Travelers Auto Insurance Discounts That Can Save You Money

If you have Travelers car insurance, there are tons of Travelers auto insurance discounts that you can use to save money on your insurance costs. Here is a list of those discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

According to the National Association of Insurance Commissioners, the average American driver will spend somewhere between $80,000 and $90,000 over the course of a driving life paying for car insurance. That’s a lot of money, but you can save some of that money by finding the right discounts. Travelers auto insurance discounts are a great way to cut back on your car insurance spending. Using the right discounts will make you feel like you’ve found Travelers insurance coupons that can save you money every day.

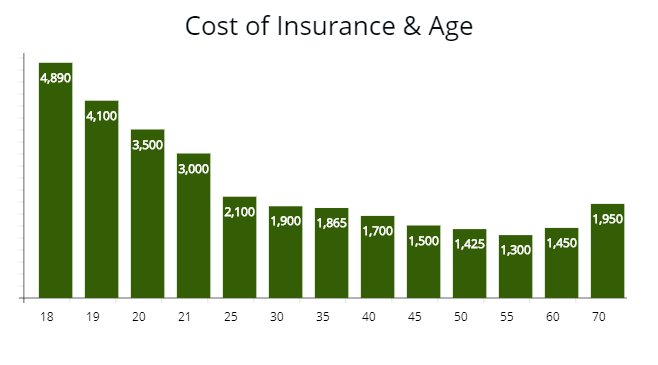

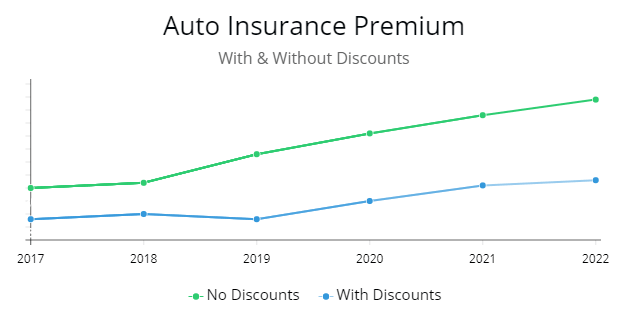

Take a look at the cost of premiums by age below.

For further details, you can read about what factors may influence the average monthly cost of car insurance.

Note: In a perfect world with no automobile accidents or traffic violations, etc. you would pay $80,000 plus or minus over your life maintaining an auto insurance premium. The chart above puts in perspective and these reasons to illustrate it.

Note: In a perfect world with no automobile accidents or traffic violations, etc. you would pay $80,000 plus or minus over your life maintaining an auto insurance premium. The chart above puts in perspective and these reasons to illustrate it.

Put in that light, it’s no wonder that so many auto insurance companies routinely try to find new ways to entice customers to switch or stay with them by offering innovative premium discount programs.

If you happen to be insured with the nation’s 9th largest provider and have a policy with Travelers, be sure you are aware of all the driver discounts they offer.

Here’s a Quick Summary of Travelers Auto Insurance Discounts

Below is a list of states which Travelers offers an auto insurance policy for personal premium.

In California and Alaska they do not offer a personal premium, only a commercial policy.

Compared to a state average quote, they are below average most of the time. In many states Travelers offers auto insurance quotes 10% less than an average premium.

The customer satisfaction results are from J.D. Power and Associates.

Enter your state in the search bar below for results.

| State | Percentage Rate Hike 2017 | State Average Quote | Travelers Quote | Difference | Satisfaction Out of 5 |

|---|---|---|---|---|---|

| Alabama | 2.3% | $1,529 | $1,465 | -$64 | 4 |

| Arizona | 3% | $1,400 | $1,378 | -$22 | 4 |

| Arkansas | 2.3% | $1,725 | $1,654 | -$71 | 4.5 |

| Colorado | 5.1% | $1,788 | $1,811 | +$23 | 4 |

| Connecticut | 4.3% | $2,255 | $2,129 | -$36 | 3 |

| Delaware | 2.3% | $1,580 | $1,576 | -$4 | 4 |

| Florida | 2.8% | $1,830 | $1,855 | +$25 | 4 |

| Georgia | 4% | $2,367 | $2,411 | +$44 | 4.5 |

| Idaho | 6% | $1,326 | $1,365 | +$39 | 3 |

| Illinois | 5% | $1,452 | $1,388 | -$64 | 4 |

| Indiana | 2.9% | $1,611 | $1,522 | -$89 | 4 |

| Iowa | 6% | $1,322 | $1,410 | +$88 | 3 |

| Kansas | 5.3% | $1,348 | $1,310 | -$38 | 3 |

| Kentucky | 5% | $1,465 | $1,210 | -$255 | 4 |

| Maine | 3.2% | $997 | $984 | -$13 | 4 |

| Maryland | 5.5% | $1,789 | $1,821 | +$32 | 4 |

| Massachusetts | 3.3% | $1,604 | $1,644 | +$40 | 4.5 |

| Minnesota | 6% | $1,689 | $1,521 | -$168 | 4 |

| Mississippi | 2.3% | $1,385 | $1,400 | +$15 | 4.5 |

| Missouri | 8% | $1,290 | $1,298 | +$8 | 5 |

| Montana | 4.9% | $1,450 | $1,569 | +$119 | 4.5 |

| Nebraska | 3% | $1,280 | $1,321 | +$41 | 3 |

| Nevada | 4% | $1,587 | $1,600 | +$13 | 4 |

| New Hampshire | 2.3% | $1,173 | $1,155 | -$18 | 4.5 |

| New Jersey | 2.6% | $1,905 | $1,765 | -$140 | 4 |

| New Mexico | 5% | $1,690 | $1,704 | +$14 | 4 |

| New York | 6% | $1,590 | $1,490 | -$100 | 4 |

| Ohio | 5% | $1,634 | $1,680 | +$46 | 4 |

| Oklahoma | 4.5% | $1,400 | $1,446 | +$6 | 4 |

| Oregon | 6.4% | $1,890 | $1,900 | +$10 | 3.5 |

| Pennsylvania | 6.7% | $1,943 | $2,004 | +$61 | 3.5 |

| Rhode Island | 2.7% | $2,020 | $1,987 | -$33 | 3.5 |

| South Carolina | 6% | $1,300 | $1,343 | +$43 | 4 |

| Tennessee | 6% | $1,319 | $1,346 | +$27 | 3 |

| Texas | 5.5% | $1,990 | $1,890 | -$100 | 4 |

| Utah | 4% | $1,354 | $1,323 | -$31 | 3.5 |

| Washington | 6% | $1,760 | $1,754 | -$6 | 3.5 |

| Wisconsin | 4.7% | $1,654 | $1,632 | -$22 | 3 |

Travelers Auto Insurance Discounts: Travelers’ Safe Driver Advantage

Like many insurers, Travelers offers a discount to safe drivers.

To be eligible for this discount with Travelers, all the covered drivers in a household must be free of any at-fault accidents and have driving records free of any major traffic violations.

Travelers Insurance Discounts: Accident Forgiveness

Technically, this may not be considered a discount, but it is a benefit that can hedge against future rate increases.

If you maintain insurance from Travelers for four consecutive years and if you have five total consecutive years of driving without an accident or serious traffic violation, Travelers will “forgive” the first accident you have resulting in a claim with them and your premium won’t go up as a result. In other words, this provider has an accident forgiveness program.

This may not apply if your first accident results in a homicide, is the result of a DUI, or has other serious criminal charges associated with it.

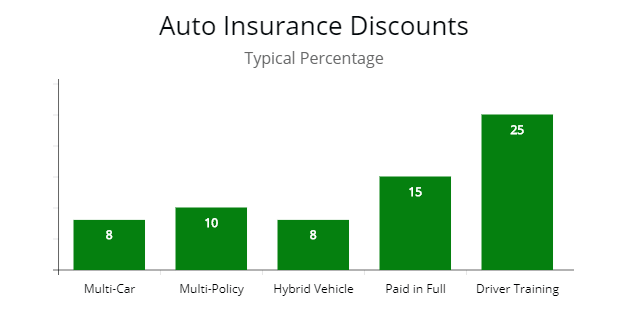

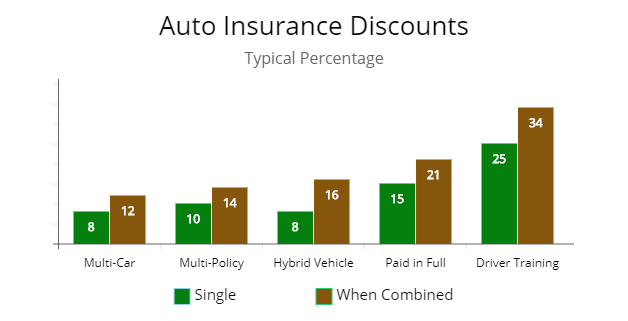

Note: Illustrated above is the typical amount you can discount from your premium. An expense you will have the majority of your life, taking advantage of as many discounts as possible is extremely important. To keep your premiums low, keep a good driving record and drive sparingly whenever you can afford it. See “Low Mileage Discount” below.

Travelers Car Insurance Discounts: Multi-Car Advantage

If you own or lease two or more cars and have them covered through Travelers insurance, you can enjoy a multi-car discount for covering all of them (drivers must all reside at the same address.)

Travelers Discounts: Multi-policy Discounts

You can apply for up to a 20 percent discount on your premium with Travelers if you add a Travelers policy for homeowners, condo, dwelling fire, renters, valuable items, boat and yacht, or a personal liability policy. Just inquire about a multi-policy discount.

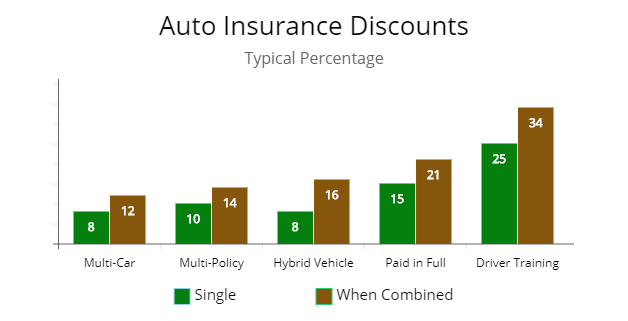

Note: If you have the opportunity to combined discounts your discounts can lower your premium from 12 to 30% or more. 10% off a $1,500 policy is $150. When tallied over 10 or 15 years the amount becomes substantial.

Travelers Auto Insurance Discounts: Hybrid Vehicle Discount

If you own or lease a hybrid, Travelers may be able reduce your premium even further.

Travelers Discount: Paid-in-full Discount

Receive another five percent discount on your Travelers premium when you pay the entire amount in a single lump sum.

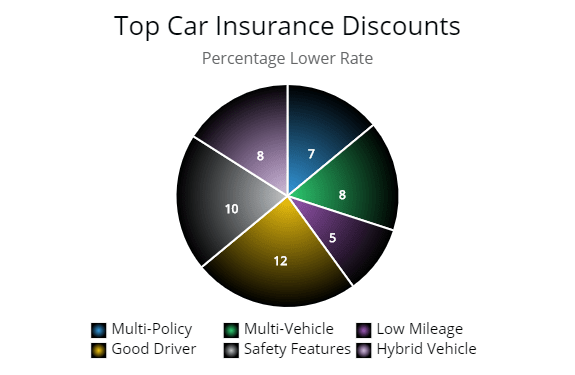

Note: Illustrated above are the most common discounts for your auto policy. The two which can really lower your bill are “Good Driver” and “Low Mileage”. Of course, if you can take advantage of them all, you should absolutely do it.

Travelers Auto Insurance Discounts: Travelers’ Buying Early Advantage

If you purchase your Travelers car insurance policy within eight days of requesting a quote for coverage, you can get an additional reduction in the total premium.

Travelers Car Insurance Discounts: Good Student Discount

For drivers between the ages of 16 and 25 who are full time students, maintaining a “B” average or better can result in additional reductions in premium costs.

Travelers Insurance Discounts: Driver Training Discount

Drivers under the age of 21 who successfully complete an approved driver-training course can enjoy additional discounts from Travelers.

The course must have a minimum of 30 classroom hours of instruction and a minimum of six hours of hands-on driving experience training per student.

Travelers Discounts: Student-away-at-school Discount

If you have kids who are students attending a school at least 100 miles away from home and they are under the age of 25, additional discounts may apply.

Note: Illustrated is the cost of an auto policy over 5 years. When a driver is able to take advantage of all discounts the cost is lowered substantially. Above is illustrated the same driver profile one with and the other without the advantage of discounting a premium.

Travelers Discount: Home Ownership Discount

If you own a home or condo, you don’t even have to have it insured with Travelers for them to consider giving you additional discounts on your premium.

Travelers Auto Insurance Discounts: New Vehicle Discount

If you insure a car with Travelers that is less than three years old, you may qualify for up to 10 percent off your collision coverage costs.

Travelers Discounts: Low Mileage Discount

In a handful of states, Travelers will extend added discounts if you drive less. To ensure this, Travelers offers its own version of an in-car monitoring system it calls IntelliDrive.

Agree to have your driving habits monitored for a period of time and Travelers will take up to 10 percent off your premium.

In a few states, keep your annual driving miles under 13,000 and you could get another 30 percent taken off your premium.

Comparing Travelers Auto Insurance Discounts

With a side-by-side comparison of top carriers Travelers offers more discounts than their competitors with State Farm being the only carrier offering the same amount. Geico and Progressive offer slightly less.

Top Auto Insurance Companies Offering Discounts

| Discount | Travelers | State Farm | Geico | Progressive |

|---|---|---|---|---|

| Multiple policies | x | x | x | x |

| Multivehicle | x | x | x | x |

| Anti-theft | x | x | x | x |

| Anti-lock brakes | x | x | x | |

| Passive restraint | x | x | ||

| Daytime running lights | x | x | ||

| New vehicle | x | x | ||

| 'Green' vehicle | x | |||

| Safe driver/accident-free | x | x | x | x |

| Defensive driver | x | x | x | x |

| Low mileage | x | x | x | |

| Military | x | x | x | |

| Affinity / occupational | x | x | ||

| Full payment | x | x | x | |

| Paperless billing / automatic payment | x | x | x | x |

| Loyalty | x | x | x | |

| Early signing: | x | x | ||

| Good student | x | x | x | x |

| Distant student | x | x | x | |

| Homeowner | x | x | x |

A Word About Conditions

States regulate providers and there are some states that don’t allow Travelers to extend the full range of these discounts to drivers in that state.

Be sure you get all the information you need about what your state allows (and requires) so that you receive all the benefits you are due with a Travelers policy.

(Note: the article is intended solely for informational purposes only and is in no way to be considered a promotional piece or a solicitation. The author is in no way, affiliated with Travelers or any other provider.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jun 22, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.