Utah Cheapest Car Insurance & Best Coverage Options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

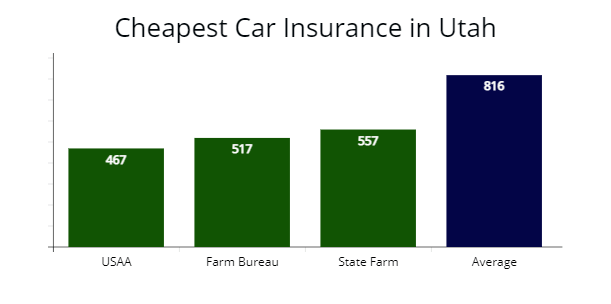

AutoInsureSavings.org licensed insurance agents did a comparison study of the cheapest car insurance companies in Utah and found Farm Bureau Insurance ($517 per year) provides the cheapest rate for a Utah minimum coverage policy.

Progressive ($1,270 per year) provides the most affordable auto insurance coverage options for Utah drivers with full coverage.

Affordable Utah Car Insurance Rates

Drivers in Utah can find the best coverage policy and save more on auto insurance premiums by comparing quotes from multiple insurance providers with our comparison study’s best rates.

| Cheapest Car Insurance in Utah - Key Takeaways |

|---|

The cheapest Utah car insurance options are: The cheapest Utah car insurance options are:Cheapest for minimum coverage: Farm Bureau Insurance Cheapest for full coverage: Progressive Cheapest after an at-fault accident: Farm Bureau Cheapest after a speeding ticket: Bear River Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: American Family For younger drivers with a speeding violation: Geico For younger drivers with an at-fault accident: Bear River |

This Utah car insurance guide is the best way to find affordable coverage and save money regardless of your age or driving type.

Cheapest Car Insurance in Utah for Minimum Coverage

During our auto insurers analysis in Utah, Farm Bureau Insurance provided us a $517 per year or $43 per month rate for the cheapest minimum liability insurance for Utah drivers with good driving records. Farm Bureau’s quote is 37% cheaper than the Utah average of $816 per year.

| Company | Average Annual Rate | Monthly Rate |

|---|---|---|

| USAA | $467 | $38 |

| Farm Bureau | $517 | $43 |

| State Farm | $557 | $46 |

| Bear River | $570 | $48 |

| Progressive | $624 | $52 |

| Allstate | $679 | $56 |

| Geico | $811 | $67 |

| Farmers | $890 | $74 |

| Auto-Owners Insurance | $955 | $79 |

| American Family | $1,043 | $87 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on driver profiles.

Military personnel or an immediate family member of armed forces can get cheaper car insurance rates with USAA. Insurance rates with USAA are $50 less expensive than Farm Bureau and 43% less per year than the average cost of minimum coverage in Utah.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum liability coverage can ensure you stay legal and have the cheapest possible premium. Still, it may not provide you with all the coverage you need if you are involved in an accident.

In the event of an at-fault car accident, state minimum policies will not cover property damage to your car. To avoid expensive repairs, our licensed agents recommend full coverage policies when shopping for Utah car insurance.

Cheapest Full Coverage Car Insurance in Utah

Progressive offers the cheapest car insurance rates for full coverage for drivers in Utah with clean driving records. Progressive offered our sample driver a $1,270 annual rate or 29% less per year than Utah’s average at $1,786 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $1,270 | $105 |

| Farm Bureau | $1,512 | $126 |

| Geico | $1,659 | $138 |

| Utah average | $1,786 | $148 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on driver profiles.

Full coverage policies offer a better coverage level of protection, which covers property damage to the other driver’s car and your car by adding collision and comprehensive coverage.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Collision coverage pays for damage to your motor vehicle in the event of an auto accident, and comprehensive insurance pays for inclement weather damage, such as from a storm or fallen tree branch or if you accidentally hit an animal.

Cheapest Car Insurance With a Speeding Ticket for Drivers in Utah

AutoInsureSavings insurance agents found Bear River ($1,510 per year) offers cheap auto insurance coverage in Utah for drivers who have one speeding violation on their driving record. Bear River’s quote is 31% less expensive or $655 less per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Bear River | $1,510 | $125 |

| State Farm | $1,587 | $132 |

| Progressive | $1,753 | $146 |

| Utah average | $2,165 | $180 |

In Utah, traffic tickets will increase your rates by $379 or 18%, but not as much as a driver with an at-fault accident (43%) or DUI violation (51%).

Cheapest Car Insurance With a Car Accident for Drivers in Utah

We found Farm Bureau offers cheap auto insurance quotes to Utah drivers with one at-fault accident on their driving records with a $2,060 annual rate ($171 per month) for our sample 30-year-old driver.

Farm Bureau’s rate is $693 less per year than Utah’s average rate of $2,753 or 26% less expensive.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Farm Bureau | $2,060 | $171 |

| Progressive | $2,254 | $187 |

| State Farm | $2,414 | $201 |

| Utah average | $2,753 | $229 |

We found insurance rates increase about 36% after a driver is involved in an at-fault accident in Utah during our licensed agent’s analysis. Just one at-fault accident could cause your car insurance rate to go up as much as $967 per year.

Cheapest Car Insurance for People With a DUI in Utah

With a drunk driving (DUI) violation, people in Utah can find the cheapest car insurance with Progressive with a quote at $2,119 per year for a full coverage policy or a $176 monthly rate for our sample driver. Progressive’s quote is 35% cheaper than Utah’s DUI rate of $3,247 annually.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $2,119 | $176 |

| State Farm | $2,648 | $220 |

| Bear River | $2,955 | $246 |

| Utah average | $3,247 | $270 |

According to the Utah Department of Public Safety, a DUI conviction in Utah will cause your car insurance premiums to increase 49%. The DUI will remain on your driving record for ten years, and the Utah Department of Motor Vehicles (DMV) will report your conviction to your insurance company during that time.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In most instances, your car insurance company will file an SR-22 form to the Utah DMV. Most drivers with a DUI in Utah will have a 120-day driver’s license suspension, and a Utah Judge may require you to install an ignition interlock device (BAIID) on your motor vehicle for one year.

Cheapest Car Insurance for Drivers With Poor Credit in Utah

AutoInsureSavings.org agents recommend Geico, which provides the cheapest insurance for Utah drivers with poor credit history. Geico’s rate of $1,940 with comprehensive and collision insurance included is 28% less expensive than the average rate for 30-year-olds.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $1,940 | $161 |

| Progressive | $2,254 | $187 |

| Auto-Owners | $2,416 | $201 |

| Utah average | $2,683 | $223 |

Auto insurers in Utah use your credit score when setting your auto insurance rate, plus a variety of other risk factors. Drivers in Utah with bad credit pay 34% more for insurance per year ($897 annually) or $2,691 over three years than those with a good credit score.

Make sure to keep an eye on your credit information, credit score, and pay credit cards on time. Any mistakes on your credit report may cause your auto insurance rates to increase.

Cheapest Car Insurance for Young Drivers in Utah

Young Utah drivers can find the cheapest full coverage auto insurance with American Family, which provided us a $3,564 annual rate or 45% less expensive than Utah’s younger driver average rates.

Drivers under 25 can also get affordable insurance coverage with Farm Bureau Insurance, which offered our agents an annual rate of $3,682 for full coverage and $1,511 for state minimum coverage.

Bear River also provides the cheapest minimum coverage rates for young or teen drivers at $1,569 per year or 36% lower than average Utah rates.

The next best option for young Utahns for state minimum is State Farm, at $1,607 per year.

| Insurer | Full Coverage | Minimum Coverage |

|---|---|---|

| American Family | $3,564 | $1,843 |

| Farm Bureau | $3,682 | $1,511 |

| USAA | $4,004 | $1,658 |

| Bear River | $4,087 | $1,569 |

| Geico | $4,546 | $2,161 |

| Progressive | $5,328 | $2,358 |

| State Farm | $5,537 | $1,607 |

| Allstate | $6,031 | $2,288 |

| Auto-Owners Insurance | $7,742 | $3,034 |

| Utah average | $6,520 | $2,438 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on your driver profile.

According to the Insurance Information Institute (III.org), your age correlates with safe driving habits. Statistically, the younger you are, the higher likelihood you will be in an accident.

According to the National Highway Traffic Safety Administration (NHTSA), auto insurers account for this risk factor by charging higher insurance rates for inexperienced drivers. As you gain more driving experience, your rates should decrease as you get older.

Cheapest Car Insurance for Younger Drivers with Speeding Tickets

Younger drivers who receive a ticket for speeding in Utah can find the cheapest auto insurance quotes with Geico. The average insurance cost with Geico is $4,596 per year for full coverage or 33% less expensive than Utah’s average speed violation rate for young drivers.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $4,596 | $383 |

| Bear River | $4,675 | $389 |

| Progressive | $5,238 | $436 |

| Utah average | $6,785 | $565 |

Cheapest Car Insurance for Young Drivers with an At-fault Accident

Inexperienced Utah drivers with a recent at-fault accident can find the best car insurance with Bear River with a $4,916 quote for full coverage insurance.

Bear River’s at-fault accident rate for young drivers is 33% cheaper than Utah’s average rate of $7,248 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Bear River | $4,916 | $409 |

| Geico | $5,836 | $486 |

| State Farm | $6,327 | $527 |

| Utah average | $7,248 | $604 |

Best Auto Insurance Companies in Utah

Based on customer service and claims satisfaction, Utah’s best car insurance companies are Auto-Owners, USAA, and American Family.

If customer service is a priority, we recommended Auto-Owners as the best auto insurer in Utah.

ValuePenguin conducted a recent customer satisfaction survey, which had similar results.

| Auto Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| American Family | 86% | 50% |

| USAA | 78% | 62% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Geico | 64% | 42% |

| Farm Bureau | n/a | n/a |

Buying cheap insurance helps Utah insurance shoppers save money, but insurance companies with poor customer service or claims handling sometimes are not worth the extra savings in your bank account.

Finding affordable auto insurance companies in Utah that offers the cheapest premium can be good. Other things such as customer service rating, claims satisfaction, and driver discounts are good to consider when deciding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings licensed agents collected information on car insurance companies in Utah from the National Association of Insurance Commissioners (NAIC), J.D. Powers, and A.M. Best’s financial strength ratings.

The insurance companies with the lowest NAIC complaint index ratio are Bear River (0.00), Auto-Owners (0.42), and Farm Bureau (0.43). All three insurers have a complaint index ratio of less than one (1.00).

| Company | NAIC complaint index | J.D. Power Claims Satisfaction | A.M. Best Rating |

|---|---|---|---|

| Bear River | 0.00 | n/a | A- |

| Auto-Owners | 0.42 | 890 | A++ |

| Farm Bureau | 0.43 | n/a | A |

| American Family | 0.44 | 862 | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| USAA | 0.98 | 890 | A++ |

| Geico | 1.02 | 871 | A++ |

NAIC’s complaint ratio compares the numbers of complaints based on the market share of the car insurer. The national average is 1.00. Any auto insurance provider below 1.00 is better than the national average.

Auto-Owners ratio is 0.42 with a J.D. Power’s claims satisfaction score of 890 out of a possible score of 1,000 with “A++” financial strength ratings with AM Best.

Bear River’s complaint ratio is only 0.00, but without a J.D. Powers auto claims score and “A-” financial strength rating with A.M. Best.

While comparing Utah car insurance companies, several factors contribute to your insurance estimates. Your driving history, type of vehicle, age, and even your credit rating can impact your total monthly or annual insurance premium.

It is always best to compare plans to find a Utah auto insurance company with the cheapest rates with excellent customer service ratings.

Average Car Insurance Cost by City in Utah

We collected insurance quotes from zip codes in The Beehive State from top auto insurance companies and found rates can vary by $298 by zip code and city.

Your zip code is one of many risk factors auto insurers use to set auto insurance estimates. Other factors include your marital status, credit history, age, liability limits, and vehicle type.

Cheapest Car Insurance in Salt Lake City, UT

Drivers in Salt Lake City can find the best coverage rates with State Farm, which provided us a quote at $1,240 annually for a full coverage insurance policy. State Farm’s rate is 32% cheaper than Salt Lake City’s yearly insurance rate of $1,823 per year.

| Salt Lake City Company | Average Premium |

|---|---|

| State Farm | $1,240 |

| Bear River | $1,366 |

| Geico | $1,453 |

| Salt Lake City average | $1,823 |

Cheapest Car Insurance in West Valley City, UT

AutoInsureSavings’ agents found Farm Bureau is the cheapest insurance company for people in West Valley City, Utah. They provided us a $1,180 annual rate for full coverage, 35% less expensive than West Valley City’s yearly average rate of $1,797.

| West Valley City Company | Average Premium |

|---|---|

| Farm Bureau | $1,180 |

| Geico | $1,307 |

| Liberty Mutual | $1,569 |

| West Valley City average | $1,797 |

Cheapest Car Insurance in Provo, UT

Provo drivers can find the best full coverage insurance policy with Bear River, which provided us a $1,154 annual rate per year. Bear River’s insurance quote is 34% cheaper than average rates for 30-year-old drivers in Provo.

| Provo Company | Average Premium |

|---|---|

| Bear River | $1,154 |

| Progressive | $1,246 |

| Geico | $1,511 |

| Provo average | $1,760 |

Cheapest Car Insurance in West Jordan, UT

During our analysis, we found the cheapest auto insurance in West Jordan is Progressive, with a $101 monthly rate or $1,214 per year for a 30-year-old male driver. Progressive’s rate is 32% cheaper than average rates in West Jordan, UT.

| West Jordan Company | Average Premium |

|---|---|

| Progressive | $1,214 |

| State Farm | $1,287 |

| Geico | $1,458 |

| West Jordan average | $1,784 |

Cheapest Car Insurance in Orem, UT

Orem drivers can find the cheapest auto insurance with Progressive, which provided our agents a $1,042 average rate per year for our 30-year-old driver. Progressive’s quote is 37% less expensive than Orem’s average rates.

| Orem Company | Average Premium |

|---|---|

| Progressive | $1,042 |

| State Farm | $1,386 |

| Geico | $1,623 |

| Orem average | $1,649 |

Cheapest Car Insurance in Sandy, UT

Drivers in Sandy, UT looking for cheaper car insurance rates should get quotes from Progressive, which offered our agents a $1,058 per year rate for full coverage. Progressive’s rate is 40% less expensive than Sandy Utah’s average rates of $1,735 per year.

| Sandy Company | Average Premium |

|---|---|

| Progressive | $1,058 |

| Allstate | $1,547 |

| Liberty Mutual | $1,618 |

| Sandy average | $1,735 |

Average Car Insurance Costs for All Cities in Utah

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Salt Lake City | $1,823 | Nephi | $1,514 |

| West Valley City | $1,797 | White City | $1,564 |

| Provo | $1,760 | West Bountiful | $1,531 |

| West Jordan | $1,784 | Sunset | $1,555 |

| Orem | $1,649 | Moab | $1,665 |

| Sandy | $1,735 | Midway | $1,594 |

| Ogden | $1,746 | Perry | $1,525 |

| St. George | $1,717 | Kanab | $1,546 |

| Layton | $1,649 | Hyde Park | $1,589 |

| South Jordan | $1,664 | Silver Summit | $1,531 |

| Lehi | $1,623 | La Verkin | $1,564 |

| Millcreek | $1,555 | Morgan | $1,607 |

| Taylorsville | $1,631 | Maeser | $1,514 |

| Logan | $1,600 | Mountain Green | $1,622 |

| Murray | $1,514 | Wellsville | $1,615 |

| Draper | $1,607 | Elk Ridge | $1,652 |

| Bountiful | $1,525 | Blanding | $1,594 |

| Riverton | $1,531 | Manti | $1,677 |

| Herriman | $1,652 | Delta | $1,564 |

| Spanish Fork | $1,589 | Gunnison | $1,546 |

| Roy | $1,656 | Mount Pleasant | $1,700 |

| Pleasant Grove | $1,594 | Beaver | $1,525 |

| Kearns | $1,665 | Parowan | $1,711 |

| Tooele | $1,672 | Hildale | $1,555 |

| Cottonwood Heights | $1,652 | Naples | $1,613 |

| Midvale | $1,589 | Richmond | $1,514 |

| Springville | $1,555 | Erda | $1,531 |

| Eagle Mountain | $1,680 | Monticello | $1,594 |

| Cedar City | $1,634 | Salina | $1,607 |

| Kaysville | $1,607 | Fillmore | $1,668 |

| Clearfield | $1,531 | Kamas | $1,546 |

| Holladay | $1,564 | Garland | $1,613 |

| American Fork | $1,631 | Monroe | $1,531 |

| Syracuse | $1,525 | Helper | $1,594 |

| Saratoga Springs | River Heights | $1,555 | |

| Magna | $1,655 | Huntington | $1,589 |

| Washington | $1,514 | Lewiston | $1,665 |

| South Salt Lake | $1,820 | Millville | $1,564 |

| Farmington | $1,546 | Marriott-Slaterville | $1,531 |

| Clinton | $1,721 | Emigration Canyon | $1,675 |

| North Salt Lake | $1,831 | Duchesne | $1,693 |

| Payson | $1,704 | Toquerville | $1,652 |

| North Ogden | $1,555 | Coalville | $1,525 |

| Brigham City | $1,589 | Panguitch | $1,613 |

| Highland | $1,594 | Willard | $1,704 |

| Centerville | $1,555 | Milford | $1,514 |

| Hurricane | $1,652 | South Willard | $1,546 |

| South Ogden | $1,803 | Mona | $1,589 |

| Heber | $1,665 | Centerfield | $1,483 |

| West Haven | $1,614 | Oakley | $1,607 |

| Bluffdale | $1,555 | Moroni | $1,594 |

| Santaquin | $1,674 | Honeyville | $1,525 |

| Smithfield | $1,514 | Enterprise city | $1,589 |

| Woods Cross | $1,652 | East Carbon | $1,531 |

| Grantsville | $1,546 | Benson | $1,613 |

| Lindon | $1,525 | Uintah | $1,674 |

| North Logan | $1,594 | Wellington | $1,555 |

| West Point | $1,437 | Genola | $1,564 |

| Vernal | $1,607 | Ferron | $1,665 |

| Alpine | $1,514 | Fairview | $1,607 |

| Cedar Hills | $1,611 | Wolf Creek | $1,704 |

| Pleasant View | $1,665 | Castle Dale | $1,613 |

| Mapleton | $1,531 | Carbonville | $1,514 |

| Stansbury Park | $1,613 | Woodland Hills | $1,594 |

| Washington Terrace | $1,564 | Orangeville | $1,525 |

| Riverdale | $1,704 | West Mountain | $1,546 |

| Hooper | $1,555 | Mendon | $1,589 |

| Tremonton | $1,514 | Francis | $1,704 |

| Ivins | $1,594 | Spring City | $1,652 |

| Park City | $1,680 | Elwood | $1,531 |

| Price | $1,525 | Daniel | $1,613 |

| Hyrum | $1,674 | Ballard | $1,677 |

| Summit Park | $1,607 | Wendover | $1,564 |

| Salem | $1,589 | Hideout | $1,525 |

| Richfield | $1,652 | Spring Glen | $1,674 |

| Santa Clara | $1,613 | Paradise | $1,594 |

| Providence | $1,546 | Rocky Ridge | $1,652 |

| South Weber | $1,525 | Benjamin | $1,644 |

| Vineyard | $1,531 | Annabella | $1,607 |

| Ephraim | $1,564 | Fountain Green | $1,514 |

| Roosevelt | $1,649 | Liberty | $1,589 |

| Farr West | $1,609 | Enterprise | $1,546 |

| Plain City | $1,525 | Randolph | $1,555 |

| Nibley | $1,594 | Copperton | $1,612 |

| Enoch | $1,514 | Levan | $1,531 |

| Harrisville | $1,591 | Minersville | $1,614 |

| Snyderville | $1,555 | Goshen | $1,564 |

| Fruit Heights | $1,546 | Green River | $1,525 |

Minimum Car Insurance Requirements in Utah

According to the Rocky Mountain Insurance Information Association (RMIIA), all auto insurance policies sold to Utahns must have minimum liability limits, including $3,000 in PIP coverage level or personal injury protection since Utah is a no-fault state. PIP coverage will pay for your medical expenses in case of an accident, no matter who is at fault.

| Liability insurance | Minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $65,000 per accident |

| Property damage liability | $15,000 per accident |

| Personal Injury Protection (PIP) | $3,000 per person |

Bodily injury liability coverage requirements cover injuries sustained in a car accident up to $25,000 per person of bodily injury and $65,000 per accident. Property damage liability insurance pays for repairs to personal property up to $15,000 per accident.

According to the Insurance Information Institute (III.org), we recommend adding uninsured motorist coverage to your auto insurance policy since the uninsured motorist rate is 8.2%, according to the Insurance Information Institute (III.org).

Frequently Asked Questions

Who has the Cheapest Car Insurance Coverage in Utah?

Farm Bureau Insurance offers the cheapest minimum coverage in Utah, with average rates of $517 per year. The average annual premium for minimum coverage is $816, and Farm Bureau’s premium costs 37% less per year.

How Much Is Car Insurance For Drivers in Utah per Month?

The average cost for car insurance per month in Utah is $148 or $1,786 per year for full coverage. The average price of a minimum coverage car insurance policy per month is $68 or $816 per year. Progressive’s full coverage average rate is $1,270 per year or 29% less expensive, while Farm Bureau offers state minimum policies in Utah at $517 per year or 37% cheaper.

How Much Is Full Coverage Car Insurance in Utah?

The average cost of full coverage car insurance in Utah is $1,786 annually or $148 per month. Progressive’s average rate for full coverage is $1,270 a year or $105 per month. Farm Bureau ($1,512) and Geico ($1,659) are also below the state’s average rates.

How do I Save on Car Insurance in Utah?

There are many ways for drivers in Utah can save on their car insurance premiums. You can determine if you are eligible for a money-saving driver discount offered by the auto insurance company. Many insurance providers will lower your overall rates if you have multi-policies with them, such as life or home insurance.

Another way to save on your car insurance premium is to practice good driving habits and keep a clean driving record. That will not only keep you and your passengers safe but will also help you avoid auto accidents or traffic violations that could cause your premium to increase.

To learn more about the most affordable car insurance options for drivers in Utah, get expert advice at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping insurance study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Utah rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– Rocky Mountain Insurance Information Association. “Utah Auto Insurance Requirements.”

– Utah Department of Public Safety. “DUI FAQs.”

– Utah Insurance Department. “Protect Yourself: Insuring Your Teen Driver.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.