Get Free & Cheap Online Auto Insurance Quotes to Compare

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If you are making an online car insurance quote comparison, you have come to the right place.

All you have to do is enter your five-digit zip code at the top of the page to get an accurate quote from top car insurance companies in your area.

Comparing Online Auto Insurance Quotes to Save Money

Before buying a policy online or learning about comparing auto insurance quotes, here are the key considerations and takeaways.

| Car | Insurance | - | Key | Takeaways | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| src="https://staging.autoinsuresavings.org/wp-content/uploads/2020/12/AutoInsureSavings.org-Logo-2.png" | alt="AutoInsureSavings.org" | width="120" | height="120" | class="aligncenter | size-full | wp-image-32168" | />AutoInsureSavings.org | could | save | you | thousands | of | dollars | Monthlyly | on | auto | insurance | by | getting | free | online | quotes | from | trusted | insurance | companies. |

| | ||||||

| AutoInsureSavings.org | licensed | insurance | agents | recommend | getting | multiple | car | insurance | quotes | as | the | best | way | to | help | you | find | cheap | rates. | |||||||||||||||

| When | using | a | quote | tool, | make | sure | to | compare | the | same | coverage | levels | with | different | insurance | companies. | ||||||||||||||||||

| We | will | explain | what | a | car | insurance | quote | is, | how | they | work, | why | you | should | get | a | quote, | how | to | get | quotes | fast | and | easy, | and | what | you | need | to | know | for | your | insurance | needs. |

What is car insurance & what are the benefits?

Insurance coverage is going to protect you from financial liability when you are in an auto accident.

There are two major rating factors.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It can help you save money from the costs involved when you or another person is injured in a car crash.

This is called “bodily injury liability.”

The other major insurance factor is property damage to personal property and other motor vehicles involved in the accident.

Also known as “property damage liability.”

It is important to note that car insurance is mandatory in most states and illegal to operate a vehicle without it.

What are Car Insurance Quotes & What You Need to Know to Find a Policy

Car insurance quotes are an estimated price of your insurance policy from an insurer.

It is based on your personal information and driving record. The more you provide, the better the insurance estimate.

Your car insurance premium will change based on all the necessary information the insurer needs from you, including driver history, accident history, suspended license, vehicle type, credit, and other personal factors.

If you want to lower your insurance costs to take it easy on your bank account, it is time to start shopping for quotes online.

Next, we’ll go through step-by-step how to compare car insurance rates and how the price likely will be determined.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

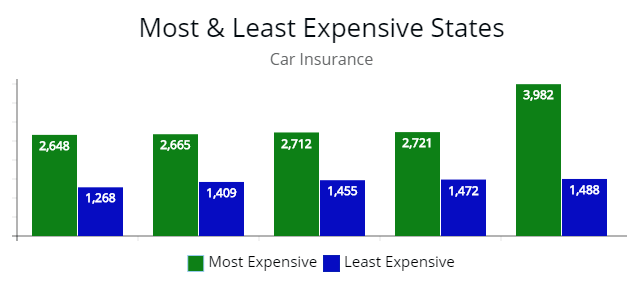

How Your Location Affects Car Insurance Quotes

Where you live will be one of the biggest factors when determining your car insurance policy’s cost.

Living in dense urban areas with a high population will have a higher likelihood of an auto accident than in rural areas.

Note: As illustrated, the most expensive states compared to the least expensive can vary by nearly 100% in most cases and more for Michigan’s most expensive state. Annual rates may vary when you compare insurance from state to state.

Note: As illustrated, the most expensive states compared to the least expensive can vary by nearly 100% in most cases and more for Michigan’s most expensive state. Annual rates may vary when you compare insurance from state to state.

You may be saying, “I am a good driver,” which is probably true.

And of course, it helps to lower your cost.

However, there are other drivers on the road who can contribute to an accident.

The table below outlines the average car insurance premium by state.

| State | Annual Premium | State | Annual Premium |

|---|---|---|---|

| Alabama | $1,513 | Montana | $1,365 |

| Alaska | $1,388 | Nebraska | $1,329 |

| Arizona | $1,517 | Nevada | $1,903 |

| Arkansas | $1,749 | New Hampshire | $1,137 |

| California | $1,974 | New Jersey | $1,763 |

| Colorado | $1,720 | New Mexico | $1,374 |

| Connecticut | $1,782 | New York | $2,498 |

| Delaware | $1,730 | North Carolina | $1,378 |

| Florida | $2,587 | North Dakota | $1,211 |

| Georgia | $1,746 | Ohio | $998 |

| Hawaii | $1,234 | Oklahoma | $1,741 |

| Idaho | $1,055 | Oregon | $1,281 |

| Illinois | $1,400 | Pennsylvania | $1,372 |

| Indiana | $1,187 | Rhode Island | $2,066 |

| Iowa | $1,122 | South Carolina | $1,568 |

| Kansas | $1,567 | South Dakota | $1,597 |

| Kentucky | $1,850 | Tennessee | $1,281 |

| Louisiana | $2,351 | Texas | $1,974 |

| Maine | $831 | Utah | $1,301 |

| Maryland | $1,787 | Vermont | $1,123 |

| Massachusetts | $1,399 | Virginia | $1,136 |

| Michigan | $2,105 | Washington | $1,305 |

| Minnesota | $1,622 | West Virginia | $1,631 |

| Mississippi | $1,719 | Wisconsin | $1,049 |

| Missouri | $1,955 | Wyoming | $1,335 |

Cost of Coverage in the District of Columbia: $1,675.

Further, insurers are regulated at the state level, a common reason for a significant difference in coverage rates.

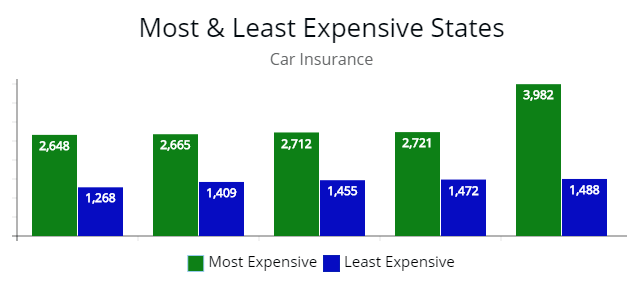

Your Age Group and Affect on Car Insurance Premiums

Age is another major factor multiple insurance companies use to determine your auto insurance rate.

Most everyone knows the older you are, the lower your rates when comparing quotes by age.

Average rates typically are determined by age.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

For example, the average insurance rate for a 30-year-old is different than for a 45-year-old driver.

Your age indicates driving experience and, therefore, your level of risk.

Auto insurers assume the more experience you have as a motorist, the less chance you will cause a crash or get moving violations.

Note: Illustrated above is the cost of an average premium for driver profiles from 18 to 45 years of age with car insurance companies. Teen drivers from 16 to 19 have high premiums and begin to lower substantially around 30. Age is a factor used to determine an insurance quote from an insurer.

Note: Illustrated above is the cost of an average premium for driver profiles from 18 to 45 years of age with car insurance companies. Teen drivers from 16 to 19 have high premiums and begin to lower substantially around 30. Age is a factor used to determine an insurance quote from an insurer.

Therefore there’s a higher likelihood for young drivers to have an accident.

Statistically, older drivers have a lower chance of an accident and filing a claim than teen drivers.

At 30 years of age and older, your auto insurance premiums begin to decrease in price until around 65.

How Car Insurance Quotes Work

Many drivers are afraid to file a claim because their auto insurance company will possibly increase premiums, even if it’s just a fender bender.

Though there is a chance you may have an increase in car insurance premiums from an insurance company if you do file a claim, however, it is not always true.

At the end of the day, if you do find yourself in an auto accident, even minor, you should exchange information with the other driver and let your car insurance company know.

You could have substantial damage to your vehicle and yourself, as well as to the other driver and his/her vehicle.

You mostly want to know that the other person will be taken care of so you don’t get sued over their damages.

The most minimal insurance coverage is a liability for property damage on the road.

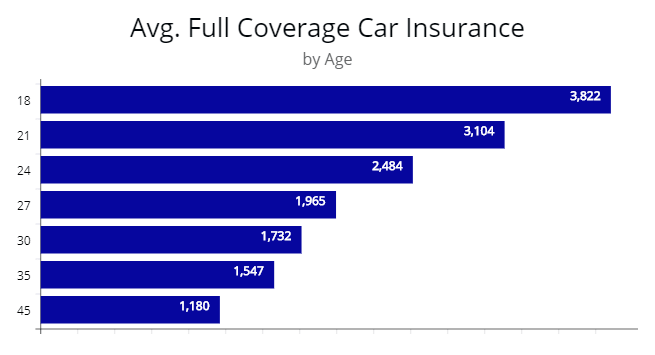

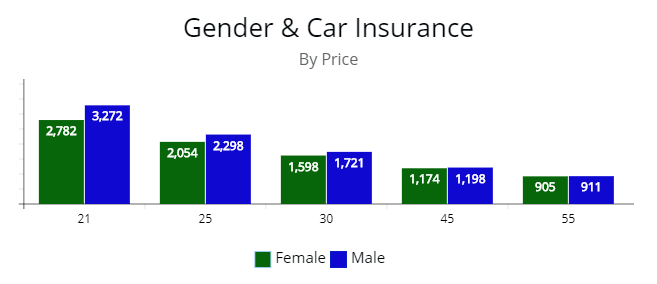

How Gender Affects Car Insurance Quotes

Note: Illustrated above is the difference in prices for drivers by gender from 21 to 55 years of age. Young male drivers are going to pay 7% to 14% more than their female counterparts. Nearing the age of 45 and up, the price difference is negligible with most car insurance companies.

Note: Illustrated above is the difference in prices for drivers by gender from 21 to 55 years of age. Young male drivers are going to pay 7% to 14% more than their female counterparts. Nearing the age of 45 and up, the price difference is negligible with most car insurance companies.

Gender is another factor the insurance industry uses to determine your rate.

Typically policies are going to more expensive for men, especially for young drivers.

On the other hand, senior drivers have a negligible difference between genders.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The difference is how an insurance company determines risk.

Men are engaging in riskier behavior at a young age and usually drive more than women.

Fortunately, there are states which prohibit the use of gender when determining your final premium.

The states include California, Hawaii, and Massachusetts, to name a few.

If you live in a state with such laws, all things being equal, there shouldn’t be a gender difference.

| Age | Female | Male | Difference |

|---|---|---|---|

| 21 | $2,782 | $3,272 | 14% |

| 25 | $2,054 | $2,298 | 11% |

| 30 | $1,598 | $1,721 | 7% |

| 45 | $1,174 | $1,198 | 1% |

How the Vehicle Type Affects Car Insurance Quotes

Most know the type of vehicle you drive determines the cost of car insurance coverage for your vehicle.

The cost is different for a Toyota Camry LE than a Ford Escape.

This is true, but not as most people think.

The safety rating and the cost to replace parts and/or replace the vehicle determine how much an insurance company will charge for an annual premium.

If you have a small sedan with a poor safety rating, you could pay a little more than a medium-size SUV.

Below is outlined the typical costs for a driver with a clean driving record and type of vehicle.

| Type of Vehicle | Cost of Premium per Year |

|---|---|

| Small SUV | $1,132 |

| Medium SUV | $1,167 |

| Minivan | $1,237 |

| Hybrid | $1,257 |

| Large sedan | $1,289 |

| Electric | $1,328 |

| Medium sedan | $1,375 |

| Pickup | $1,410 |

| Small sedan | $1,469 |

How Insurance Quotes Affect Your Car Insurance Policy

When you are shopping for insurance, you’ll pay premiums according to your selected coverage options.

You are going to pay more for full coverage than minimum liability limits.

Full coverage options include comprehensive, collision, and other insurance options, such as roadside assistance.

The minimum requirements meet the minimum legal requirements to be able to drive in your state.

Realize if you finance your vehicle, you will be required to carry optional coverage options – comprehensive and collision insurance.

Below are 12 states for a typical insurance policy with the minimum liability insurance requirements, full coverage options, and price difference.

| State | Minimum Liability | Full Coverage | Difference |

|---|---|---|---|

| California | $611 | $1,974 | $1,363 |

| Connecticut | $790 | $1,782 | $992 |

| Illinois | $462 | $1,400 | $938 |

| Kansas | $468 | $1,567 | $1,099 |

| Maine | $312 | $831 | $519 |

| Maryland | $858 | $1,787 | $929 |

| Massachusetts | $621 | $1,399 | $921 |

| Minnesota | $625 | $1,622 | $997 |

| Missouri | $688 | $1,955 | $1,267 |

| Nebraska | $389 | $1,329 | $940 |

| New York | $1,295 | $2,498 | $1,203 |

| Texas | $708 | $1,974 | $1,266 |

Why Different Auto Insurers Have Different Car Insurance Quotes

One of the most important reasons to compare rates is the different prices from insurers.

At times insurance costs can differ drastically.

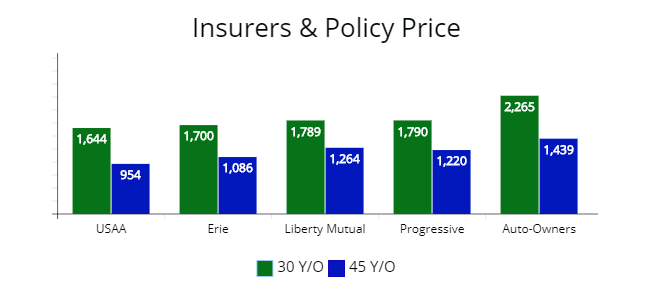

Note: The cost of a car insurance policy may vary by 40% from one insurance company to the next. A 30-year-old driver can get auto insurance quotes at $1,644 from USAA and $2,265 from Auto-Owners. Or $621 difference in price and nearly 40% more with some insurance companies.

Note: The cost of a car insurance policy may vary by 40% from one insurance company to the next. A 30-year-old driver can get auto insurance quotes at $1,644 from USAA and $2,265 from Auto-Owners. Or $621 difference in price and nearly 40% more with some insurance companies.

As you see in the illustrations, rates may vary by a few hundred dollars for a 30-year-old driver.

Each insurer has its own way of determining risk.

One car insurance company may put you in a riskier category and charge more.

If you are in the market for a new policy or replacing an old one, you should compare quotes and coverage levels from three or more insurers.

| Company | Annual Premium |

|---|---|

| USAA | $1,644 |

| American Family | $1,655 |

| State Farm | $1,697 |

| Nationwide | $1,734 |

| Geico | $1,759 |

| Liberty Mutual | $1,789 |

| Progressive | $1,790 |

| 21st Century | $1,943 |

| Allstate | $1,955 |

| MetLife | $1,983 |

| Farmers | $2,006 |

| Mercury | $2,187 |

| Elephant | $2,235 |

| Auto-Owners | $2,265 |

| Safe Auto | $2,376 |

| Travelers | $2,462 |

What Information Do You Need for Car Insurance Quotes

When you compare rates, you are going to need personal information.

The more you give, the more accurate your car insurance quote is going to be.

Below is a list of information typically asked for when getting an online car insurance quote.

— Zip Code

— Address

— Date of Birth

— Phone Number

— Current Insurance

— Marital Status

— Social Security Number

— Make & Model of Vehicle

— Driver’s License Number

— How many miles driven per year

— Daily commute

— Driving Record – Accidents, etc.

You can make an insurance price comparison with only your age, vehicle type, and location, but your insurance quote will not be accurate.

How Your Credit Score Affect Your Car Insurance Quotes

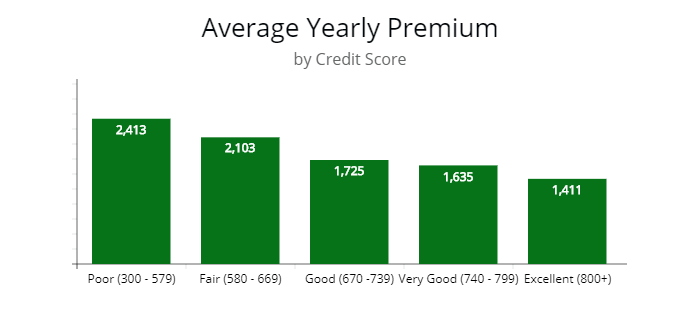

Depending on your state, a poor credit score can impact your auto insurance costs differently.

If you have a poor credit history, you are going to pay more in car insurance premiums.

Note: Illustrated above are auto insurance companies quotes for a driver with poor to excellent credit score. All things being equal, a driver with a poor credit score will pay substantially more in auto insurance than a driver with an excellent credit score.

Note: Illustrated above are auto insurance companies quotes for a driver with poor to excellent credit score. All things being equal, a driver with a poor credit score will pay substantially more in auto insurance than a driver with an excellent credit score.

This is another reason to keep your credit in good standing with creditors.

They report it to the credit bureaus, and car insurance companies like to check it when you request a quote for auto insurance.

Three states do not allow the use of credit when determining insurance rates.

They are California, Hawaii, and Massachusetts.

| State | Poor (300-579) | Difference | Excellent (800-850) |

|---|---|---|---|

| New Jersey | $2,318 | 31% | $1,765 |

| New York | $2,532 | 52% | $1,657 |

| North Carolina | $2,498 | 36% | $1,832 |

| North Dakota | $1,655 | 33% | $1,243 |

| Oregon | $2,200 | 53% | $1,432 |

| South Carolina | $2,015 | 35% | $1,487 |

| South Dakota | $2,282 | 52% | $1,498 |

| Vermont | $1,700 | 31% | $1,294 |

| Virginia | $1,409 | 43% | $986 |

| West Virginia | $2,095 | 74% | $1,200 |

| Wisconsin | $1,550 | 50% | $1,032 |

How to Choose a Policy After Comparing Car Insurance Rates

There isn’t one type of coverage that makes up an insurance policy.

There is a combination of them, such as:

— Liability insurance

— Comprehensive coverage

— Collision coverage

— Uninsured motorist coverage

— Personal injury protection (PIP)

— Gap insurance

— Medical payments coverage (MedPay)

After you have to set coverage limits and determine the deductible amount.

The type and amount of coverage you get are going to affect the average rate.

You want to consider any unique circumstances you have, which may influence the price of your policy.

And set yourself up ahead of time to determine auto insurance options of standard coverage:

| Coverage | |

|---|---|

| Bodily injury liability | Reimburses medical expenses, loss of income, and in some instance funeral expenses. |

| Property damage liability | Covers repairs and replacement costs to vehicles and other property for which you are at fault. |

| Uninsured motorist protection | Reimburses bodily injury and property damage when in an accident with a driver without proper coverage. |

| Personal injury protection | Covers your own medical expenses regardless who is at fault. |

It is best to have a general idea of which and any additional auto insurance you need before shopping for a policy.

How Much Auto Insurance Coverage Do You Need?

When choosing your auto insurance policy limits and deductibles, think how much you can pay out of pocket if you caused a car accident.

As well as the value of your vehicle and the likelihood it may get stolen.

Many drivers opt for minimum coverage because of the cheaper cost. It offers much less financial protection against any assets you may have.

Many drivers get the minimum auto insurance coverage required by their state.

However, if you are liable for someone’s medical and property damage, but can’t pay the costs, most of your assets can be seized to cover the amount you owe.

| Coverage | California Minimum Liability Coverage | Recommended Coverage |

|---|---|---|

| Bodily Injury Protection | $15,000 / $30,000 | $100,000 / $300,000 |

| Property Damage | $5,000 | $15,000 |

| Personal Injury Protection | Optional | $25,000 / $50,000 |

| Uninsured / Underinsured Motorist BIL | Optional | $50,000 / $100,000 |

| Comprehensive Coverage | Optional | $500 deductible |

| Collision Coverage | Optional | $500 deductible |

Comparing Car Insurance Rates & Seek Out Discounts

Once you have gathered all your information and decided on coverage limits, you can compare auto insurance.

A straightforward way to get a quote is by entering your zip code at the top of the page.

An alternative approach is to get auto insurance rates directly from each insurer.

Or, if you like a personal touch, call an independent agent and get a quote.

It’s easier to go through an independent agent that can quote multiple carriers.

Make sure to get potential auto and home insurance discounts and cost-cutting programs once you decided on your auto insurance quote.

— Multi-policy

— Good driver discount

— Good student discount

— Telematics

— Payment via bank account

— Paid-in-full discount

— Paperless billing discount

— Multi-car discount

— Multi-driver discount

— Safe driving senior discount

Shop Around and Compare At Least Once a Year

Each auto insurance provider has its own way of doing business.

Some are dedicated to low-priced policies, while others are more interested in customer satisfaction with car insurance discounts and efficient claims processing.

You want to take the time to compare each insurers’ auto insurance quote.

And contact your licensed advisor and/or a licensed insurance agent.

In the meantime, check customer reviews of each insurer.

Then take time and learn about the insurer’s claims, customer service process, multi-policy options, and benefits offered such as accident forgiveness.

Frequently Asked Questions

What rating factors go into insurance rates?

There are primary factors such as your location, age, vehicle type, and driving history.

Other factors, such as your credit score and marital status, make less of a difference in your premium.

An easy way to compare insurance rates is to use AutoInsureSavings.org to help you find or get quotes.

How do I get the best auto insurance rates?

Don’t assume the company you get a quote from is the cheapest.

It would be best if you compared national and regional insurers to find the lowest car insurance quote.

Be sure to ask about discounts and pay your bill on time.

Are online insurance quotes accurate?

Unless you put detailed information, you will get an estimate only.

To get an accurate insurance quote, you will need detailed information about yourself, your vehicle, and your household.

Online auto insurance quotes are non-binding, which means you are not guaranteed to get the same price as the quote from most insurance companies.

Why do I need to make a car insurance comparison?

One of the best ways to be sure you aren’t overpaying for an auto policy is to compare multiple online quotes.

You can use either online quotes, your local agent, or directly from an insurer.

We recommended doing all three.

Each insurer uses the same factors but weighs them differently, one of the reasons you get different prices.

Typically, your age, driving behavior, zip code, and vehicle information are the largest factors to determine rates.

We recommend you get auto insurance quotes at least once a year.

If you have a DUI or an at-fault accident or moving out-of-state, shop around again.

What is the price of an average car insurance premium?

According to NerdWallet, the average price of a premium is approximately $1,427 for a good driver with good credit.

When you shop for an insurance quote, any initial estimate will be specific to you.

Once you put detailed information such as:

– Street address

– Marital Status

– Current job

– Driver’s license

– Type of vehicle

– Vehicle identification number (VIN#)

– Social security number

– Current employment

– How much you drive

– Driving record

You will get a more accurate auto insurance quote from insurance companies.

Methodology

AutoInsureSavings Coverage Methodology

| AutoInsureSavings.org used insurance data provided by Quadrant Information Services. Rates were publicly sourced from insurer filings and are intended for comparative purposes as your premiums could differ. Our sample driver a 30-year-old male drives 12,000 miles each year in a 2018 Honda Accord. |

Sources

National Association of Insurance Commissioners

www.nerdwallet.com/blog/insurance/instant-car-insurance-quotes-online/

moneygeek.com/insurance/auto/compare-quotes/