond.

The most significant difference revolves around the fact that auto insurance policies cover things like damages to motor vehicles and medical bills, up to the policy limits.

Still, the individual at fault is only responsible for a small portion of these monetary damages.

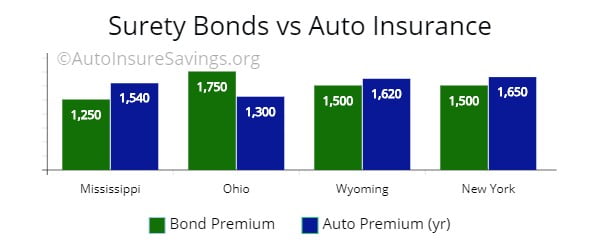

Note: As illustrated, the auto insurance bond amount for Mississippi is $15,000; therefore, I figure the premium to be approximately $1,250. The average price for an auto policy for the year in Mississippi is approximately $1,540. Also, you have to pay that for each year. As you can see, the bond premiums are much cheaper upfront. However, if you have an accident, you will pay the deductible amount if you have an auto policy through an insurer. This amount is $0 to $1,500, depending on your deductible. With a surety bond, you will have to pay the full $15,000 back if you have to use it from an automobile accident.

Note: As illustrated, the auto insurance bond amount for Mississippi is $15,000; therefore, I figure the premium to be approximately $1,250. The average price for an auto policy for the year in Mississippi is approximately $1,540. Also, you have to pay that for each year. As you can see, the bond premiums are much cheaper upfront. However, if you have an accident, you will pay the deductible amount if you have an auto policy through an insurer. This amount is $0 to $1,500, depending on your deductible. With a surety bond, you will have to pay the full $15,000 back if you have to use it from an automobile accident.

That may come in the form of a deductible or for damages incurred above policy limits.

A surety bond instead of car insurance means the individual at fault is takes full financial responsibility for damages due to an accident or liability involving a vehicle.

The bonded auto insurance pays in advance to the damaged party, but the bond owner repays the entire amount over time.

Another significant difference is that surety bonds cost less initially than auto insurance, given they are priced as a percentage of the bonded auto insurance amount.

Auto policy insurance requirements entail premiums being paid every month (or every year) to maintain coverage, and the cost of auto insurance may rise over time.

Finally, surety bond availability is based on an individual or business’s financial track record and ability to repay the bond.

Auto insurance availability is mostly dependent on one’s driving record and location of the vehicle.

One can be more cost-effective than the other in some cases because of these determining factors in price and availability.

Getting an Individual Surety Bond Instead of Car Insurance

An individual may opt to get a surety bond instead of car insurance when they cannot secure traditional insurance for one reason or another, for example, if they need insurance with a DUI.

However, not all states allow individual drivers to purchase a surety bond instead of car insurance.

However, when available, the bonded car insurance amount is often the same as the minimum insurance policy coverage mandated by the state, just at a potentially lower cost upfront.

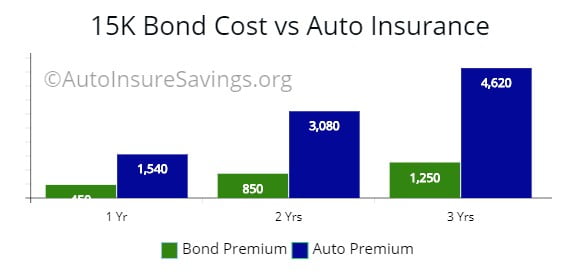

Note: Using the Mississippi example above, the bond premium over three years will be approximately $1,250 for an individual with strong financials and good credit. If you bought an auto policy in the same state, the cost over three years is $4,620. A significant price difference, but there is more risk.

Note: Using the Mississippi example above, the bond premium over three years will be approximately $1,250 for an individual with strong financials and good credit. If you bought an auto policy in the same state, the cost over three years is $4,620. A significant price difference, but there is more risk.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How much do car insurance bonds cost?

How much is going to pay for a surety bond premium? It is going to depend on your credit score.

Below is a table to show you the bond amount with the applicant’s credit score.

The better your credit history, the lower the price for the bond.

As you can see, a $50,000 bond for a person with good credit will cost approximately $350 to $750 or so. A $35,000 surety bond would cost less.

This can be cheaper than paying for an auto premium, which can cost that amount per month in some states.

Below is the surety bond premium for the bonded car insurance amount.

And it is only for illustrative purposes.

Your premium may be higher or lower, depending on your financial circumstances and risk.

High-risk bond premiums can easily exceed 10%.

Most drivers opt to have auto premiums through an insurer since it is less risky, although the financial burden is higher.

| Bond Amount | 700+ | 650 - 699 | 600 - 649 | 550 - 599 | 549 and under |

|---|---|---|---|---|---|

| $5,000 | $100 | $100 | $125-$250 | $250-$375 | $375-$500 |

| $10,000 | $100 | $100-$300 | $250-$500 | $500-$750 | $750-$1,000 |

| $15,000 | $112.5-$225 | $150-$450 | $375-$750 | $750-$1,125 | $1,125-$1,500 |

| $25,000 | $188-$375 | $250-$750 | $625-$1,250 | $1,250-$1,875 | $1,875-$2,500 |

| $30,000 | $225-$450 | $300-$900 | $750-$1,500 | $1,500-$2,250 | $2,250-$3,000 |

| $50,000 | $375-$750 | $500-$1,500 | $1,250-$2,500 | $2,500-$3,750 | $3,750-$5,000 |

| $75,000 | $563-$1,125 | $750-$2,250 | $1,875-$3,750 | $3,750-$5,625 | $5,625-$7,500 |

| $100,000 | $750-$1,500 | $1,000-$3,000 | $2,500-$5,000 | $5,000-$7,500 | $7,500-$10,000 |

Getting a Business Surety Bond Instead of Car Insurance

Surety bonds come into play in a much more prevalent way among businesses that own several vehicles at one time.

Licensed auto dealers, for instance, may be required to have an auto dealer bond in place to operate a business legally.

Still, a car insurance bond often works in place of traditional auto insurance.

The cost difference for dealerships between conventional coverage and car insurance bonds can be significant, given the price is only a fraction of the total bond required.

Surety Bond Car Insurance: The Bottom Line

Obtaining a surety bond as an alternative to a standard car insurance policy can be a more financially viable option for individuals who live in a state where it is allowed, and businesses with many vehicles that must have coverage.

A surety bond is often a less expensive method of protecting others from a financial loss than auto insurance policies.

This is particularly true for auto dealers or other businesses with fleets of vehicles and individuals who cannot afford independently secure auto insurance.

However, it is essential to remember that even though the initial cost is lower, there are long-term costs associated with surety bonds that can be far higher than auto insurance, should an accident or liability take place.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.