West Virginia Cheapest Car Insurance & Best Coverage Options

Erie Insurance and Nationwide have the best West Virginia cheapest car insurance and best coverage options. Erie Insurance is the best for drivers who want WV minimum coverage, with rates averaging $36/mo. Nationwide is best for drivers who want full coverage in WV, with rates averaging $118/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- The cheapest minimum WV insurance is at Erie Insurance

- The cheapest full coverage WV insurance is at Nationwide

- All WV drivers must carry at least minimum coverage to drive

Drivers looking for the West Virginia cheapest car insurance and best coverage options will find them at Erie Insurance and Nationwide. Other best auto insurance companies for cheap WV auto insurance include State Farm and USAA.

Read on to learn more about affordable auto insurance in WV. You can also use our free quote tool anytime to quickly find cheap auto insurance in West Virginia.

Affordable West Virginia Car Insurance Rates

Choosing the right car insurance company can help you improve your level of coverage while you stay within your budget.

| Cheapest Car Insurance in West Virginia - Key Takeaways |

|---|

The cheapest West Virginia car insurance options are: The cheapest West Virginia car insurance options are:Cheapest for minimum coverage: Erie Insurance Cheapest for full coverage: Nationwide Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Erie Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Erie For younger drivers with a speeding violation: State Farm For younger drivers with an at-fault accident: State Farm |

To help you save money and find the best deal on your car insurance premium in West Virginia, we have compared the best rates from several top companies in the insurance industry for various types of drivers and age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in West Virginia for Minimum Coverage

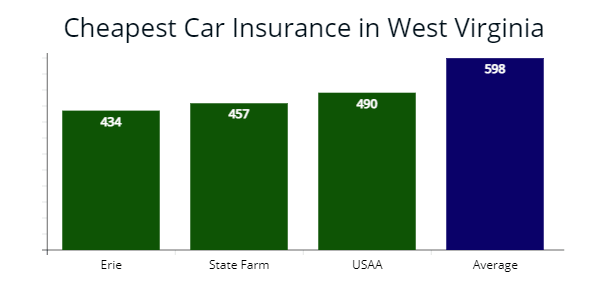

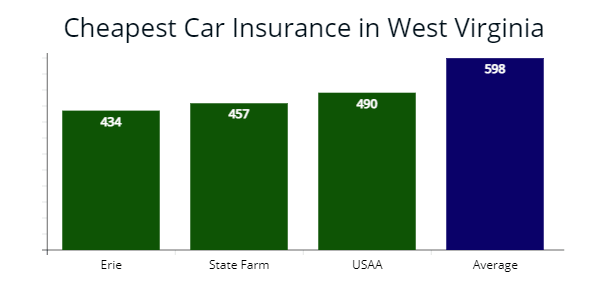

Our agents found that Erie offers the cheapest state minimum coverage car insurance for drivers in West Virginia with a clean driving record at $434 annually, which is 28% less expensive than the average cost for minimum liability from other car insurance companies in West Virginia at $598 (learn more: A Review of Erie Auto Insurance & Policy Options).

| Company | Annual cost | Monthly cost |

|---|---|---|

| Erie Insurance | $434 | $36 |

| State Farm | $457 | $38 |

| USAA | $490 | $40 |

| Nationwide | $541 | $45 |

| Westfield | $568 | $47 |

| Allstate | $619 | $51 |

| Geico | $684 | $57 |

| Progressive | $814 | $67 |

| West Virginia average | $598 | $49 |

*USAA is for qualified military members, their spouses, and direct family members. Car insurance rates may vary depending on the driver’s profile.

West Virginia drivers’ can purchase state minimum liability requirements for less than $600 per year from several providers.

While Erie and State Farm are the cheapest options for many drivers, we also found that Nationwide and Westfield are two good insurance carriers to consider based on our research for drivers who want to save the most money.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum property damage and bodily injury liability policies are cheaper car insurance premiums, which exclude comprehensive and collision coverage, but AutoInsureSavings.org licensed agents recommend buying full coverage insurance in West Virginia since filing a claim with a minimum coverage car insurance policy, you could pay out-of-pocket expenses.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Cheapest Full Coverage Car Insurance in West Virginia

We found that Nationwide offers cheap full coverage insurance for drivers in West Virginia with a $1,415 annual quote or 29% cheaper than the state average rate.

State Farm is the next best option at $1,481 per year or 25% less expensive than West Virginia’s average $1,963 insurance rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,415 | $117 |

| State Farm | $1,481 | $123 |

| Geico | $1,858 | $154 |

| West Virginia average | $1,963 | $163 |

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and zip codes.

The average driver in West Virginia paying for full coverage insurance is $163 per month. Drivers can find cheaper auto policies by comparing top car insurance providers’ rates like those listed here.

Cheapest Car Insurance in West Virginia with a Speeding Ticket

Our licensed agents found Erie offers the cheapest auto insurance rates for drivers in West Virginia with a speeding violation at $1,513 per year or a $126 monthly rate. Erie’s quote is 30% lower than the West Virginia average of $2,160 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $1,513 | $126 |

| State Farm | $1,574 | $131 |

| Westfield | $1,946 | $162 |

| West Virginia average | $2,160 | $180 |

Average rates increase by $197 per year after a moving violation in West Virginia.

Because insurance companies use traffic tickets to assess risk, having one or more tickets on your driving record indicates you are riskier to the insurer than drivers with a clean driving history.Dani Best Licensed Insurance Producer

According to the West Virginia Division of Motor Vehicles (DMV), if you receive five points in twelve months, you will receive a warning letter, and car insurance companies increase rates by 14% until the traffic violation falls off your driving record in two years.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in West Virginia with a Car Accident

State Farm offers the most affordable car insurance rates for drivers with a recent at-fault accident in West Virginia, with annual premiums as low as $1,687. That is $1,056 less than the state average, or 39% cheaper, amount drivers pay for coverage in West Virginia.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,687 | $140 |

| Erie | $1,941 | $161 |

| Geico | $2,311 | $192 |

| West Virginia average | $2,743 | $228 |

Erie and Geico are insurance companies that offer lower than state average rates for many drivers in West Virginia who have an accident on their record.

According to the West Virginia DMV, a car accident will remain on your motor vehicle record for two years, along with an average insurance rate increase of 29%.

Cheapest Car Insurance With a DUI in West Virginia

Progressive offers the cheapest car insurance rates in West Virginia for drivers with a DUI in their driver history at $2,035 per year.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

The average rate for drivers with a DUI in West Virginia is $3,567, and Progressive best rates are 43% lower than other car insurance companies.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,035 | $169 |

| State Farm | $2,326 | $193 |

| Erie | $2,854 | $237 |

| West Virginia average | $3,567 | $297 |

Drivers with a DUI in West Virginia can expect to see their insurance rates increase by as much as 45%. That is why it is essential to find a car insurance provider that offers the most affordable rates after a DUI offense.

Read more: The Best Car Insurance Companies After a DUI

Cheapest Car Insurance in West Virginia with Poor Credit

Geico offers the cheapest auto insurance rates for drivers who have a poor credit history in West Virginia. Geico’s rates are $1,948 per year for our sample 30-year-old male driver or 22% less per year.

State Farm and Westfield are two insurance companies with a less expensive option offering their best rates in the Mountain State 14% lower than the state’s $2,489 average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,948 | $162 |

| State Farm | $2,123 | $176 |

| Westfield | $2,186 | $182 |

| West Virginia average | $2,489 | $207 |

Those who have a bad credit score in West Virginia may see that their insurance rates are higher than average. For most people, poor credit score insurance rates are 22% higher than those with good credit scores, according to the West Virginia Offices of the Insurance Commissioner.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Make sure to pay your bills and credit cards on time to save money on your West Virginia auto insurance premium.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers in West Virginia

Want the best car insurance for teens? Erie offers the cheapest car insurance rates for younger drivers in West Virginia with clean driving records, with an average premium of $3,367 per year for full coverage car insurance.

For less than average costs for minimum coverage, younger drivers should choose Erie and State Farm, which offered our licensed agents a $1,043 and $1,217 per year quote or 38% less per year than average rates.

For young drivers’ state minimum coverage, Westfield offers cheaper than average insurance rates at $1,477 per year or 25% less expensive than other car insurance companies in West Virginia.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Erie | $3,367 | $1,047 |

| Westfield | $3,751 | $1,477 |

| USAA | $4,022 | $1,186 |

| State Farm | $3,838 | $1,217 |

| Geico | $6,384 | $2,128 |

| Progressive | $7,135 | $2,836 |

| Allstate | $7,836 | $1,563 |

| Nationwide | $8,241 | $2,947 |

| West Virginia average | $5,972 | $1,956 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Young or teen drivers needing coverage in West Virginia can save more by comparing insurance costs like those shown above. Drivers who choose Erie Insurance can save as much a 44% on their insurance premiums, which can be substantial savings for younger drivers and their parents.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our analysis of auto insurers with best rates, our agents found teen drivers needing coverage in West Virginia with traffic violations on their driving record can get cheaper insurance rates with State Farm at $3,903 per year or $325 monthly rate, which is 40% less expensive than average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $3,903 | $325 |

| Erie | $4,011 | $334 |

| Geico | $6,415 | $534 |

| West Virginia average | $6,433 | $536 |

Cheapest Car Insurance for Young Drivers with a Car Accident

Young West Virginia drivers with an at-fault car accident on their driving record can find the cheapest full coverage auto insurance quotes with State Farm, which provided us a quote at $3,959 per year or 44% lower than the average car insurance rates of a similar driver profile.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $3,959 | $329 |

| Erie | $4,451 | $370 |

| Geico | $6,737 | $561 |

| West Virginia average | $6,954 | $579 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies in West Virginia

Several great insurance companies to choose from coverage in West Virginia based on their price, customer service and support, and coverage level.

ValuePenguin did a survey and found the overall best car insurance companies in West Virginia are Nationwide and USAA, with high marks from current policyholders for claims satisfaction. If you are not eligible for USAA, which is one of the best car insurance options for veterans and military members, then the next best options are Progressive and State Farm based on customer service.

| Insurer | % respondents satisfied with recent claim | % customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Erie Insurance | 67% | 50% |

| Geico | 64% | 42% |

AutoInsureSavings.org team of licensed insurance agents compared complaints by each insurance company using the National Association of Insurance Commissioners complaint index.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Using the complaint index (best ratio of complaints to market share) from NAIC, the best car insurers are Nationwide and State Farm. Both car insurance companies are below the national average of 1.00

| Insurer | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Nationwide | 0.37 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Allstate | 0.71 | 876 | A+ |

| USAA | 0.96 | 890 | A++ |

| Progressive | 0.97 | 856 | A+ |

| Erie | 0.99 | 880 | A+ |

| Geico | 1.01 | 871 | A++ |

| Westfield | 1.43 | n/a | A |

Using J.D. Power’s claims satisfaction survey and A.M. Best’s financial strength ratings, the best insurance providers are USAA, State Farm, and Erie.

Average Cost of Car Insurance by City in West Virginia

Auto insurers use your zip code and many risk factors like your credit score, marital status, vehicle type, and past driving history to determine your West Virginia car insurance costs (learn more: Understanding How Car Insurance Premiums Are Calculated).

The average cost of insurance for West Virginia drivers is $1,963 per year or $163 per month. During our comparison shopping study, we found the cheapest insurers by city.

Cheapest Car Insurance in Charleston, WV

Charleston, WV drivers can shop around and find the cheapest auto insurance coverage from Nationwide, which provided our agents a $1,472 rate per year for a full coverage auto insurance policy. Nationwide’s rate is 35% lower than average rates in Charleston.

| Charleston Company | Average Premium |

|---|---|

| Nationwide | $1,472 |

| Westfield | $1,583 |

| State Farm | $1,661 |

| Charleston average | $2,237 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance in Huntington, WV

Drivers in Huntington, WV with clean driving history, can find the least expensive insurance rate with State Farm at $1,317 per year for full coverage for our sample 30-year-old driver, 41% below average rates in Huntington, West Virginia.

| Huntington Company | Average Premium |

|---|---|

| State Farm | $1,317 |

| Westfield | $1,480 |

| Liberty Mutual | $1,695 |

| Huntington average | $2,213 |

Cheapest Car Insurance in Morgantown, WV

We found the cheapest auto insurance quotes in Morgantown, WV is from Geico, with a $1,278 quote per year for full coverage with $500 deductibles of collision and comprehensive coverage. Geico’s rate is 42% cheaper than average rates in Morgantown.

| Morgantown Company | Average Premium |

|---|---|

| Geico | $1,278 |

| Westfield | $1,374 |

| Allstate | $1,707 |

| Morgantown average | $2,171 |

Cheapest Auto Insurance in Parkersburg, WV

For Parkersburg’s cheapest auto insurance rates, our agents recommend Nationwide with a quote at $1,254 for our sample 30-year-old driver. Nationwide’s rate is 43% cheaper than Parkersburg, WV average rates.

| Parkersburg Company | Average Premium |

|---|---|

| Nationwide | $1,254 |

| State Farm | $1,461 |

| Allstate | $1,675 |

| Parkersburg average | $2,180 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Wheeling, WV

In Wheeling, WV, drivers with clean driving records can get the cheapest auto insurance coverage with Erie, which provided our agents a quote at $1,306 per year for our 30-year-old sample driver with a full coverage policy.

| Wheeling Company | Average Premium |

|---|---|

| Erie | $1,306 |

| State Farm | $1,443 |

| Geico | $1,519 |

| Wheeling average | $2,157 |

Cheapest Auto Insurance in Fairmont, WV

Fairmont residents needing the cheapest auto coverage for their car should get quotes from Erie, who provided our insurance agents a rate at $1,473 per year or 35% lower than average rates in Fairmont, WV.

| Fairmont Company | Average Premium |

|---|---|

| Erie | $1,473 |

| Westfield | $1,619 |

| The Hartford | $1,758 |

| Fairmont average | $2,245 |

Cheapest Car Insurance in Beckley, WV

Beckley, WV’s cheapest auto insurance, is with Erie, who provided us a quote at $1,382 per year for a 30-year-old driver with full coverage. Erie’s rate is 35% less expensive than the average Beckley rate.

| Beckley Company | Average Premium |

|---|---|

| Erie | $1,382 |

| Geico | $1,497 |

| Nationwide | $1,644 |

| Beckley average | $2,094 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Auto Insurance Costs for All Cities in West Virginia

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Charleston | $2,237 | Boaz | $1,816 |

| Huntington | $2,213 | Marmet | $1,798 |

| Morgantown | $2,171 | Parsons | $1,874 |

| Parkersburg | $2,180 | Montgomery | $1,842 |

| Wheeling | $2,157 | Nutter Fort | $1,911 |

| Weirton | $2,207 | Fairlea | $1,857 |

| Fairmont | $2,245 | Hamlin | $1,888 |

| Martinsburg | $1,899 | Shepherdstown | $1,920 |

| Beckley | $2,094 | Glen Dale | $1,927 |

| Clarksburg | $2,054 | Rand | $1,948 |

| Teays Valley | $2,116 | Mabscott | $1,798 |

| South Charleston | $2,325 | Mullens | $2,023 |

| Vienna | $1,816 | Cassville | $1,986 |

| St. Albans | $1,842 | Mount Gay-Shamrock | $2,038 |

| Bluefield | $1,920 | Falling Waters | $1,927 |

| Cross Lanes | $2,065 | Benwood | $2,012 |

| Cheat Lake | $1,911 | Eleanor | $1,874 |

| Bridgeport | $1,888 | Fort Ashby | $1,902 |

| Moundsville | $1,857 | Ansted | $2,019 |

| Oak Hill | $2,046 | Lavalette | $2,023 |

| Dunbar | $1,948 | Beaver | $2,068 |

| Elkins | $2,012 | Barrackville | $1,798 |

| Pea Ridge | $1,986 | Newell | $1,816 |

| Hurricane | $2,068 | Sistersville | $1,920 |

| Brookhaven | $2,111 | Marlinton | $2,172 |

| Nitro | $2,146 | Rainelle | $1,927 |

| Charles Town | $2,127 | Bolivar | $2,012 |

| Princeton | $1,902 | Brush Fork | $1,842 |

| Buckhannon | $2,127 | Wayne | $1,888 |

| New Martinsville | $2,023 | Gilbert Creek | $1,857 |

| Ranson | $2,114 | Oceana | $2,037 |

| Grafton | $2,107 | Tornado | $1,911 |

| Keyser | $2,100 | Monongah | $2,019 |

| Barboursville | $1,920 | Buffalo | $2,127 |

| Sissonville | $2,140 | Belle | $1,948 |

| Westover | $1,874 | Coal Fork | $2,068 |

| Point Pleasant | $1,927 | Chapmanville | $1,986 |

| Weston | $1,798 | Athens | $1,902 |

| Lewisburg | $1,842 | Washington | $2,127 |

| Ravenswood | $2,141 | Alderson | $2,129 |

| Shannondale | $2,068 | Ceredo | $1,798 |

| Summersville | $2,149 | Lubeck | $1,857 |

| Shady Spring | $2,012 | Sophia | $2,114 |

| Philippi | $1,920 | Smithers | $1,927 |

| Culloden | $1,911 | Clendenin | $2,133 |

| Inwood | $1,888 | Sutton | $1,920 |

| Blennerhassett | $1,902 | Despard | $2,105 |

| Moorefield | $2,037 | New Cumberland | $2,012 |

| Ripley | $2,019 | Piney View | $2,068 |

| Pleasant Valley | $2,127 | Pennsboro | $1,798 |

| Paden City | $1,948 | Poca | $1,842 |

| Kingwood | $2,152 | Bethany | $2,019 |

| White Sulphur Springs | $1,986 | Mallory | $1,874 |

| Kenova | $1,857 | Enterprise | $2,023 |

| Welch | $1,927 | Rupert | $1,888 |

| Williamstown | $2,155 | Rivesville | $2,037 |

| Fayetteville | $2,140 | Chelyan | $2,127 |

| Williamson | $1,948 | Mount Hope | $1,911 |

| Madison | $2,137 | Accoville | $2,141 |

| Hinton | $1,920 | Gassaway | $1,798 |

| Winfield | $1,789 | Man | $1,902 |

| Follansbee | $2,012 | North Hills | $2,019 |

| Pinch | $1,874 | Stanaford | $1,857 |

| Granville | $2,114 | East Bank | $1,927 |

| Wellsburg | $2,105 | Fort Gay | $1,986 |

| Bluewell | $1,888 | Triadelphia | $2,133 |

| Milton | $2,068 | Belmont | $2,127 |

| Hooverson Heights | $1,911 | Danville | $1,920 |

| Crab Orchard | $2,023 | Gauley Bridge | $2,100 |

| Petersburg | $1,842 | Wiley Ford | $2,141 |

| Bethlehem | $2,136 | Bruno | $1,948 |

| Craigsville | $1,902 | Mason | $2,140 |

| Chester | $2,019 | Lumberport | $1,920 |

| Shinnston | $1,798 | Hilltop | $2,030 |

| Star City | $2,037 | Addison (Webster Springs) | $1,789 |

| Richwood | $1,857 | Shrewsbury | $1,888 |

| Harrisville | $2,141 | Bath (Berkeley Springs) | $2,019 |

| Belington | $1,986 | Piedmont | $2,105 |

| Romney | $1,798 | Lesage | $1,911 |

| Mineralwells | $1,927 | Glasgow | $1,874 |

| Spencer | $2,133 | Powellton | $2,037 |

| Ronceverte | $2,141 | War | $2,068 |

| St. Marys | $1,948 | Scarbro | $2,114 |

| Stonewood | $2,012 | Boomer | $1,798 |

| Chesapeake | $2,119 | Carpendale | $1,842 |

| Daniels | $1,920 | Beverly | $1,789 |

| Logan | $1,888 | Gallipolis Ferry | $1,902 |

| Prosperity | $2,105 | Elizabeth | $2,023 |

| Alum Creek | $2,037 | East Dailey | $1,857 |

| McMechen | $1,874 | Clay | $1,986 |

| Bradley | $1,911 | Holden | $1,927 |

| Glenville | $2,100 | Peterstown | $2,132 |

| Terra Alta | $1,902 | White Hall | $1,986 |

| Coal City | $1,789 | Mill Creek | $1,920 |

| Salem | $1,842 | Cedar Grove | $2,012 |

| MacArthur | $1,927 | Pineville | $1,874 |

| Mannington | $1,986 | Davis | $1,911 |

| Elkview | $1,857 | Paw Paw | $1,789 |

| West Liberty | $2,089 | Chattaroy | $1,888 |

| New Haven | $1,798 | West Hamlin | $1,844 |

Minimum Requirements for West Virginia Car Insurance

West Virginia drivers must have a minimum amount of liability insurance requirements in their insurance policies to follow state laws and financial responsibility.

Along with standard liability coverage, drivers in West Virginia need uninsured motorist coverage options, which covers you in the event of an auto accident with an uninsured motorist.

Below are the minimum coverage limits.

| Liability insurance | Minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured motorist bodily injury | $25,000 per person / $50,000 per accident |

| Uninsured motorist property damage liability | $25,000 per accident |

AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury liability and property damage liability insurance to cover your assets in the event of an accident.

Our agents recommend most motorists in West Virginia carry full coverage with comprehensive and collision coverage to protect their vehicle in an unforeseen car accident.

Learn more:

To help you find the right and affordable car insurance options in West Virginia, get expert insurance advice at AutoInsureSavings.org. The best way is to get started and enter your zip code. Our licensed professionals will help you find the best answer to any questions you have.

Methodology

AutoInsureSavings.org collects hundreds of quotes in West Virginia across various zip codes from the largest insurance companies via Quadrant Information Services. Our sample driver profile is a 30-year-old driving a 2018 Honda Accord with good credit. We used a full coverage car insurance policy unless otherwise stated with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

When AutoInsureSavings.org quotes a driver with a minimum coverage policy, we used the minimum liability limits per West Virginia insurance regulations. We used credit score, marital status, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Sources

– NOLO. “West Virginia Car Insurance Requirements.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– AIPSO. “Plan Sites: West Virginia.”

– WV Offices of Insurance Commissioner. “Shopping for Coverage.”

– West Virginia Division of Motor Vehicles. “Consumer Insurance Information.”

Frequently Asked Questions

Who has the cheapest car insurance in West Virginia?

Erie Insurance for minimum coverage. Erie offers some of the best insurance industry rates, with a $434 per year rate for a 30-year-old driver in West Virginia. State Farm at $457 per year and USAA at $490 per year are two other insurers offering the best rates for drivers needing minimum coverage in West Virginia. The average cost of West Virginia auto insurance is $598 per year for state minimum coverage.

Because insurance rates are based on various factors such as vehicle type, it is best to compare multiple providers’ rates to determine who has the cheapest coverage in West Virginia for you.

How much is car insurance in West Virginia per month?

The average rate for West Virginia auto insurance is $163 per month for a driver who is 30 years old and has full coverage. That is $1,963 per year. Here are some totals for the average monthly car insurance rate for drivers in West Virginia: Nationwide: $117 per month, State Farm: $123 per month, and Geico: $154 per month.

How much is full coverage car insurance in West Virginia?

The average cost of full coverage car insurance in West Virginia is $1,963 per year or $163 per month. Nationwide’s best rate for full coverage is $1,415 per year or $117 per month for a 30-year-old male driver with a good driving record. State Farm’s rate is $1,481 per year, and Geico’s rate is $1,858 per year, and both are below the state’s average rate.

How can I save on West Virginia car insurance?

There are several things drivers in West Virginia can do to save money on their car insurance costs. We suggest asking your insurance agent about any car insurance discounts you may be eligible for. If you are looking for a new provider, it is best to find one that offers plenty of discounts to help you save even more. Find out if you are eligible for telematics or usage-based insurance, such as Nationwide’s SmartRide program, where you could save as much as 40% on your auto insurance premium at renewal.

The car you drive also plays a significant role in your rates, driving history, and credit rating. Therefore, practicing safe driving habits, maintaining good driving records, and keeping a close eye on your credit cards and reports can lower your car insurance rates.

What is the best car insurance in West Virginia?

Full coverage is the best car insurance option for WV drivers, as it provides the best financial protection in the event of an accident.

What is the minimum car insurance in West Virginia?

Drivers must carry 25/50/25 of liability auto insurance and uninsured motorist insurance to drive in WV.

Is it illegal to not have car insurance in WV?

Yes, it is illegal to drive without car insurance in West Virginia. To avoid being penalized, get cheap insurance in WV by shopping around for quotes.

What is the penalty for driving without insurance in WV?

Fines, suspended license and registration, and possible jail time for multiple offenses. To avoid penalties, get cheap auto insurance in WV by purchasing at least minimum coverage.

Is West Virginia a no-fault state?

No, West Virginia is an at-fault state, so make sure to carry the best West Virginia auto insurance to avoid financial issues after an accident.

Is West Virginia a PIP state?

No, West Virginia auto insurance laws do not require drivers to carry PIP on their WV auto insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.